Whilst we decided yesterday to look at the US we were well aware that our old friend the Euro was gaining attention again as the ADHD market moved on from Japan and Libya news flow that was not showing any signs of getting worse. European negative news is all the more pertinent now as Euro has been a default, almost safe haven, buy over the past weeks of turmoil. So it is worth us having a better look at where we have got to with the TMM euro views.

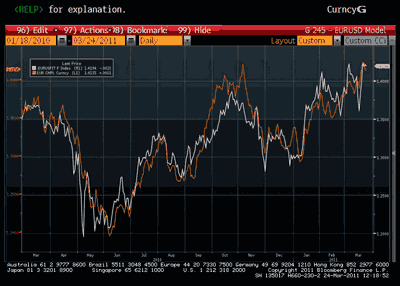

The first thing we note is that, you may remember, we run a model that has been calling EURUSD to the 1.41-43 area for a while. This has now balanced up and is much more neutral in terms of valuation at these levels (see chart below).

(click to enlarge)

The argument over how to trade the euro is composed of 2 parts: the core (good euro) and the periphery (bad euro). We could actually consider the Euro as a vinaigrette, composed of 2 immiscible liquids, the core as the Vinegar at the bottom and the periphery the Olive Oil on the top (somewhat appropriately). When shaken together they emulsify enough to appear as one homogeneous gloop. However, if left alone they will separate out into their constituent parts, but remain in the same bottle (the Euro). Whilst the last year has seen the Eurocrats and policy makers trying to shake the bottle enough to keep the two parts smoothly mixed, the market is sure that there is too much oil in the mix and is focused on the interface between the core and the periphery to detect if policy is actually working. That interface is still seen as being Spain.

And it is with interest that TMM note that despite a raft of tape bombs, ranging from the collapse of the Portuguese government, to Moody’s downgrading various Spanish banks (to move them in line with the sovereign downgrade a couple of weeks ago), the Euro and European Equities have barely blinked. TMM were particularly interested to see the Swedish Fin Min mention that he expected a number of banks to fail their stress test. In our minds, given last year’s disastrous failure to reveal a EUR30bn black hole in Ireland’s banks, that the EU is already suggesting several banks will fail adds credibility to the process and provides a high likelihood of the banks being recapitalised. In particular, a key problem with last year’s testing round was the wildly differing scenarios tested in different countries, the exception being Spain, which was alone in actually providing a realistic scenario with something like a 30% fall in house prices. More on Spain, later.

The EFSF/ESM provide a backstop to sovereigns that engage in providing new bank capital and can break the feedback loop between sovereigns and the banking system. As TMM have pointed out in the past, bank capital can be leveraged and thus result in a positive feedback loop into sovereign financing costs.

As far as Portugal goes, TMM was surprised at the fuss being made in the FX market, as a far as we can tell, everyone expected Portugal to go into EFSF anyway. Whether it happens now or in two months when a new government is elected is neither here nor there. Either way, with reports surfacing of an imminent EUR70bn bailout to be negotiated with the caretaker government, it seems as though the excitement is dying down there anyway. Given the recent agreement (or rather, postponed agreement) to allow the EFSF to buy in the primary market, TMM do not expect Portuguese auctions to go uncovered, either a result of a more speedy EFSF agreement or moral suasion behind the scenes to get banks to show up. TMM are sure readers can tell they are about as excited about Portugal as they were with the woollen sweaters their Grandmothers used to knit them when they were mere Macro Tots.

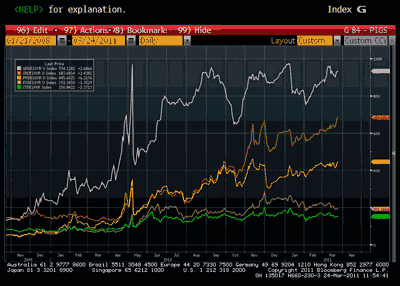

But back to the lack of more broad contagion. TMM would note that here is now no material leveraged long positioning in peripherals as there was in H1 2010. This is because volatility spiked and forced lower risk limits and management oversight in banks and funds, meaning that real money are the strong hands and that volatility now and moving forward is likely to be rather lower in places like Spain and Italy. As a result, the potential for volatility-driven contagion into other financial assets is also much lower. This is particularly important with respect to EURUSD etc because large tail risk hedging has been ongoing the past year, so exotics and other tail exposures do not have the potential to cause large moves. Like in equities yesterday, Real money were on the bid at 200bps over Bunds in Spain… Spain is increasingly trading like Italy. Since the beginning of the year, Spain (see chart below of spreads to 10yr Bunds: pink – Spain, green – Italy, yellow – Portugal, orange – Ireland, white – Greece) has actually tightened, even as Greece, Ireland and Portugal have been widening.

(click to enlarge)

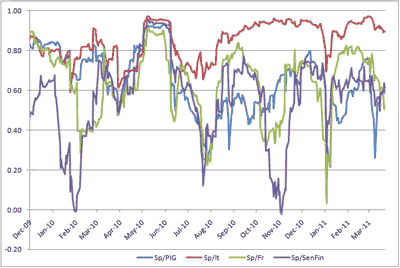

In fact, a closer look at the chart indicates that the market has repriced Spain and Italy’s credit risk to be around 200bps and 150bps above Bunds, respectively, and have merely oscillated around these levels. For a while, the market has considered Spain to be the “one that matters”, and this can be seen quite clearly in the below chart, which shows 1m rolling return correlations for Spanish 10yr spreads with Italian spreads (red line), French spreads (green line), Itraxx Senior Financials CDS (purple line) and the average cross-correlation with Ireland/Greece and Portugal (blue line). It is notable that during the systemic phase of the Eurocrisis in April-June 2010 that these were all very close to one, whereas post the stress test results these fell somewhat. But what TMM are particularly interested by is the fact that since last summer, aside from January’s failed Eurobear raid, Spain appears to trade like a slightly higher-yielding Italy. Indeed, it is also worth noting that Spain’s correlation with the rest of the PIGs, France and Senior Financial CDS in general are largely indistinguishable… correlated yes, but more a result, TMM would argue, of generalised credit risk premia than any particular Eurozone issue. As long as this is the case, TMM reckon that EURUSD, and Euro-area financial assets in general, will trade in line with factors that have been relevant in the past… for EUR/USD in particular, that is rate spreads. And with the ECB refusing to divert from its “core” Europe hiking strategy, that means the risks are still for higher prices.

(click to enlarge)

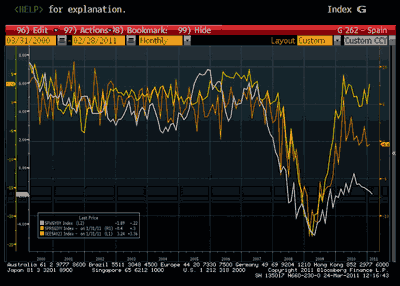

Of course, this all rests upon the macroeconomic picture in Spain remaining fine. The data here has been mixed (see chart below: white line – IP, orange line – retail sales, yellow line – OECD Spain Leading Indicator)and the data here so far has been mixed. Industrial Production and Retail Sales appear to have double-dipped recently, but the OECD’s Leading Indicator is pointing to a near-term rebound. The bear argument is that ECB tightening will crush the periphery, but TMM would point out that monetary policy works with long lags 12-18months for cuts/hikes to feed through, so we reckon it is too early to play for this yet. We do, however, reckon that it is evens that the A-Team have to do an “about turn” at some point in the next year or so, but that is a trade for another day…

(click to enlarge)

So back to the vinegarette…

There are 3 outcomes:

- Bottle shaken enough to blend the contents ready for serving to the market.

- Not enough shaking, end up with an oily mess. Market sends it back.

- Pour some of the periphery oil out to make an easier to mix more palatable blend. Market enjoys it but slip on the oil spilled on the floor.

Leave a Reply