Goldman Sachs is adding EMC Corp. (NYSE:EMC) to Conviction Buy list with a $33 price target, representing 29% upside. They believe 2011 will be a year of “beat-and-raise” quarters for EMC, and have raised their estimates as a result.

Goldman notes their bullish thesis on EMC’s shares remains intact, though they have higher conviction in the absolute upside potential for the shares. Firm believes networked storage will continue to enjoy secular tailwinds throughout 2011, and they believe EMC is well positioned to capture the lion’s share of this market’s growth. In addition, they believe EMC’s leading portfolio of cloud and next-generation enterprise technology assets will allow it to generate sustainable double-digit growth and build an increasingly software-centric earnings profile.

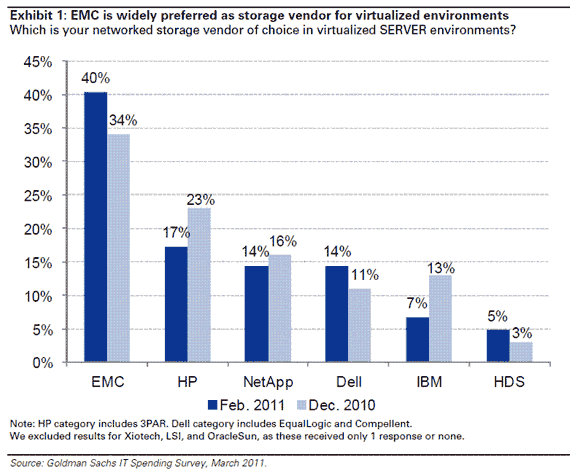

Their latest IT spending survey, published on March 4, 2011, supported firm’s view that EMC maintains a strong leadership position in networked storage, particularly in virtualized environments, where 40% of CIOs named it their preferred storage vendor (Exhibit 1). They expect the value of this advantage to grow as virtualized environments become more common across enterprises, and they continue to believe this will be the most important source of networked storage growth over the next several years.

Furthermore, the firm thinks 2011 will be a year of “beat-and-raise” quarters. In particular, they believe EMC’s recent product refresh will allow it to accelerate its share gains in the midrange and enhance its secular momentum amid an increasingly rapid and global transition to next-generation datacenters.

They are raising their estimates. For 2011, the firm is forecasting revenues and non-GAAP EPS of $19.71 billion and $1.54 (vs. consensus of $19.64 billion and $1.48), up from $19.61 billion and $1.50. They now expect revenues and non-GAAP EPS of $21.95 billion and $1.74 for 2012 and $24.34 billion and $1.98 for 2013. This is up from their prior forecasts of $21.51 billion and $1.70 and $23.58 billion and $1.91, respectively.

Notablecalls: The key part of this call is the ‘year of “beat-and-raise”’. This is what people need to hear when it comes to EMC. It’s not a cheap stock, rarely has been & needs raising estimates to work.

With Goldman out giving their blessing, you will see buyers flock in. Ultimately this thing is a $35 stock.

Leave a Reply