George Melloan is unhappy with U.S. monetary policy, and he repeats what has become by some a criticism of Federal Reserve policy:

“In accounts of the political unrest sweeping through the Middle East, one factor, inflation, deserves more attention…

“Probably few of the protesters in the streets connect their economic travail to Washington. But central bankers do. They complain, most recently at last week’s G-20 meeting in Paris, that the U.S. is exporting inflation…

“About the only one failing to acknowledge a problem seems to be the man most responsible, Federal Reserve Chairman Ben Bernanke. In a recent question-and-answer session at the National Press Club in Washington, the chairman said it was ‘unfair’ to accuse the Fed of exporting inflation. Other nations, he said, have the same tools the Fed has for controlling inflation.

“Well, not quite.”

I would simply repeat my argument from our previous macroblog post, but I don’t really have to. Mr. Melloan makes the point for me [with my emphasis added in italics]:

“Consider, for example, that much of world trade, particularly in basic commodities like food grains and oil, is denominated in U.S. dollars. When the Fed floods the world with dollars, the dollar price of commodities goes up, and this affects market prices generally, particularly in poor countries that are heavily import-dependent. Export-dependent nations like China try to maintain exchange-rate stability by inflating their own currencies to buy up dollars.”

If the United States unwisely floods the world with dollars, driving down the international value of the dollar, countries with flexible exchange rates would see the value of their currencies rise—making food grains and oils denominated in dollars more affordable, not less. The only way inflation gets exported to these other countries is if they attempt to maintain the values of their currencies below the levels that markets would otherwise take them. That inflation is purely homegrown.

That point is also exactly the one I made last time with respect to Chinese inflation:

“To keep the nominal exchange rate from rising, the People’s Bank of China in effect prints yuan and buys dollars. Though this has limited impact on any real fundamentals, it is the source material for inflation.”

I did, however, leave one unfinished piece of business in the previous blog post:

“Of course, the astute and skeptical among you might ask, if the money-to-inflation nexus is relevant to China, why not the United States? A fair question, one that I will take on another day.”

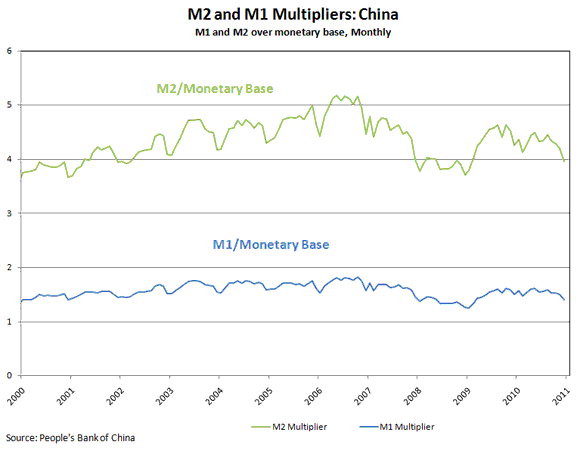

Well, it’s another day, so here we go. In China, increases in the monetary base—the stuff that the central bank directly creates—translate pretty directly into broader measures of money held (and spent) by the public, as illustrated by the relative stability of the so-called M1 and M2 multipliers:

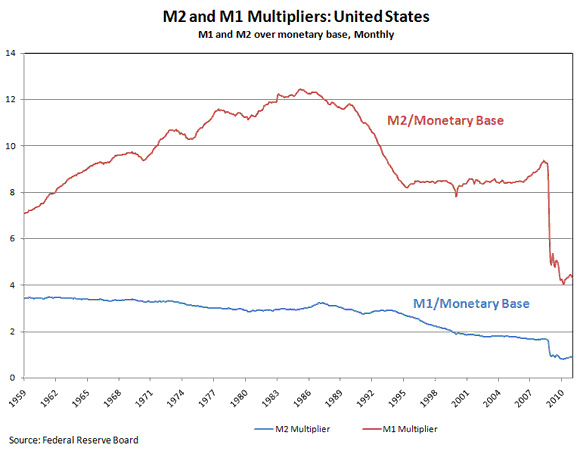

Admittedly, the collapse in the M2 multiplier in the United States—which has, for practical purposes neutralized the inflationary impact of the increase in the Fed’s balance sheet—may not last forever. If it reverses, I for one will read this again.

Leave a Reply