Selling continued in the major market indices yesterday, on significant volume, with the SPDR S&P 500 (SPY) breaking the intermediate trend line and 20-day simple moving average. For further confirmation that the intermediate uptrend is over, SPY should close below the trend line today as well.

STR Holdings, Inc. (STRI), a solar related company, had it’s IPO debut at the end of 2009.

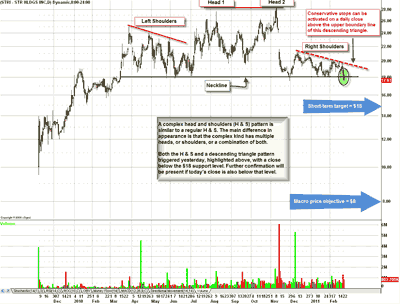

Currently there is a 23.20% short interest (% of float as of Jan 31, 2011), and it looks like the bears have it right. In March 2010, a complex bearish head and shoulders reversal pattern began developing. The pattern triggered yesterday with a close below the neckline, which is at $18, and further confirmation of the trigger will be present if today’s close is also below the neckline. A price objective of 8 dollars is obtained by measuring the height of the pattern and expanding lower, from the trigger point, by the same distance. In addition, the right shoulder is a price pattern itself, called a descending triangle pattern, which also triggered yesterday and has a price objective of $15.

Targets: short term: $15, macro: $8, Protective Stops: aggressive: confirmed move back above the neckline, which is $18, conservative: daily close above the upper boundary line of the descending triangle.

(click to enlarge)

Leave a Reply