As I have repeatedly stated, when the “Fed” took over the power to create money in the year 1913, we began the transition from a sovereign money system to a credit (debt-backed) money system. In the beginning, the ratio of sovereign money to debt money was low. Today it has progressed to the point that 100% of our money is debt-backed.

When the ratio of sovereign money to debt money is low, then adding debt money to the system indeed stimulates growth, as postulated by Keynes and others.

However, when the ratio of debt money reaches the saturation point, then adding more debt into the system actually works to diminish real growth.

The Saturation Point is defined as the point at which aggregate incomes can no longer support an increase in debt.

Debt saturation is exactly why real employment has been falling despite massive attempts to stimulate the economy with more debt backed dollars. REAL GROWTH has not occurred since the year 2000 – it has only been monetary growth creating the illusion of growth.

By some studies, today it requires roughly 6 new debt dollars to create $1 of net GDP growth. This is due to the diminishing return on debt, again a concept that goes alongside debt saturation. As more debt is added to the system, then the cost to carry that debt increases and makes the system less and less efficient at being productive and creating jobs.

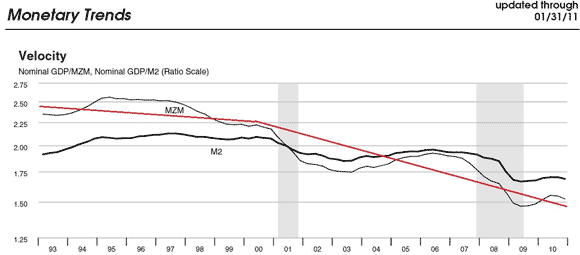

The velocity of money is a cousin to this concept. If an economy is saturated with debt, then new money creation does not move from one hand to another, instead it quickly returns back to the banks to service debt. This can be seen clearly in the Velocity chart below, note how MZM (currently the largest tracked measurement of “money”) was on a descending path in the nineties, but made a sharp turn down beginning in the year 2000:

The following chart shows the Civilian Participation Rate versus our government’s Total Debt. Note that from the middle sixties until the year 2000 that debt was forming the base of a now parabolic curve, and that adding debt during that time frame resulted in a higher percentage of people working in the population:

Note, however, that from the peak in the year 2000 to today, that debt is growing exponentially, yet the ratio of people employed in the population is falling dramatically! While this chart may not show direct causation, I believe that there are many pieces of corroborating evidence that all point to this same conclusion, that debt saturation is indeed real.

It requires only a simple mental exercise to illustrate the common sense behind this concept: If your personal income is $10,000 a year, but you owe $50,000 in debt lent at a simply interest rate of 10%, then your interest expense alone takes half of all the dollars you earn. Adding more debt at this point may temporarily increase spending, but it will diminish your ability to buy more things in the future as your future productive efforts go to servicing more interest on the debt. The only way adding debt makes your situation better is if it improves your ability to produce income.

In the United States, the addition of debt dollars has made us less productive due to the carrying costs of debt and the fact that capital is now fleeing to find non-saturated countries in which to work.

In fact, since the year 2000 total payrolls in the United States have actually declined!

That net employment decline over the past decade has occurred despite a GDP that has “grown” nearly 50% in size since that time, and a population that has grown by 30 million, or roughly 10.5%!!

In the beginning, the creation of debt lifts everyone as productive capacity is leveraged and thus enabled. In the end, however, DEBT cuts the other way, destroying productive capacity and employment.

Thus, our inflationary monetary system was doomed to fail from the moment it was conceived. In its current debt-backed form, the dollar is indeed wailing in the throws of death. There is but one mathematically sustainable system, that system must target Zero percent price inflation if it is to survive over the long haul. You will not create such a system as long as it remains in the hands of the bankers, and it is a myth that gold accomplishes this feat – it does not and never has throughout history. That’s because what’s most important is WHO produces the currency not what backs it!

Politicians also have incentives to inflate the supply of money. Thus the only chance we have at a prosperous and sustainable future is to place the money creation power into our representatives hands, but only with complete transparency for the people, with separation of special interest money from politics, and with proper checks and balances.

The power of money creation belongs in the hands of the people, not a few individuals.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

very intersting analysis. Whitney Tilson’s interview on 60 minutes discussing the mortgage market and Alt-A and Option ARM loans similarly references a massive debt situation that we can’t handle. 2011 may be a negative year in the markets, but timing this in light of all the other positive news will be the tough part.