Looking a little better each day.

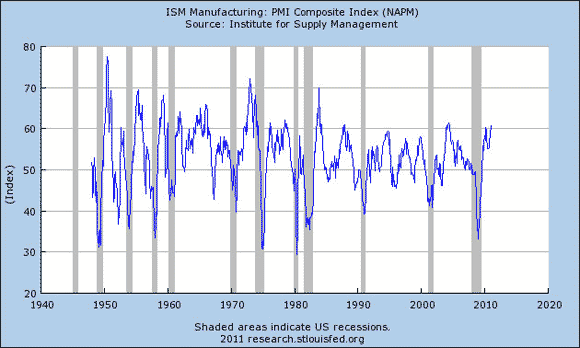

Let’s start with Tuesday’s manufacturing ISM survey of plant managers. A value above 50 signifies that more responders reported improving conditions than reported deterioration. The January reading of 60.8 is the highest we’ve seen since 2004, and is the sort of number we might see if real GDP were growing at a 6% annual rate.

Source: FRED

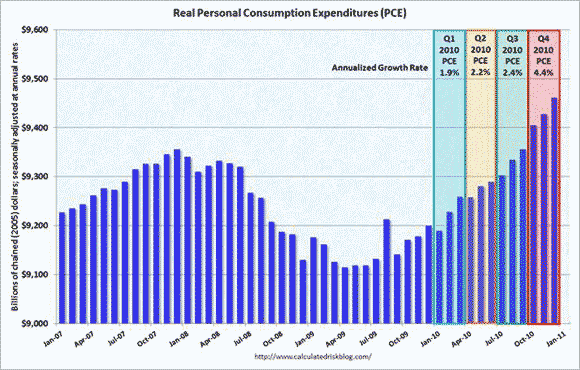

On Monday the BEA released December details for income and consumption. Personal consumption expenditures have been growing strongly quarter-to-quarter and month-to-month within each quarter.

Source: Calculated Risk

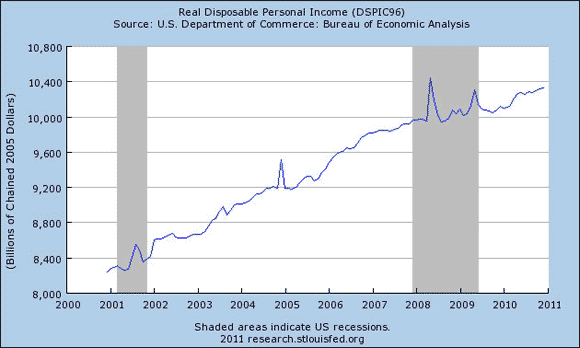

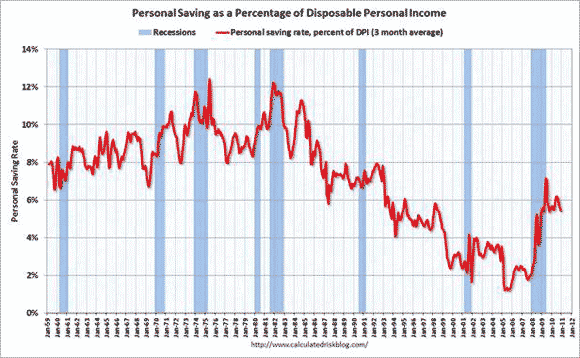

Earlier in the decade consumption spending was sustained by home equity withdrawals and very low saving rates. Trying to work out from under those debt burdens has been a key factor holding us back over the last three years. My hope had been that, with disposable personal income back to growing on track, we could see parallel growth in consumption spending while maintaining a decent saving rate.

Source: FRED

Source: Calculated Risk

Consumer spending now seems to be growing a little faster than income, and I’d be more convinced we’re on a sustainable path if the key driver of growth was coming from investment and net exports.

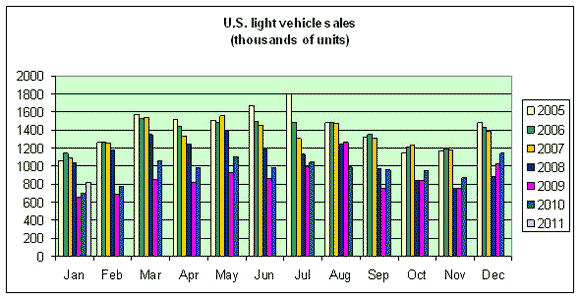

Light vehicle sales continue to experience steady moderate gains. The number of light vehicles sold in the United States in January was up 17.2% from the year before, though we’re still short of halfway back up from the low point reached in 2009.

Data source: Wardsauto.com

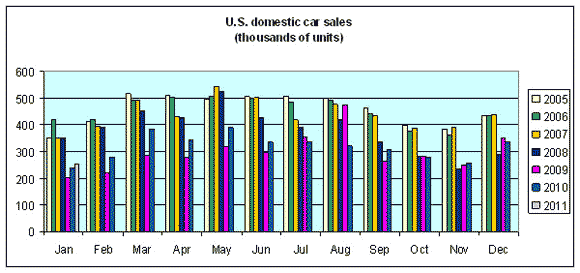

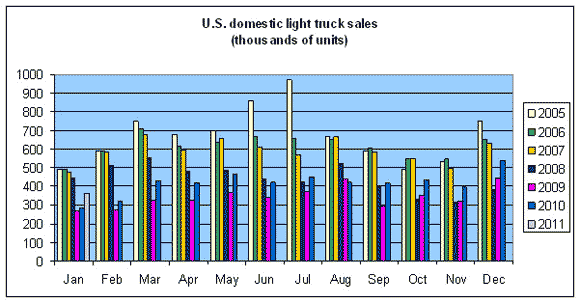

Motor vehicles and parts alone contributed 0.9 percentage points to the fourth-quarter real GDP annual growth rate of 3.2%, perhaps a little surprising since the gains in the number of light vehicles sold is more modest. But there’s also been a shift in the composition of vehicles sold, with the more expensive light truck and SUV category making a comeback. Sales of domestically manufactured cars were up 7.7% from the previous year, while light trucks and SUVs were up 28.1%.

Data source: Wardsauto.com

Data source: Wardsauto.com

That fact also becomes relevant when we consider the possible macroeconomic implications of recent oil price increases. As long as $4/gallon gasoline had been recent enough in people’s memories, car buyers remained wary of the gas guzzlers, and increases in gasoline prices from the levels we’d been seeing last year did not have the potential to significantly disrupt spending patterns or shock consumers.

But the gasoline price spike of the summer of 2008 is now almost 3 years behind us. And I’m guessing that by now there may be some shock potential of ongoing geopolitical turmoil in the Middle East.

Leave a Reply