I look for singles when it comes to speculative macro investing. A five percent move in currencies or bonds creates a ton of action given the amount of leverage the futures markets provide. If I’m lucky enough to catch a decent piece of one of these big swings I walk away happy. That would be a single. You need a few of these to make runs and win. But a man on base is, well, a man on base.

It happens to be that I cut all spec positions well before the end of the year. So I am looking at an empty plate. I’m looking for the next 5% play.

Individual stocks are of course going to give you the greatest opportunity for a 5% pop. Thousands do that every day. That is a very different game. I want to pick a broad market index and ride that for a bit one direction or the other. Basically your talking an S%P bet, a swing at the bond market or a shot at a currency position.

I don’t see an obvious bet in the short run on the S%P. It looks like two-way risk. The trend is your friend so often in this market. So you could argue that the path of least resistance is still higher. But how long is this going to go before there is the inevitable correction? I hate buying high on short-term plays. So no S%P bets for me till the fog lifts a bit.

Bonds will surely make a 5% move in the not too distant future. Once again the chart is pointing lower. It would be easy jump on the slide down. But there are a lot of headwinds on shorting bonds right now. Those most significant of which is that all of the smart money boys on Wall Street have been pumping up the talk for the ten-year with a 5 handle. That always makes me nervous. My worst fear on the short bond side is that the talk of a major conflict on the debt ceiling escalates and becomes an issue. Guess what happens when there is no agreement? They stop issuing bonds for a bit. A surprise like that would make short side bond guys puke. I’m not playing bonds for the time being.

So I’m stuck looking at currencies. I don’t see a reliable 5% move in either AUS or CAN. The Euro is an interesting place to look for a quick 5%. That could happen in any given week. Once again, “Which way to play?” The problem is that I can make a pretty good case for the EURUSD to make a hefty move one way or the other. If the outcome is a toss of the coin then it better to just not toss the coin at all.

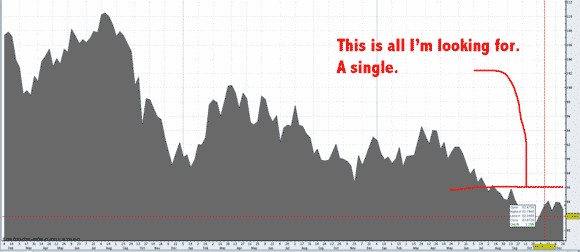

So that leaves the Yen. I’m more comfortable playing the long side of USDYEN than all the other options. We are currently around 81.80 so the target is 86.00.

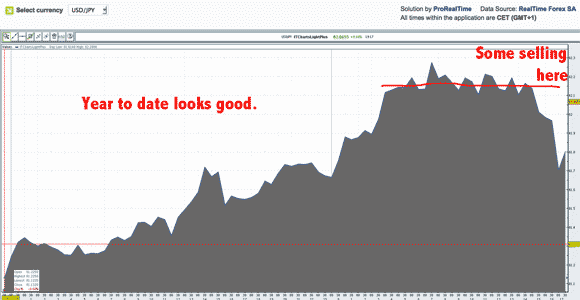

A return to 86 is supported by this longer-term graph.

The market has had a bid to it so for in 11’. There was a solid seller above 82.00. We’ll see if he’s there the next time around.

Why this trade now? Silly answer, it seems like an obvious choice. I’m just hoping some other folks see it that way too. If you’re looking for a different voice on this consider these words from Ambrose Evans-Pritchard at The Telegraph.

Japan will slip back into technical recession. It cannot keep raiding its foreign reserve fund to pay bills. Public debt will spiral up to 235pc of GDP. Interest payments will approach 30pc of tax revenues. Fresh debt issuance will outstrip fresh private savings this year. Dagong, Fitch, and S&P will have to act. Downgrades will come thick and fast. This time they will hurt.

Leave a Reply