The global imbalances that we have witnessed over the last years have led to significant changes in the net investment position of some countries. Those with persistent current account deficits (e.g. the US) have seen their net investment position deteriorate, while those with persistent current account surpluses have seen their net investment position improve (such as China). An improvement in the net position represents an increase in the foreign assets held by that country relative to its liabilities (domestic assets held by foreigners).

In some of the surplus countries (certainly in China), the majority of the accumulation of foreign assets has resulted in large increases in the amount of foreign assets held by the public sector (government or central bank), what is known as foreign reserves. Have they gone too far? Is there an optimal amount of foreign reserves for a country such as China?

SAFE (the State Administration of Foreign Exchange in China) provides on its web site an interesting list of FAQs regarding the current level of foreign reserves in China. To the question “What is the appropriate scale for China’s foreign reserves?” they provide an intriguing answer. They start with the assertion that “Too much foreign exchange reserves can be bad.” and then they follow with the paragraph:

“In terms of aggregate foreign exchange assets, in a broad sense, at year-end 2009, China held USD 3.46 trillion in foreign financial assets, far lower than the developed countries in North America and Europe. The main problem at present is that most of China ‘s foreign exchange assets are controlled by the government, leaving only a small proportion in private hands. Specifically, foreign exchange reserves held by the Chinese government account for two-thirds of all foreign assets in China, compared with only one-sixth in Japan. Therefore, we encourage businesses and individuals to hold and invest in foreign exchange so as to diversify the mix and to distribute foreign exchange within the private sector. This, of course, takes time. With the development of our national economy and the increase in income, enterprises and individuals will have greater demands for diversification of asset allocations. If more foreign exchange investment channels and products are provided for the public to reap concrete benefits from the foreign exchange, then the foreign exchange pressures on the government will be greatly relieved.”

The opening sentence is a claim that the overall level of foreign assets in China is not that high if you consolidate the public and private sector. Is this true?

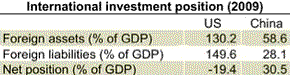

The table above summarizes the gross international investment position for the US and China in 2009. By looking at the first row we can see that the claim by SAFE is correct. The overall level of foreign assets (public and private) held by domestic individuals, companies or institutions in the US is more than 130% of GDP, significantly higher than in China (around 58%). However, in the case of China the majority of these assets are held as foreign reserves, i.e. they are in the hands of the government or central bank; foreign reserves in China represent more than two thirds of all the foreign assets. It is this unusual volume of foreign reserves what drives the headlines about excessive foreign reserves accumulation in China. But the SAFE claim is correct: if one is willing to consolidate the public and private holdings of foreign assets China is still far from the levels of the advanced economies.

But is the public/private composition relevant to understand these numbers? Let’s first understand the comparison between China and the US. No doubt that as a country opens up to international capital flows and individuals and companies diversify their portfolio of assets, we expect to see an increase in the amount of foreign assets (as % of GDP); that’s why the US (or advanced economies) have a much higher ratio of these assets relative to GDP.

In the case of China, the flow of foreign assets (a result of exports and capital inflows) ends up in the hands of the government because of restrictions on capital flows (domestic agents see no value in holding foreign assets or are not allowed to invest in the assets they might want to hold), which is unusual.

But if we take the view that what matters is the aggregate (public + private), does this mean that the level of foreign reserves in China is too low? No, this would be the wrong reading of the numbers or the debate. What matters in this debate is the net investment position which keeps improving (+30.5% in 2009) and it is the outcome of current account surpluses that reflect an imbalance which is not sustainable (or, possibly, optimal). It is true that if capital markets in China were more integrated with the rest of the world and more individuals and companies diversified their portfolios by holding foreign assets, we would not see such a high level of official foreign reserves in China. But this would not change the diagnosis of the situation. As long as the exchange rate remains undervalued and the current account in surplus, we would still see a continuous improvement in the net investment position as a sign of unsustainable global imbalances, regardless of the ownership composition of the foreign assets.

Leave a Reply