U.S. fashion retailer J Crew Group Inc (JCG) is near a deal to sell itself for nearly $3 billion in cash to the buyout firms TPG Capital and Leonard Green & Partners, sources familiar with the deal told Reuters on Tuesday.

Under the terms of the proposed deal, San Francisco-based TPG — a former owner of the retailer — would own 75% of the co. and Los Angeles-based Leonard Green would own the remaining 25%. J Crew’s Chairman and CEO, Millard Drexler, who owns more than 5% of the New York – based retailer, would also participate in the deal, the report said.

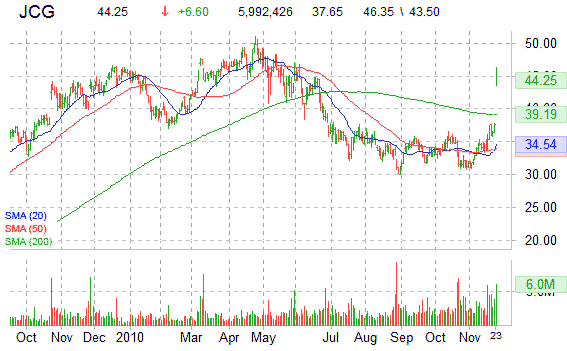

The buyout firms are expected to pay about $43.50 a share, or 16 percent more than J. Crew’s $37.65 closing price yesterday. Barring any last-minute snags in the talks, notes Reuters, an agreement could be announced as early as Tuesday.

Shares of J Crew surged 19% this morning on heavy volume. More than 5.9 million shares have already traded hands compared to a daily average of around 2.7 million. J Crew, which has a market cap of $2.4 billion, currently carries virtually no long-term debt. That makes it an attractive target for PE firms, which rely on borrowed money to acquire companies.

Technically speaking, JCG shares, which have been moving largely lower over the last 2 quarters, have underperformed the broader SPX by more than 10% during the past year. The equity has displayed a wide range intraday throughout the last 3-months along the $31 – $35 area. Currently the stock is pushing to fresh highs intraday as it lifts up to probe its Nov range high near the $36.00 area.

JCG is currently trading above its 50-day moving average of $33.93 and above its 200-day MA of $39.16. Ticker has a trailing trailing twelve P/E of 15.11, a forward multiple of 15.38 and a P/E to growth ratio of 0.90.

The 52 week trading range for shares of J Crew Group has been between $30.06 and $50.96 per share.

At last check, JCG shares were up $6.60 to $44.25, a gain of 17.53%.

Leave a Reply