Polo Ralph Lauren Corp. (RL) recently traded within striking distance of its multi-year high as the company’s earnings rebound on a better consumer environment. With an average earnings surprise of 41% over the last four quarters and a bullish next-year estimate, this Zacks #1 rank stock offers some nice momentum.

Company Description

Polo Ralph Lauren Corp., together with its subsidiaries, designs and sells clothes and accessories for men, women and children worldwide. The company was founded in 1967 and has a market cap of $8.99 billion.

Ralph Lauren’s business has rebounded briskly over the last year as the weak consumer environment has improved from the deep recession of 2008. We saw that trend show up in the company’s Q2 results from early August that easily beat expectations.

Second-Quarter Results

Revenue for the period was up 13% from last year to $1.2 billion. Earnings also came in strong at $1.21, 36% ahead of the Zacks Consensus Estimate, where the company now has an average earnings surprise of 41% over the last four quarters.

The strong results were led by the company’s retail segment, where operating income was up 50% from last year to $104 million. The segment also saw its operating margin spike, climbing to 17.5% from 13.5% last year.

Solid Balance Sheet

Polo Ralph Lauren’s balance sheet was also on the upswing during the quarter, with its total debt falling $156 million from last year to $262 million against close to $1 billion in cash and short-term investments. It’s debt-to-equity ratio of 8.8% is well ahead of its peer average of 36%.

Estimates

We saw some decent movement in estimates off the good quarter, with the current year adding 27 cents to $4.94 and the next-year adding 19 cents to $5.68, a solid 15% growth projection.

Valuation

On the valuation front, shares do look a bit pricey, trading with a forward P/E of 19X against its peers 14X.

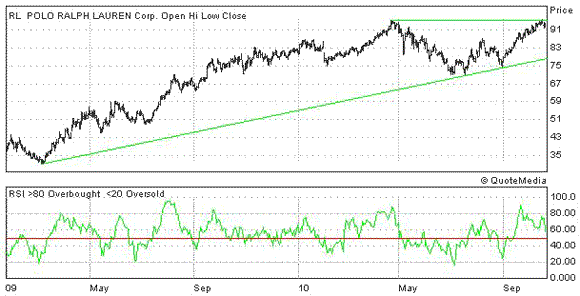

2-Year Chart

On the chart, shares are pressuring the multi-year high after jumping with the market in September. The RSI indicator below the chart says shares are trading safely away from over-bought territory, take a look below.

Leave a Reply