Union Pacific Corp. (UNP) just hit a new all-time high ahead of its Oct 21, Q3 results. With estimates climbing into the number and industry cohort CSX reporting another strong quarter, this Zacks #1 stock offers some nice upward momentum.

Company Description

Union Pacific Corp., provides railroad shipping services through a network of more than 32,000 miles of rails in North America. The company was founded in 1862 and has a market cap of $43 billion.

If UNP’s record Q2 results from late July are any indication, Q3 should offer plenty of treats for shareholders.

Second-Quarter Results

Revenue for the period was up 21% from last year to $4.2 billion. Earnings also came in strong at $1.40, 16% ahead of the Zacks Consensus Estimate, lifting the average earnings surprise to 6.72% over the last four quarters.

The company noted that it saw an 18% increase in car loads with very little incremental cost increases, a nod to its attention to curbing expenses.

All six of the company’s business groups saw revenue gains from last year, with automotive up 105% and intermodal up 35%.

Balance Sheet Improving

Union Pacific’s balance sheet has also been on the upswing, with its total debt load falling $625 million to $9.37 billion. It’s Debt-to-equity ratio of 53% is ahead of its peer average of 60%.

Estimates

We have seen some nice movement in estimates over the last few months, with the current year up 50 cents to $5.29. The next-year estimate is up 43 cents in the same time to $6.11, a solid 16% growth projection.

Valuation

Things look good on the valuation front too, with a forward P/E of 16X against its peer average of 17X.

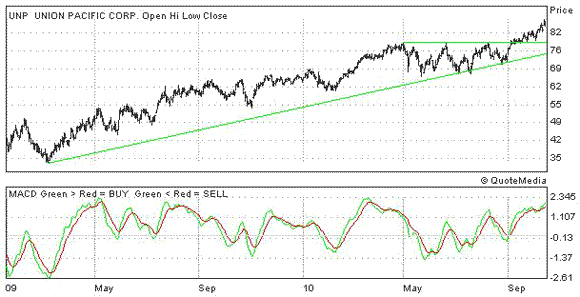

2-Year Chart

On the chart, shares recently hit a new all-time high after spending most of the last 18 months trending higher. The MACD below the chart is bullish too, take a look.

Leave a Reply