From the policy paper “A Taxpayer Receipt” from a D.C.-based policy group called “The Third Way“:

From the policy paper “A Taxpayer Receipt” from a D.C.-based policy group called “The Third Way“:

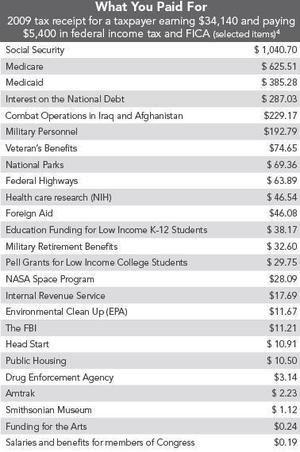

“Corn syrup, milk chocolate, sugar, cocoa butter, coconut, almond, soy lecithin… any consumer can read these ingredients and their nutritional value on every package of a75-cent Almond Joy. What is provided to a taxpayer with a $5,400 tax bill? Nothing. For many Americans, the amount they pay in taxes is larger than any purchase they make during the year, but studies show they know almost nothing about where that money goes.

An electorate unschooled in basic budget facts is a major obstacle to controlling the nation’s deficit, not to mention addressing a host of economic and social problems. We suggest that everyone who files a tax return receive a “taxpayer receipt.” This receipt would tell them to the penny what their taxes paid for based on the amount they paid in federal income taxes and FICA.”

MP: See the example above of an itemized tax receipt for the median tax filer in 2009 making an adjusted gross income of $34,140, and paying $2,790 in federal taxes, and $2,610 in Social Security and Medicare “contributions,” for a total federal tax bill of $5,400.

And here’s a slightly different version of an interactive itemized tax receipt calculator at a website called “Where My Money Goes,” which allows you to put in any income amount and see an itemized tax receipt (thanks to Alex Rodriguez for this website).

Leave a Reply