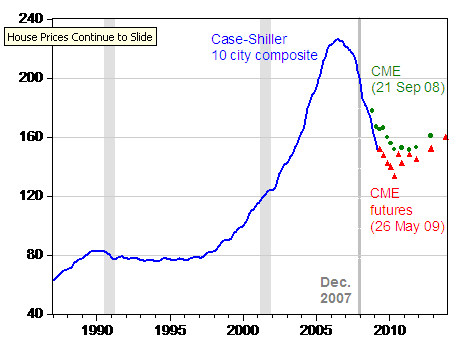

House prices continued to tumble in March, according to the Case-Shiller index. Time to see what the futures say (keeping in mind the forecasting capacity of the Case Shiller futures are not well known).

Figure 2: Case-Shiller 10 city price index, (blue line), CME futures prices, 26 May 2009 (red triangle), and CME futures prices, 21 Sep 2008 (green diamond). NBER-defined recessions shaded gray, and start date dashed gray line. Source: Standard and Poors’ [xls], ino.com, St. Louis FRED II, NBER, and author’s calculations.

So as of March, the 10 city is 40% lower than its May 2006 peak, in log terms (37%, in percent terms). The CME futures indicate that the 10 city index will be 52.7% lower by May 2010 (41% in percent terms). Compared to last September, the trough has moved up (the trough back then was slated to be in May 2011). However, one doesn’t want to make too much of these long horizon indications, since the futures prices for these dates (November 2011 onward) have not changed since, for instance, the February 25 futures (shown in this post).

Of course, futures prices incorporate both expectations and risk preferences. In addition, these markets — particularly at longer horizons — are not likely to be particularly thick, so one has to be careful about using these prices as forecasts, even if one were to assume risk neutral agents. For an alternative, one can use the forecasts of the old OFHEO indices and convert to implied Case-Shiller (see this post for example).

More commentary at Calculated Risk.

House Prices Continue to Slide

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply