Renesola Ltd. (SOL) is fresh off another great quarter, pushing shares back near the multi-year high at $8.75. Estimates have since spiked higher, with the current year up 28% in the last month.

Company Description

ReneSola Ltd. manufactures and sells solar wafers and related products. The company was founded in 2003, is based out of China and has a market cap of $677 million.

With crude quickly jumping back to elevated territory on the back of a rebounding global economy, alternative energy is once again back in the spotlight. The renewed interest and growing demand helped Renasola produce better than expected Q2 results on August 9 that contained the company’s second consecutive earnings surprise.

Second-Quarter Results

Revenue for the period was up 23% from last year to $254 million. Earnings also came in strong at 42 cents, 5% ahead of the Zacks Consensus Estimate.

The nice top-line growth was accompanied by effective expense management, with gross margin jumping to 30% from 17% last year on wafer processing cost reductions and a decrease in poly silicon costs.

The company’s operating profit also spiked, more than doubling from last year to $52 million.

Cash Position Jumps

Renesola used the good quarter to strengthen its balance sheet, with its cash and equivalents climbing 60% to $171 million. Its total debt of $578 million is down $26 million from last year for a debt-to-equity level of 42%, in line with its peer average.

Estimates

Analysts were encouraged by the results, with estimates taking a nice jump higher on the quarter. The current year is up 28% to $1.41 while the next-year estimate added more than 50% to $1.46.

Valuation

Not only does SOL have some very nice upward momentum right now, shares also look reasonably priced, trading with a forward P/E of 5.6X, a slight discount to its peers 6.40X.

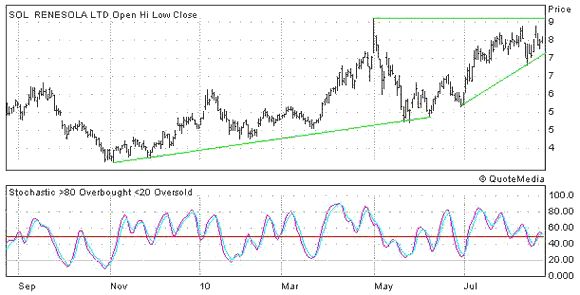

12-Month Chart

SOL has been climbing for most of the last six weeks, recently approaching the multi-year high at $8.75 on the good quarter. Look for support from the two trend lines and recent low just above $7. The stochastic below the chart is signaling that shares well away from over-bought territory, take a look below.

Leave a Reply