This is the second time I’ve made an Anoat allusion in a week. That has to be a record of some kind.

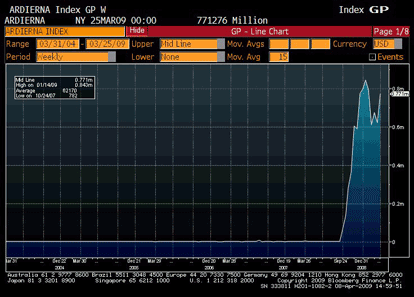

Anyway, how worried should we be about the lack-lustre start to the TALF? The thing that really worries me long-term is that we fall into a deflationary spiral, which really would result in Great Depression: Episode II. As you can see in this graph…

… bank reserves have sky-rocketed. Meaning that while the Fed has been busy “crediting bank reserves (i.e. printing money) to pay for their programs, banks have been shoving that money under the proverbial mattress.

The so-called shadow banking system is even worse. The ABS market has completely collapsed (at least until the TALF, more on that coming). Thus all spigots to consumer credit have slowed to a trickle. That has serious implications for the de facto money supply, which by my estimation is sharply negative.

TALF aims to reverse that. We might not be able to force banks to lend, and maybe we really want them to rebuild capital anyway. And we do want consumers to save and rebuild their own balance sheets. But we also don’t want them to over-save. That’s how we become Japan. But if we get a decent new issue ABS market doing, then at least consumers who can afford credit can access credit.

The TALF was supposed to work by basically giving a tax-payer subsidized free lunch. A nearly guaranteed arbitrage. But in fact, no one is showing up at the Fed to take out TALF loans.

Its worrisome, but we shouldn’t panic yet. First, we don’t really care how much the Fed lends under the TALF program. We actually only care that the ABS market gets back on its feet. So far, we’ve only had very high quality ABS deals get done since the TALF: a couple auto loan deals, a couple credit card deals, and a student loan deal back by the Department of Education.

ABS traders I’ve talked to say there is plenty of demand for those deals, but for whatever reason it isn’t TALF demand. Its possible that buyers have other funding options away from the TALF. Amidst worries about Congressional interference in compensation and other BS, I’d sure as hell take some other funding option even if it were at a higher cost. The ability to bring back my girlfriend from the dead just isn’t worth making a deal with Darth Pelosi.

There is also supposedly strong secondary demand for ABS, which is stuff that wouldn’t be TALF eligible anyway. Its almost like a market that’s properly functioning! People are looking for good bonds at decent spreads!

Anyway, its possible that the TALF actually revives the market without being used heavily. This is basically what happened with the Fed’s commercial paper program. It revived that market at least to the point where the top issuers can access the market.

So the thing to watch is not TALF loans, which I’m sure is what the media will focus on. Watch ABS issuance.

Leave a Reply