A. O. Smith Corporation (AOS) has jumped higher over the last few days on a 22% earnings surprise that has shares trading within a few Dollars of the multi-year high at $56.64. Even though estimates are on the rise, shares still trade at a discount to their peers, providing plenty of upward momentum for this Zacks #1 rank stock.

Company Description

AO Smith Corp. develops and manufactures water heating equipment and electric motors for residential and commercial applications worldwide and has a market cap of $1.66 billion.

AO Smith operates in what would generally be considered a more conservative segment of the market, selling small engines and water heaters worldwide. But that hasn’t prevented the company from posting some pretty impressive growth numbers, recently on display with better than expected Q2 results that included a 22% earnings surprise.

Second-Quarter Results

Revenue for the period was up 15% from last year to $573 million. Earnings also came in strong at $1.22, 22% ahead of the Zacks Consensus Estimate. The company now has an average earnings surprise of 25% over the last four quarters.

AO Smith’s electrical products division, which sells small motors to industrial customers, saw a big 22% gain in revenue, up to $198 million.

Its Water Products division was nothing to sneeze at either, up 11% to $375 million on strong international demand from Canada and China.

Although $9.3 million of that revenue pie came from its new water purification business in China, the company reported that progress on the initiative remains below expectations, and expects it to break even in 2010 with an eye to profitability in the near future.

Balance Sheet Perks Up

AO Smith used the great quarter to strengthen its balance sheet, boosting its cash and equivalents by $40 million to $94 million while its total debt load fell by $50 million to $245 million for a paired down debt-to-equity ratio of 14.2%.

Estimates

With some encouraging results on the table, estimates took a nice jump forward, with the current year adding 22 cents to $3.79. The next-year estimate is up 25 cents in the same time to $4.16, a solid 10% growth projection.

Valuation

But in spite of the great results and optimistic view, shares still look reasonably priced, trading with a forward P/E of 14X, a slight discount to its peers 15X.

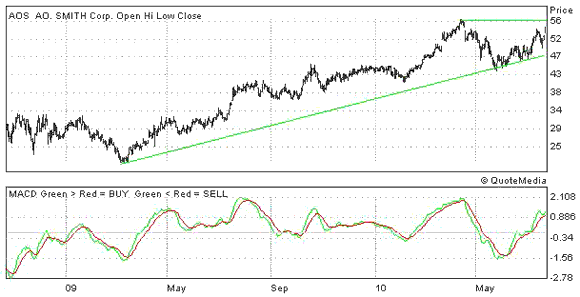

2-Year Chart

AOS spiked higher on the good quarter, reversing a string of losses from the previous week in the volatile market. As it stands, AOS is within striking distance of its multi-year high at $56.64. Look for support from the trend line and the short-term low an on any weakness, take a look below.

SMITH (AO) CORP (AOS): Free Stock Analysis Report

Zacks Investment Research

Leave a Reply