CSX Corporation (CSX) recently reported another solid quarter as the recovery continues on the rails. CSX trades at 13x forward earnings, well under its peers which trade at 16x.

CSX is a Florida-based railroad company with 21,000 miles of service in 23 eastern states and the District of Columbia.

CSX Beat by 10.3% in the Second Quarter

CSX was one of the earliest companies to report second quarter results but its earnings surprise and optimistic outlook set the tone for the second quarter earnings season.

On July 12, the company reported earnings per share of $1.07 which crushed the year ago number of 71 cents and easily beat the consensus of 97 cents.

Revenue rose 22% to $2.7 billion as volume rose in all of its major markets.

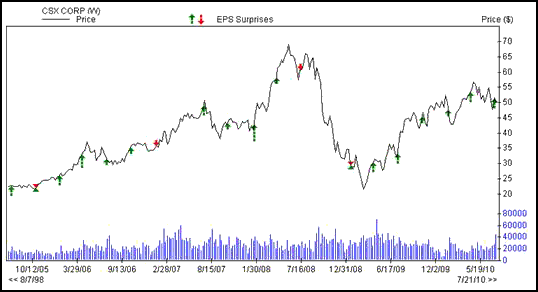

This earnings surprise extended the company’s earnings surprise streak to 6 quarters. In the last 5 years, it also has a pretty solid earnings surprise track record, as you can see below.

Zacks Consensus Estimates Soar

Given the better than expected earnings report, including that volumes were up in all markets, the analysts have been busy raising earnings estimates.

22 estimates out of 25 for the third quarter rose in the last 30 days to push up the Zacks Consensus by 8 cents to $1.02.

23 estimates, including 3 in just the last week, rose for the full year in the last month. Analysts now expect 2010 earnings growth of 34.3%.

The 2010 Zacks consensus moved higher by 27 cents to $3.85 per share during the prior 30 days.

Value Fundamentals

In addition to its low P/E ratio, it also have a value price-to-book ratio of 2.3. This is a little higher than its peers, which come in at 2.0, but it is still within the value parameters.

CSX boosts a solid return on equity (ROE of 15.1%, well above its peers at 10.2%.

The company also rewards shareholders with a dividend yielding 1.9%.

CSX is a Zacks #1 Rank (strong buy) stock.

CSX CORP (CSX): Free Stock Analysis Report

Zacks Investment Research

Leave a Reply