Yesterday’s protests were nowhere near as bad as feared, though we should probably reserve judgement until the return leg is played today at the G20 meeting.

Regardless, after a day spent watching the news yesterday it feels as if the London market is in its starting blocks, looking to sprint out of the gate into Q2. It appears to be a race to see which “risk on” trade can go furthest the fastest; while Macro Man noted yesterday that he thought that there might be some short-term upside in equities, for example, he has been bemused and bewildered by the enthusiasm for stocks and risky currencies today.

Regardless, today should prove to be eventful, with two key announcements. The ECB kicks things off at 12.45 London time, when they are widely expected to cut rates by 0.50%. The real key, however, will be any announcement at 12.45 (or hint from the 1.30 press conference) of unconventional easing measures.

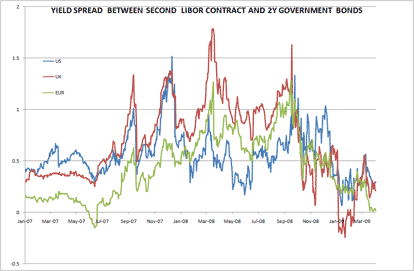

To be sure, the short end has rallied quite a bit, spurred on by huge upside option flows in June and September euribor. From Macro Man’s perch, Schatz offers more attractive upside for those that don’t need billions of euros worth of liquidity; the current gap between German 2 year yields and the second Euribor contract is the lowest its been since the crisis started.

Meanwhile, in the US, FASB announces its decision on whether to suspend mark-to-market accounting today. It seems likely that some of yesterday’s rally was anticipating a suspension today (though the tick up in the macro data surely helped.) How much of the recent equity rally has been predicated on the potential, ahem, “flexibility” that would accrude from MTM suspension? It’s hard to know for sure.

But as the chart below illustrates, the sort of illiquid turds that banks still carry on their balance sheets contin ue to plumb new depths (the price below is for the first 2006 vintage AAA-rated ABX index.) The watchword over the past year or two has been “where credit goes, equities follow.” Suspension of MTM may break that link, if only temporarily. Then again, if MTM is not suspended, stocks could snap back lower with a resounding thud. Macro Man has no view on the outcome, and hence no position in stocks.

If only he were on the distribution list for “the memo” that tips certain punters off in advance! Sadly, his application to join the list in the United States has been rejected. But let’s bear in mind that the US is hardly the only, or indeed the worst, bastion of crony capitalism out there.

A particularly egregious example has taken place in Switzerland, where today SNB governor Philipp Hildebrand made some comments supporting the prospect of further SNB intervention. In mid-afternoon yesterday, EUR/CHF had no friends and was sinking fast. Then magically, as if out of nowhere, huge bids appeared for overnight 1.52 call options when spot was trading 1,5130. Sure enough, Hildebrand has made his remarks today and we’re at 1.5234.

While this has helped Macro Man’s portfolio, it still doesn’t make it any more right. Macro Man has filed an application to join the so-called “Swiss mafia” of insiders….he’s even promised to grow a moustache and wear shiny green suits and white socks to work every day. Sadly, he’s had no reply so far.

Anyhow, while today might set the tone for Q2 it by no means will guarantee wherre we are in a month or two. Markets are, after all, a marathon, not a sprint, and the first one out of the blocks doesn’t always win the race.

Leave a Reply