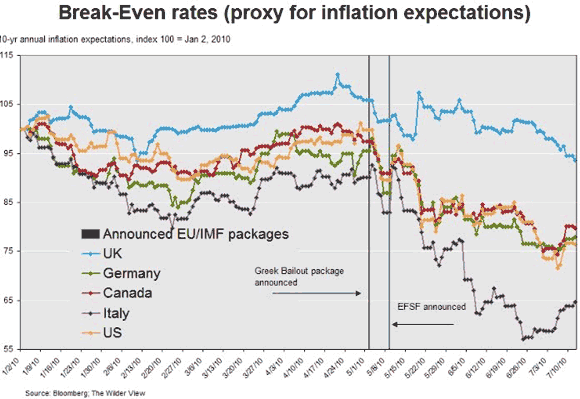

Rebecca Wilder alerts us to the fact that the drop in inflation expectations is not limited to the United States:

[I]nflation expectations are falling globally. The chart [below] illustrates the 10-yr break-even expected inflation rates for the UK, Germany, Canada, Italy, and the US using their respective inflation-indexed bond markets (TIPS in the US). Notably, declining inflation expectations is not specific to the US.

Here is her chart:

What this chart says to me is that not only is the Fed allowing U.S. aggregate demand to slip, but it is also allowing global aggregate demand to falter. How so? It all goes back to the Fed’s role as a monetary hegemon. As I noted earlier:

[T]he Fed is a global monetary hegemon. It holds the world’s main reserve currency and many emerging markets are formally or informally pegged to dollar. Thus, its monetary policy is exported across the globe. This means that the other two monetary powers, the ECB and Japan, are mindful of U.S. monetary policy lest their currencies becomes too expensive relative to the dollar and all the other currencies pegged to the dollar. As as result, the Fed’s monetary policy gets exported to some degree to Japan and the Euro area as well.

The Fed’s monetary hegemon status in conjunction with its loose monetary policy during the early-to-mid 2000s helped create the global liquidity glut at that time. As a consequence, there was an unsustainable boom in global aggregate demand. Now the Fed’s superpower status is working in the opposite direction: it is allowing to global demand to slow down. Focus, Ben, Focus!

Leave a Reply