Macro Man was sceptical of the PPIP yesterday and sceptical of the early-doors knee-jerk rally in stocks. He was short. He was wrong. His stop having been executed above 800, he can now sit back and survey the damage to his portfolio. Fortunately, his equity short was appropriately-sized, so the pain has been more intellectual than monetary. He is suffering through one of those irritating periods of correlation breakdown that are the cost of managing money the way that he does. It’s frustrating, but hopefully it’ll be short-lived.

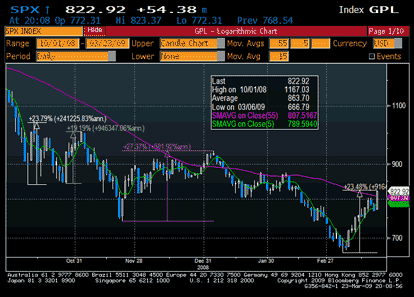

Macro Man was admonished last night not to repeat his mantra about 6% rallies. Coming so soon after the last 6% rally, there would appear to be little utility in doing so, so he won’t. Instead, he’ll cue up the Smiths’ “Stop Me If You’ve Hear This One Before”. The 23% rally off the recent lows has been impressive, but let’s remember that it’s the fourth such rally of similar magnitude of the last six months…..many of which have been centered around policy developments. So while he’s retreated to the equity market sidelines, nursing his wounds, Macro Man retains a less-than-enthusiastic outlook moving forwards.

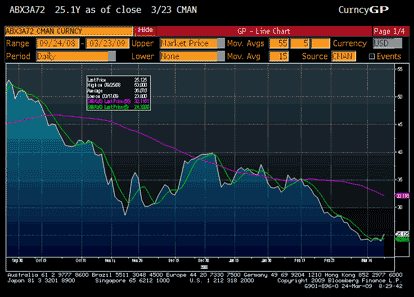

The question he has re: the PPIF is not why an asset manager would participate, but rather why a bank would sell assets at a level that would be economically viable for the buyer. While it is true that fund managers will be putting up a small sliver of equity relative to the assets that they can buy, what this means is that if the managers overpay it will take only a small decline in the value of the assets to completely wipe out that equity. If these investments are placed in specially-crafted vehicles, this will encourage them to drive the hardest bargain possible. Would you invest in a fund that has an equal chance of doubling its money or losing all of its equity/ Neither would Macro Man. It will be worth following ABX to see if markets start getting legitimately excited. So far, it’s been met with a yawn.

Elsewhere, the debate about the dollar’s reserve currency status rages on. A UN panel has suggested a move to a multilateral framework, though why the UN is opining on the matter is open for debate. Most likely because it’s the only organization that will give a platform to some of the “experts” quoted in the story, who have made a career out of not udnerstanding the functioning of currency markets.

Still, you can’t deny that many of the largest holders of FX reserves, including some of the worst of the serial piss-takers, are getting restless. China appears to be a Huey Lewis fan, as they’ve recently started playing “I Want A New Drug” * to fuel their FX reserve-buying habit. Now, Macro Man would argue that the current arrangement is useful, insofar as when the limits of economic rationality are pushed to extremes (like having $2 trillion of FX reserves), it provides a built-in disincentive to continue mercantilist behaviour.

Another consideration is that if a new FX reserve currency is going to be managed/arranged through the IMF, there should be some sort of quid pro quo. You know, like oversight of misaligned exchange rates. Such as when a country runs, oh, the largest trade surplus in the world, and offsets more than 100% of it with FX reserve accumulation, as China did in 2008.

When faced with an oversight condition, something tells Macro Man that PBOC will be serendaing the dollar with another Huey Lewis tune…..”Stuck With You.”

*Thanks to Bobby D for passing this one on.

Leave a Reply