I went to a Karate match years ago where the contestants really got into it with chops, kicks, yells, grunts and generally loud mayhem. When they parted, the ref said: “Lotta noise, no point!” So too the market yesterday. Tonight’s special STU (which you can peruse during free week) concluded that this was a topping process.

Well, maybe. Often at major tops and bottoms we get huge volume with no motion – a churning at a level before the market snaps the other way. Lotta noise, no point! I remember the bottom in Oct 10, 2002 (boy do I remember! I held a large short position and sweated the decision to get out) and it was like that mid-day. Usually the distribution at those moments comes with high volume, and yet yesterday volume was drifting lighter, probably due to tomorrow’s Veteran’s Day holiday. Indeed, volume has subsided for the past four trading days and should be very light tomorrow. Holiday trading tends to meander upwards, so hard to project from tomorrow.

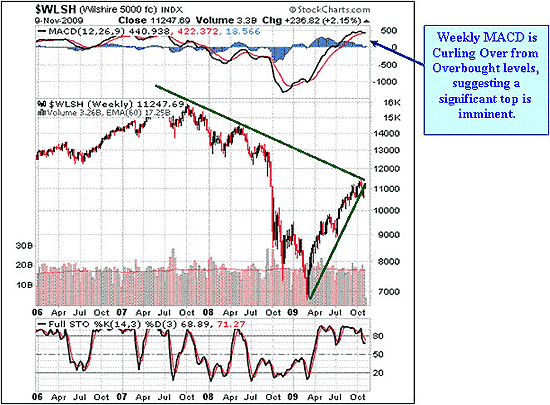

McHugh thinks we are topping, and offers the chart above as one reason: in the Wilshire 5000 (the broadest stock index), we have hit the convergence of the downward trendline off last year’s Bush Fear Crash (the falling W line) and the upwards trendline of this year’s Obama Hope Rally (the rising O line). The Wilshire broke the O line before the W line, which indicates a fall not a rise. McHugh also notes that the MACD is curling over (see lower part of chart above), which is also bearish.

SeekingAlpha has a fascinating discussion of all this which supports McHugh on the Wilshire and focuses on the US Peso. In effect, the article says we are entering a crisis, but it is not quite clear which crisis:

- Stock Collapse, which is bullish for the USD and Bonds

- Currency Collapse, which is bullish for stocks and terrible for bonds

- Country Collapse, which is bad all around as everything collapses

Let’s put the Country Collapse to the side for the moment – we get enough alarmist noise with no point from Al Gore – and ask whether the USD will break below DX74.50 (bad for bonds, good for stocks) or will the USD find a bottom, rally, and break the back of this stock rally.

BTW if any of you still doubt the inverse Dow/Dollar relationship, check out this comparison tick by tick yesterday from Karl Denninger (and read his post). Karl concludes:

The rally in the market has exactly nothing to do with the economy and the outlook for it. It is tied to one and only one thing – the decline in the dollar.

Lotta noise, but a very good point.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply