The week has started with a bit of a bang, as the Barron’s cover story arguing for a Fed rate hike sent equity longs and dollar shorts scurrying for cover. Well, for a couple of hours at least; after the initial flurry, both equities and non-dollar currencies saw solid demand and are, at the time of writing, solidly up on the day.

The Barron’s article contrasts starkly with views expressed in the weekend press by Adam Posen, newest member of the BOE MPC (and, as it so happens, a former colleague of one Benjamin S. Bernanke) arguing if favor of more, not less, QE.

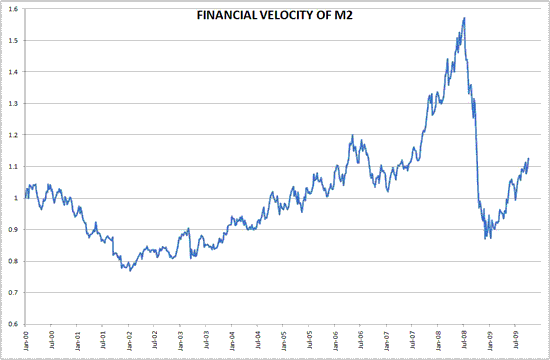

We are now entering treacherous waters for monetary authorities in highly-leveraged economies. Given the decade(s)-long dependence on the credit mechanism to spur economic growth, the financial crisis has brought about a precipitous decline in the velocity of money- i.e., how much economic activity is generated per unit of money supply. Bloomberg helpfully calculates a velocity indicator; as you can see, while recent fall has been steep, velocity never really recovered from the heady day’s of the 90’s productivity boom (and..err….internet bubble.)

(click to enlarge)

If the average or median citizen feels like they never really participated in the Noughties recovery, this is perhaps an indication of why. Q3 data, to be released towards the end of next week, will probably show a very modest uptick in velocity (presuming a small positive growth reading for nominal GDP in a quarter when M2 was broadly stable.)

Given the damage inflicted on Main Street by this recession, the Fed will almost certainly want to see what looks to be a sustained uptick in the “economic” velocity of money before meaningfully tightening the taps; after all, we know that Big Ben is a student of the Depression and of the policy mistakes that occurred in the 30’s.

So what’s the problem? Well, the challenge for the Federales is that there are some areas where velocity has picked up- namely, financial markets. Macro Man constructed a rough and ready “financial velocity” index, which is the ratio of an index of financial markets (the SPX, 10 year Treasury futures, EUR/USD, gold, and oil, all equally weighted) to M2. As you can see, after a calamitous decline in the teeth of the crisis, over the last couple of quarters financial velocity has picked up nicely.

So herein lies the problem; vast bulk of the veritable Everest of Fed liquidity provisions seems to have found its way onto Wall Street, not Main Street. Not that you didn’t know this, of course; however, it seems close to inevitable that there will be a significant backlash against, ahem, “well-connected” banks that have benefited disproportionately from the Fed’s largesse.

Now, the Fed might say that “that’s a problem for the Administration, not for us.” OK, fine. But the question still remains; does the Fed shape policy to goose economic velocity higher (in which case lower for longer will be the outcome), or does it at long last address asset prices (‘twould be troubling to see financial velocity start exceeding the 2002-2006 trend.)

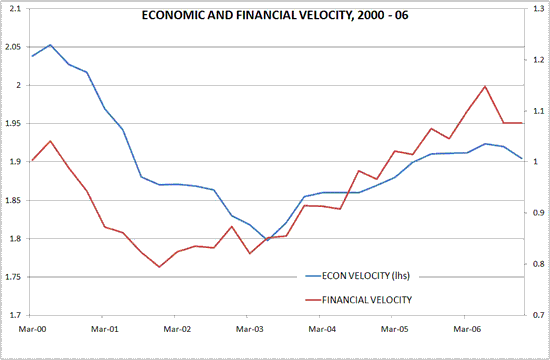

There really isn’t an obvious answer. It seems clear, however, that the government (and not just in the US, mind you) will wish to align the fortunes of Wall Street and Main Street more closely. Indeed, during the first six years or so of the Noughties, economic and financial velocity were relatively well-correlated…

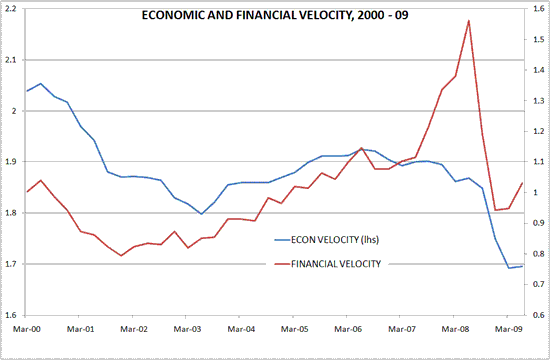

…only to diverge sharply since 2007.

Re-aligning the two would appear to be a task well outside the scope of monetary policy; small wonder, then, that pockets of policymakers the world over are expressing considerable zeal for financial regulation.

And where does that leave the Fed? Fervently praying that economic velocity picks up so that their job becomes a bit easier!

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply