How quickly the world can change. Just a few weeks ago, incoming data suggested room for optimism. And, in large measure, continue to do so. Regional manufacturing reports have been largely solid, while initial unemployment claims declined during the month, ending last week just a hair above the 400k mark. Even consumers appeared a bit brighter, with confidence rising to its highest level in three years (still low, but the right direction). To be sure, there were some setbacks as well. The revisions to 4Q10 GDP were disappointing, although I would still focus on the final demand figure rather than the headline. Non-defense, non-air capital goods declined sharply, almost erasing the previous month’s surge. But an up-and-down pattern has been a persistent feature of that data series in recent months, suggesting little to worry about in the context of other generally positive manufacturing indicators.

The rapidly evolving situation in the Middle East, however, threatens to unsettle this positive momentum as oil prices surge. Unfortunately, the suddenly choppy economic waters catch US monetary policymakers off guard, and it shows in recent Fedspeak. It appears that the Fed is stuck between two narratives, one in which the energy price shock turns inflationary given signs of economic improvement in recent months, and another in which oil undermines a still-nascent recovery. It is an unfortunate debate to have during this period of uncertainty and this early in the recovery.

The usual suspects seize upon recent data to argue for a new evaluation of the Fed’s large scale asset purchases. From the Wall Street Journal:

“Should economic prospects continue to strengthen, I would not rule out changing the policy stance to bring QE2 to an early close,” Federal Reserve Bank of Philadelphia President Charles Plosser said. “If the growth rates of employment and output begin to accelerate or if inflation or inflation expectations begin to rise, then it may be time to begin taking our foot off the accelerator,” he said.

Richmond Fed President Jeffrey Lacker continues along the same argument:

Lacker was asked if he would dissent against continued bond buying if he had a voting slot on the FOMC this year. He declined to say, but added he takes “very seriously” the Fed’s pledge to continuously re-evaluate the program. Lacker said recent growth levels should have “tilted things in the direction in modifying the program,” adding he believes QE2 has had a “minimal contribution” in driving the current recovery.

And, unsurprisingly Kansas City Federal Reserve President Thomas Hoenig continues to rail against the inflationary implications of Fed policy. More surprising is a bit of hawkishness from Governor Janet Yellen:

Yellen said “any increase that seemed to be sustained in inflation expectations or core inflation, that looked like we were getting pass through [from commodity price gains] that seemed to be sustained, would demand a response” from monetary policy.

She also said the Fed would have to be ahead of the curve and would need to move to tighten policy before inflation became an issue, repeating a mantra common to central bankers. She noted that, in past years, the central bank had enjoyed the “luxury” of unexpected commodity price gains not passing through to inflation in any significant fashion.

This suggests that Yellen is sympathetic to the notion that the recent economic upswing offers a path for commodity price gains to work their way to core inflation. Meanwhile, St. Louis Federal Reserve President Robert Bullard plays all sides of the table. Via (again) the Wall Street Journal, he raises the prospect of additional easing:

But while Bullard, a non-voting Fed member this year, said QE2 could be adjusted, he still said a third bond-buying effort is not totally off the table, given tensions in the Middle East and rising oil prices and ongoing concerns about the euro-zone debt crisis.

Still, this clearly is not the direction he is leaning:

For now though, “looking at the data today and the outlook, the natural thing would be to say either that we should pull back a little bit” on bond-buying, or just follow through with the program if the consensus is the economic outlook is not sufficient enough to end the program before June, he said.

I think it is somewhat silly to be discussing an early end to the LSAP as it only adds another layer of uncertainty on what was already an increasingly uncertain environment. Somewhat pointless as well – the end is fast approaching in any event. Indeed, I find the debate disappointing, albeit expected. Policymakers appear to have learned little from their failed exercise in hawkishness this time last year.

What should be our baseline expectation for policy at this juncture? First, the current LSAP policy concludes as planned, at least in magnitude. They could choose a more gradual end to the policy, but I am hard pressed to see a change in the ultimate amount given the time horizon (June will come faster than we think). Indeed, continuing high unemployment alone argues against meaningful alteration of the policy despite signs of economic health. Second, the oil price shock raises the odds for another round of easing. Simply put, the recent trajectory of commodity prices threatens to shift the story from a benign signal that the economy is on the mend to something much more dire. And much more dire generally induces monetary easing, not tightening.

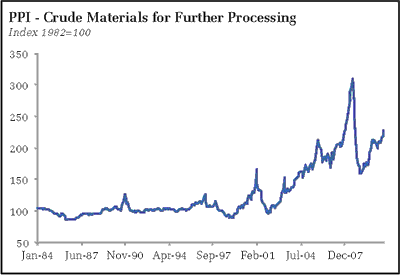

Consider an example I recently used in class. The question: What is the impact of a commodity price shock? To gain some direction, construct a four variable vector autoregression of commodity prices, core PCE prices, real GDP, and the federal funds rate. For a commodity price measure, I used the PPI measure for Crude Materials for Further Processing:

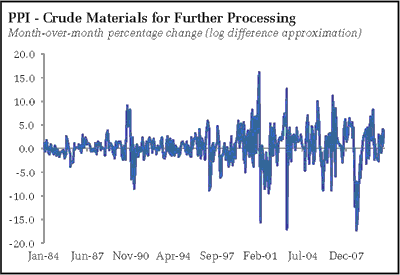

To implement the model, I took the first difference of the natural log of each of the first three variables (DIFFCOM, DIFFPRICES, DIFFGDP), multiplying each by 100 to convert to percentages. The commodity price measure is quite variable:

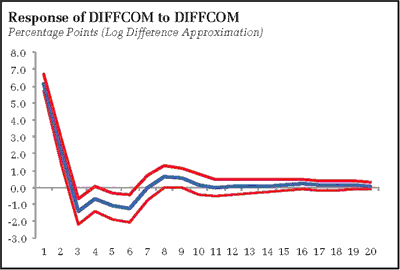

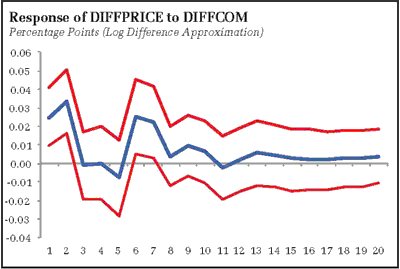

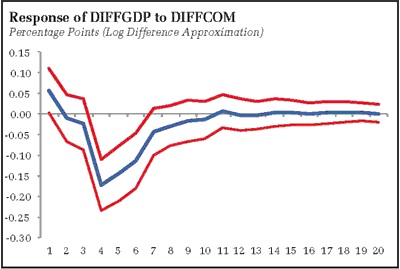

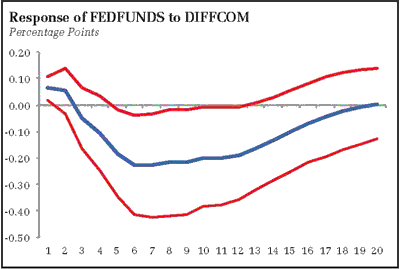

I estimated the model with 5 quarterly lags over the period 1984:1 to 2010:4. I then generated impulse response functions to examine the impact of an unexpected shock to commodity price inflation:

The results suggest that a roughly 8 percentage point increase in commodity prices yields virtually no impact on core inflation, but, after four quarters, drives real GDP growth down .17 percentage points. Monetary policy responds with a .23 percentage point decrease in the fed funds rates after 7 quarters. Of course, in the current zero interest rate environment this response would need to be mimicked with a fresh expansion of the quantitative easing (I have yet to find a satisfactory replacement for the federal funds rate to take into account the zero bound. Topic for future research).

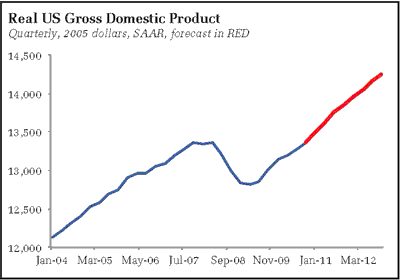

Also of interest is the GDP forecast from this model:

This translates to a Q4-over-Q4 forecast of 3.7% for 2011, pretty much dead center of the Fed’s central tendency in the most recent minutes. In contrast to the Fed’s prediction of sustained higher growth in 2012 and 2013, GDP forecasts in this model more quickly decelerate to trend growth.

Recall that the estimation period of this model was through the final quarter of last year. Note that commodity prices continued to rise in 2011, with the measure used here rising 10% in January compared to the fourth quarter average. February’s read will be even higher. In other words, we are experiencing a significant commodity price shock this quarter. While certainly a drag on growth, is it yet sufficient to derail the recovery? The White House thinks no:

Earlier in the day, Austan Goolsbee, chairman of the White House Council of Economic Advisers, said that the U.S. economy can withstand oil price increases so far.

“Anything like we have seen so far neither we nor the private sector has forecast that would derail our recovery,” Goolsbee said yesterday at a breakfast with reporters organized by the Christian Science Monitor.

I would tend to agree – if commodity price inflation slows sharply at this point. But the surge of recent weeks has already exceeded my expectations, and memories of 2007 and 2008 still linger fresh in my mind. The economy can’t withstand another quick run to $140 a barrel, and I suddenly feel that we are at a tipping point to brings such a run into view.

Bottom Line: The recent surge in oil has been a blow to my rising optimism. With this surge coming on the heels of accelerating US activity, monetary policymakers will offer some concern over the inflationary impact. Recent history, however, suggests the opposite – that unless the tide of rising commodity prices is soon arrested, Fed officials will find themselves faced with the prospect of yet another round of quantitative easing.

Leave a Reply