Shares of e-commerce giant Amazon.com, Inc. (NASDAQ:AMZN) continue to surge on Friday. Shares gained momentum Thursday after the company reported Q2 revenue and profit that easily topped Wall Street’s expectations.

Amazon said it earned $1.78 per share on revenues of $30.40 billion, up 4.4% sequentially and 31.1% from a year ago, surpassing analyst estimates of EPS of $1.12 on $29.57 billion in revenue. The North America and Amazon Web Services segments were strong contributors to profits, growing by 22 and 68 basis points, bringing in $16.52 billion and $2.9 billion, respectively.

For the third-quarter, Amazon said it expects net revenues to be between $31 billion to $33.5 billion, up 6.1% sequentially and 27.2% year over year at the mid-point, compared to the consensus revenue estimate of $31.66 billion.

Wall Street firms this morning are reacting to Amazon’s above-consensus results, becoming more bullish on the name due to the impact of profits on the company’s bottom line. In a research note to investors, UBS raised its price target on Amazon stock to $900 from $785 and reiterated a ‘Buy’ rating on the online retailer. Analysts at Jefferies also raised their price target for Amazon to $950, saying the company remains one of the best large-cap ideas in the firm’s coverage universe.

Alongside Jefferies, Pacific Crest’s Edward Yruma also issued a research report on Amazon stock, saying the company’s retail business is in the early stages of accelerating profitability. The analyst raised his 12-month base case estimate on AMZN by 27 points to $847 with an ‘Outperform’ rating.

One of the main reasons why Amazon has been crushing it recently with Q2’16 being its fifth-straight profitable quarter, is its tendency to make a lot of experimental bets. True, some of them such as Fire Phone, which clearly failed to make a dent in the smartphone market, or the company’s recently shut down flash-sales site MyHabit have missed the mark. However, they’ve had great success with their Amazon Web Services [AWS] division, which has seen significant growth.

Last quarter, AWS revenue grew by 28 percent. This quarter, it smashed that growth, with AWS revenue up 58% from $1.8 billion for the corresponding period in fiscal-year 2015. Furthermore, Amazon created its own discount holiday last year called Prime Day, which is a favorite not just for online shoppers as it offers unlimited free two-day shipping, but also for Amazon stockholders.

The self-created holiday to mark Amazon’s 20th anniversary generated significant traction this year with worldwide orders jumping more than 60 percent compared with the previous Prime Day. Morningstar’s R.J. Hottovy estimated the event may have added between $500 million and $600 million in incremental sales to Amazon’s topline. The sales day is expected to be included in Amazon’s next quarter’s earnings.

Going forward, the online retailer is betting that drone deliveries will speed up delivery times and cut down its multi-billion dollar logistics bill. Amazon is also expanding its grocery business. According to financial services firm Cowen, “Amazon will be a top-10 player in the approximately $795 billion US Food & Beverage Grocery market by 2019”.

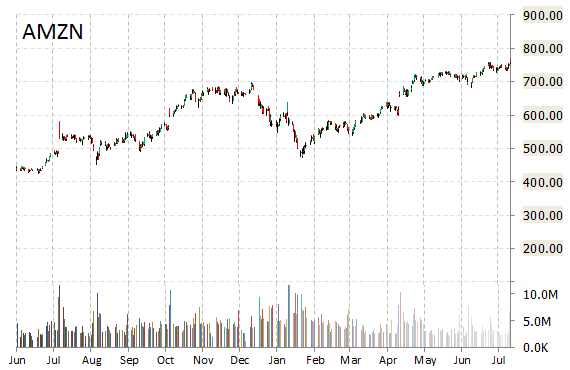

Amazon Stock Hits All-time High

Amazon stock is higher by more than 14 points to $766 in early trading Friday, as shares hit an all-time high following record second quarter results.

Shares of the e-commerce giant have surpassed their previous high of $757.34, set earlier this month. Amazon.com stock is up more than 44% year-over-year, and 13.14 year-to-date. The Seatlle-based company has a market cap of about $369 billion.

As long as Amazon keeps reporting profitable quarters, the stock is likely to respond accordingly.

Leave a Reply