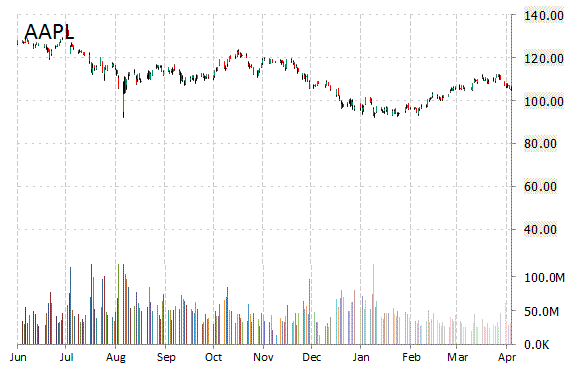

Apple (AAPL) – According to a recent report from The Wall Street Journal, it has been revealed that Apple sold 2x as many Apple Watches in its first year versus the debut year for the iPhone.

The tech giant is expected to reports Q216 earnings tomorrow after the close. The results are likely to show iPhone slowdown.

Apple stock is lower by 0.52% to $105.13 in pre-market trading on Monday.

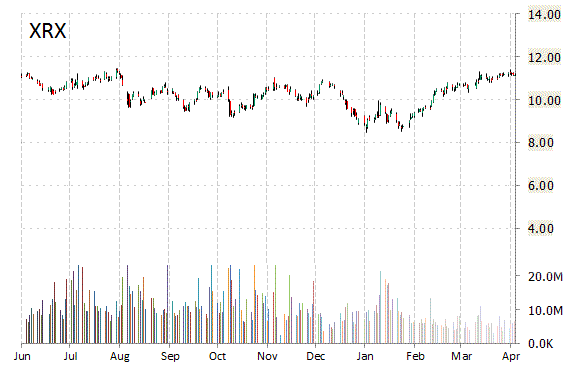

Xerox stock is down $0.77 to $10.40 in pre-market trading Monday after the company reported its first quarter earnings results.

The copier and printer giant posted earnings of $0.22 per share on revenues of $4.28 billion, down 4.2% from a year ago. Analysts were expecting EPS of $0.23 on revenues of $4.23 billion.

For Q216, Xerox (XRX) provided EPS guidance of $0.24-$0.26 versus consensus of $0.26 per share.

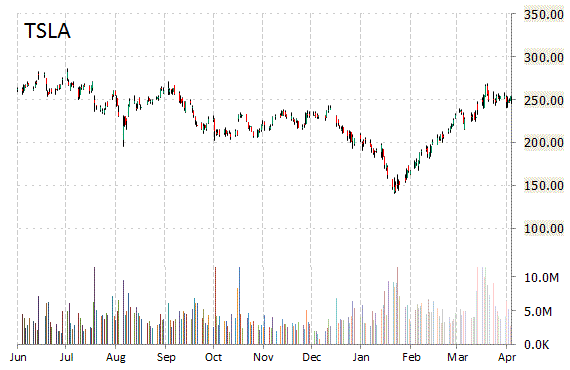

Tesla’s stock was down 0.53% to $252.40 in trading before U.S. financial markets opened. Goldman Sachs (GS) this morning raised the name’s price target to $245 from $202. The investment bank rates Tesla Motors (TSLA) a ‘Neutral’.

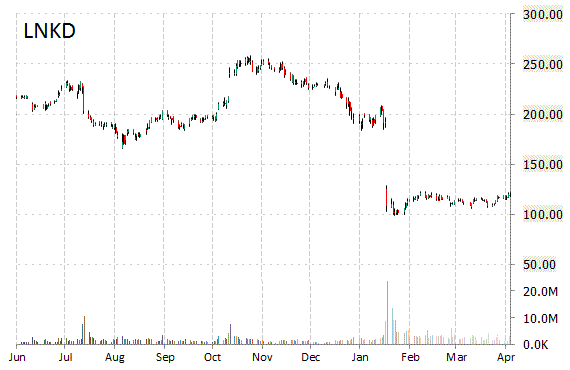

Wedbush reported on Monday that they have lowered their rating for LinkedIn Corporation (LNKD) ahead of earnings on Thursday. The firm has lowered its price target on the name to $130 from $200.

LNKD stock recently traded at $119.38, a loss of $0.07 over Friday’s closing price. The name has a current market capitalization of $15.77 billion.

Leave a Reply