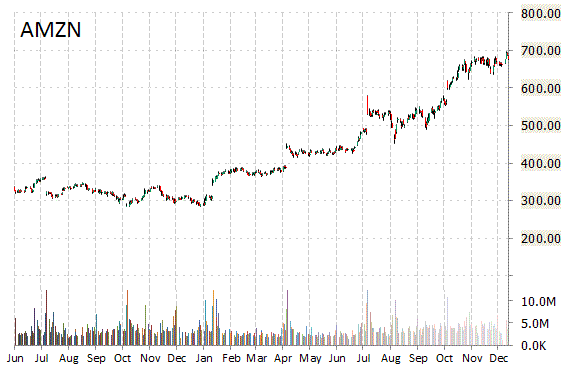

In a report published Friday, Susquehanna analysts initiated coverage on Amazon.com, Inc. (AMZN) with a ‘Positive’ rating and $900 price target.

On valuation measures, Amazon.com Inc. shares currently have a PEG and forward P/E ratio of 5.22 and 100.14, respectively. Price/sales for the same period is 2.76 while EPS is $0.70. Currently there are 34 analysts that rate AMZN a ‘Buy’, 7 rate it a ‘Hold’. No analyst rates it a ‘Sell’. AMZN has a median Wall Street price target of $760.00 with a high target of $850.00.

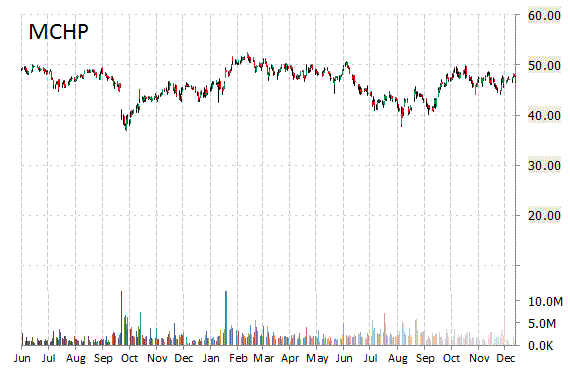

Analysts at Needham are out with a report this morning upgrading shares of Microchip Technology Inc. (MCHP) with a ‘Buy’ from ‘Hold’ rating. The firm set its price target for the company at $60.

Microchip Technology Inc. shares are currently priced at 23.38x this year’s forecasted earnings, which makes them expensive compared to the industry’s 10.22x earnings multiple. Ticker has a forward P/E of 13.67 and t-12 price-to-sales ratio of 3.98. EPS for the same period is $1.73.

In the past 52 weeks, shares of Chandler, Arizona-based company have traded between a low of $37.77 and a high of $52.44 and are now at $40.42.

Shares are down 3.73% year-over-year and 9.67% year-to-date.

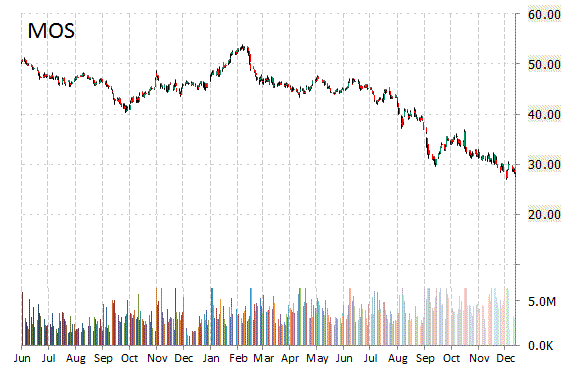

The Mosaic Company (MOS) was raised to ‘Neutral’ from ‘Sell’ at Goldman Sachs (GS) on Friday.

MOS is down $0.36 at $24.71 on normal volume. Midway through trading Friday, 3 million shares of Mosaic Co. have exchanged hands as compared to its average daily volume of 5.90 million shares. The stock has ranged in a price between $24.23 to $24.82 after having opened the day at $24.08.

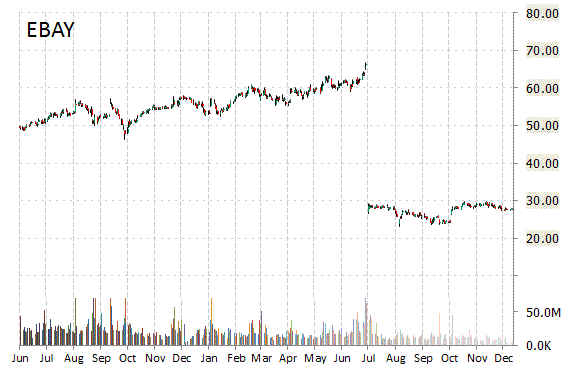

Investment analysts at Susquehanna initiated coverage on shares of eBay Inc. (EBAY) in a note issued to investors on Friday. The firm set a ‘Positive’ rating and a $34 price target on the stock. Susquehanna’s price target would suggest a potential upside of about 34% from the stock’s current price of $25.28.

eBay Inc., currently valued at $30.35 billion, has a median Wall Street price target of $29.00 with a high target of $36.00. Approximately 5.4 million shares have already changed hands, compared to the stock’s average daily volume of 10.25 million.

In the past 52 weeks, shares of San Jose, Calif.-based company have traded between a low of $22.11 and a high of $29.83 with the 50-day MA and 200-day MA located at $27.68 and $27.14 levels, respectively. Additionally, shares of EBAY trade at a P/E ratio of 13.75 and have a Relative Strength Index (RSI) and MACD indicator of 31.50 and -0.98, respectively.

eBay Inc. currently prints a year-to-date loss of around 6%.

Leave a Reply