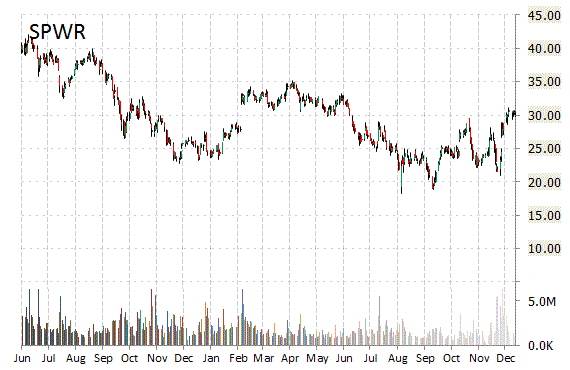

Analysts at Goldman (GS) downgraded SunPower Corporation (SPWR) from ‘Buy’ to ‘Neutral’ in a research report issued to clients on Tuesday.

On valuation measures, SunPower Corp. stock it’s trading at a forward P/E multiple of 18.71x, and at a multiple of 55.09x this year’s estimated earnings. The t-12-month revenue at SunPower is $2.37 billion. SPWR ‘s ROE for the same period is (1.18%).

Shares of the $4.15 billion market cap company are up 18.09% year-over-year.

SunPower Corp., currently with a median Wall Street price target of $33.57 and a high target of $44.00, rose $0.05 to $30.41 in recent trading.

The chart below shows where the equity has traded over the past 52-weeks.

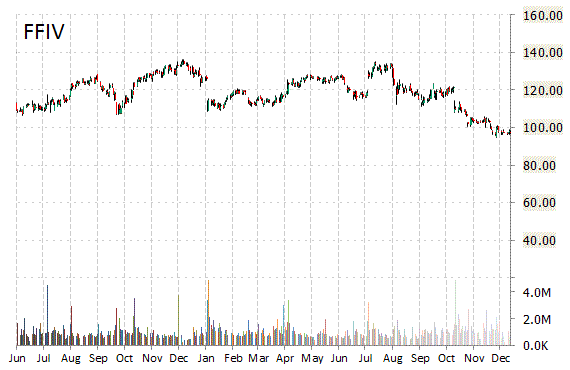

F5 Networks, Inc. (FFIV) was downgraded from ‘Outperform’ to ‘Perform’ at Oppenheimer.

Shares have traded today between $95.50 and $96.70 with the price of the stock fluctuating between $94.51 to $135.20 over the last 52 weeks.

On valuation measures, F5 Networks Inc. shares are currently changing hands at 19.18x this year’s forecasted earnings, compared to the industry’s 12.55x earnings multiple. Ticker has a t-12 price/sales ratio of 3.55. EPS for the same period registers at $5.03.

Shares of F5 Networks have lost $0.43 to $96.50 in midday trading on Tuesday, giving it a market cap of roughly $6.80 billion. The stock traded as high as $135.20 in July 31, 2015.

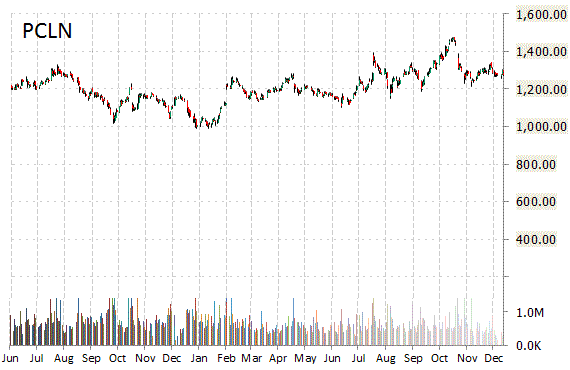

Raymond James reported on Tuesday that they have lowered their rating for The Priceline Group Inc. (PCLN). The firm has downgraded PCLN from ‘Strong Buy’ to ‘Outperform’.

Priceline Group Inc. recently traded at $1,206.85, a loss of $38.52 over Monday’s closing price. The name has a current market capitalization of $60.08 billion.

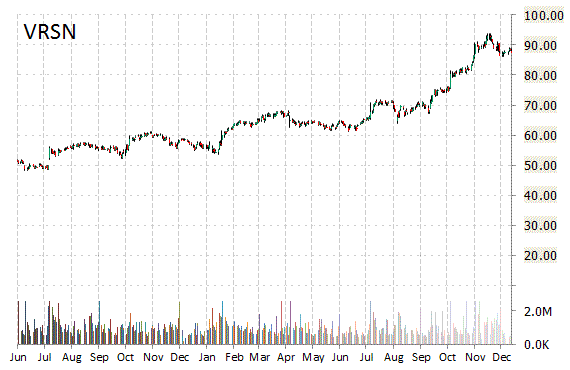

VeriSign, Inc. (VRSN) had its rating lowered from ‘Neutral’ to ‘Sell’ by analysts at Citigroup (C) on Tuesday.

Currently there is one analyst that rates VRSN a ‘Buy’, 2 analysts rate it a ‘Sell’, and 5 rate it a ‘Hold’.

VRSN was down $2.74 at $81.21 in midday trade, moving within a 52-week range of $53.48 to $93.94. The name, valued at $9.05 billion, opened at $81.64.

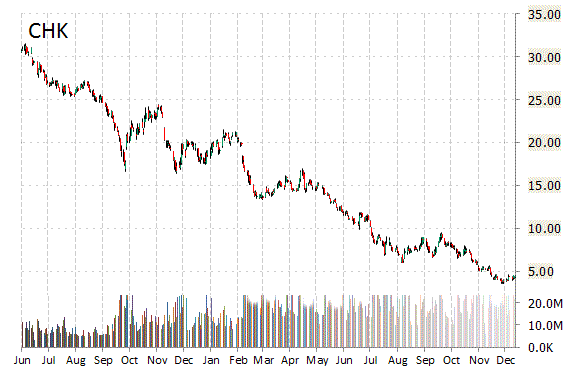

Chesapeake Energy Corporation (CHK) was reiterated a ‘Buy’ by Wunderlich analysts on Tuesday. The broker however, cut its price target on the stock to $7 from $13.

Leave a Reply