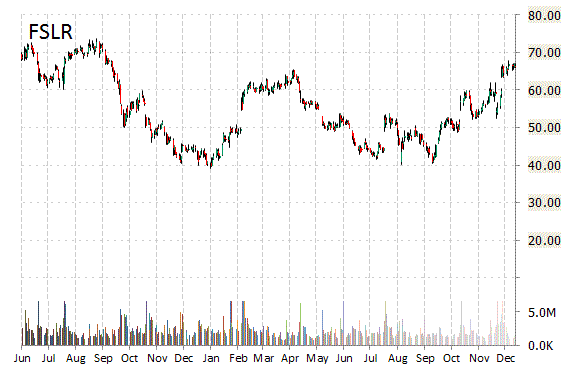

Analysts at Goldman Sachs (GS) are out with a report this morning upgrading shares of First Solar, Inc. (FSLR) with a ‘Buy’ from ‘Neutral’ rating. The firm raised its price target for the company to $100 from $61, noting they see the name as a key beneficiary of California’s decision to raise renewable mandate. They also note that the ITC ruling does not appear to be factored in yet. Goldman considers FSLR one of its top ideas for 2016.

On valuation measures, First Solar Inc. shares are currently priced at 12.67x this year’s forecasted earnings, compared to the industry’s 2.51x earnings multiple. Ticker has a forward P/E of 17.36 and t-12 price-to-sales ratio of 1.85. EPS for the same period is $5.67.

In the past 52 weeks, shares of Tempe, Arizona-based company have traded between a low of $39.18 and a high of $72.10 and are now at $71.85.

Shares are up 49.76% year-over-year.

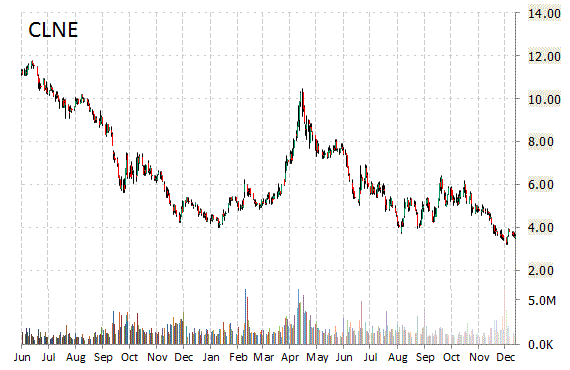

Analysts at Raymond James upgraded their rating on the shares of Clean Energy Fuels Corp. (CLNE). In a research note published on Tuesday, the firm lifted the name with a ‘Market Perform’ from ‘Underperform’ rating

Currently there are 2 analysts that rate CLNE a ‘Buy’, 2 rate it a ‘Hold’. One analyst rates it a ‘Sell’. CLNE has a median Wall Street price target of $7.50 with a high target of $15.

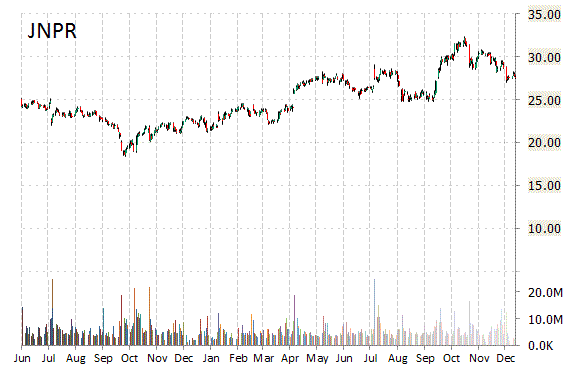

Juniper Networks, Inc. (JNPR) was raised to ‘Buy’ from ‘Hold’ and it was given a $32 from $29 price target at Deutsche Bank (DB) on Tuesday.

JNPR is up $0.06 at $27.47 on normal volume. Midway through trading Tuesday, 3.14 million shares of Juniper Networks Inc. have exchanged hands as compared to its average daily volume of 5.36 million shares. The stock has ranged in a price between $27.21 to $27.73 after having opened the day at $27.57

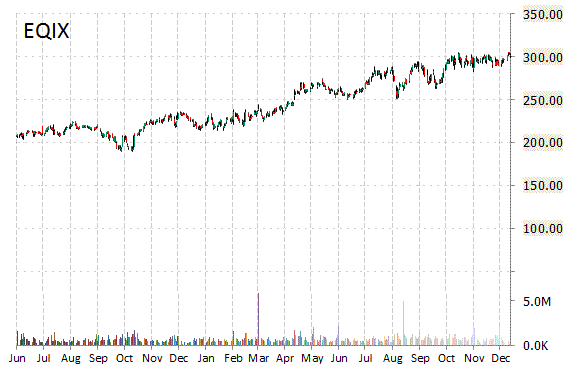

Equinix, Inc. (EQIX) was upgraded to ‘Buy’ from ‘Hold’ with $340 PT by Stifel analysts on Tuesday.

EQIX is currently printing a higher than average trading volume with the issue trading 810K shares, compared to the average volume of 773K. The stock began trading this morning at $297.98 to currently trade 2.02% higher from the prior days close of $296.08. On an intraday basis it has gotten as low as $294.17 and as high as $302.60.

EQIX shares have declined 0.64% in the last 4 weeks while advancing 10.78% in the past three months. Over the past 5 trading sessions the stock has lost 0.37%.

The Redwood City, California-based company, which is currently valued at $18.72 billion, has a median Wall Street price target of $320 with a high target of $350.

Equinix Inc. is up 39.38% year-over-year, compared with a 0.50% gain in the S&P 500.

Leave a Reply