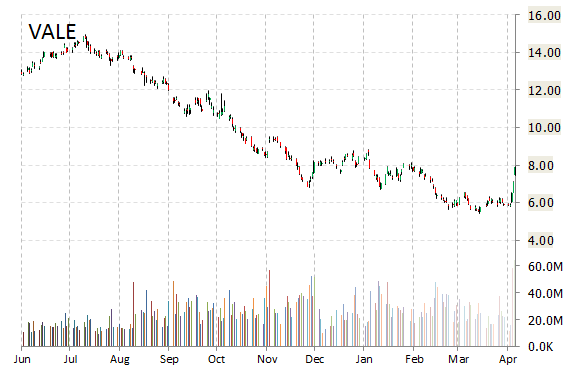

Vale SA (VALE) gapped up at the open Monday and has risen 6% in early trading. Gains being attributed to an article from ‘The Australian‘ that suggests the iron ore producer has hired Barclays Capital to sell coal assets. Ticker was up more than 5.50% in early trade to $8.40, printing a four-month high.

Technically speaking, VALE seems to have been consolidating above its $7.76 pivot to digest this strong move which shows some commitment. A break and close above $8.76 could send it higher to challenge resistance at the $9 level.

The stock began trading this morning at $8.26 from Friday’s close of $7.92. On an intraday basis it has gotten as low as $8.15 and as high as $8.45.

In terms of share statistics, Vale S.A. ADS has a total of 3.22 billion shares outstanding. The stock’s short interest currently stands at about 7%, bringing the total number of shares sold short to 224.50 million.

On valuation measures, Vale shares are currently priced at 136.17x this year’s forecasted earnings, which makes them expensive compared to the industry’s 10.24x earnings multiple. The company has a t-12 price/sales ratio of 1.40. EPS for the same period registers at $0.06.

Vale shares have advanced 31.49% in the last 4 weeks and 4.19% in the past three months. Over the past 5 trading sessions the stock has gained 34.92%. The Rio de Janeiro, Brazil-based firm, which is currently valued at $42.80 billion, has a median Wall Street price target of $7.44 with a high target of $13.00.

Offering a dividend yield of 4.70%, shares of the company are down 40.24% year-over-year ; up 3% year-to-date.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply