I have used Vale SA (ADR)(NYSE:VALE) as an illustrative example in my applied corporate finance book, and as a global mining company, with Brazilian roots, it allows me to talk about how financial decisions (on where to invest, how much to borrow and how dividend payout) are affected by the ups and downs of the commodity business and the government’s presence as the governance table. In November 2014, I used it as one of two companies (Lukoil was the other one) that were trapped in a risk trifecta, with commodity, currency and country risk all spiraling out of control. In that post, I made a judgment that Vale looked significantly under valued and followed through on that judgment by buying its shares at $8.53/share. I revisited the company in April 2015, with the stock down to $6.15, revalued it, and concluded that while the value had dropped, it looked under valued at its prevailing price. The months since that post have not been good ones for the investment, either, and with the stock down to about $5.05, I think it is time to reassess the company again.

Vale: A Valuation Retrospective

In November 2014, in a post titled “Go where it is darkest”, I repeated a theme that has become a mantra in my valuation classes. While it easiest to value mature, money-making companies in stable markets, I argue that the payoff to doing valuation is greatest when uncertainty is most intense, whether that uncertainty comes from the company being a young, start-up without a business model or from macroeconomic forces. The argument is based on the simple premise that your payoff is determined not by how precisely you value a company but how precisely you value it, relative to other people valuing the same company. When faced with boatloads of uncertainty, investors shrink from even trying to do valuation, and even an imprecise valuation is better than none at all.

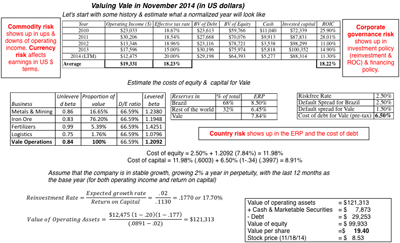

It is to illustrate this point that I chose Vale and Lukoil as my candidates of doom, assaulted by dropping commodity prices (oil for Lukoil and iron ore prices for Vale), surging country risk (Russia for Lukoil and Brazil for Vale) and plummeting currencies (Rubles for Lukoil and Reais for Vale). I valued both companies, but it is the valuation of Vale that is the focus of this post and it yielded a value of $19.40/share for a stock, that was trading at $8.53 on that day. The narrative that drovemy valuation was a simple one, i.e., that iron ore prices and country risk would stabilize at November 2014 levels, that the earnings over the last twelve months (leading into November 2014), which were down 40% from the previous year’s numbers, incorporated the drop in iron ore prices that had happened and that eventually Vale would be able to continue generating the mild excess returns it had as a mature mining company.

(click to enlarge)

Spreadsheet: http://www.stern.nyu.edu/~adamodar/pc/blog/ValeNov2014.xls

I did buy Vale shares after this analysis, arguing that there was a buffer built into earnings for further commodity price decline.

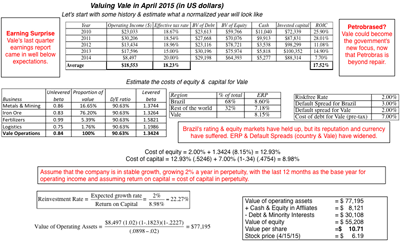

In April 2015, I revisited my valuations, as the stock prices of both companies dropped from the November 2014 levels, and I labeled the post “In search of Investment Serenity”. The post reflected the turmoil that I felt watching the market deliver a negative judgment on my initial thesis, and I wanted to check to see if the substantial changes on the ground (in commodity prices, country risk and currency levels) had not changed unalterably changed my thesis. Updating my Vale valuation, the big shifts were two fold. First, the trailing 12-month earnings that formed the basis for my expected value dropped a third from their already depressed levels six months earlier. Second, the implosion in Petrobras, the other large Brazilian commodity company, caused by a toxic combination of poor investments, large debt load and unsustainable dividends, raised my concern that Vale, a company that shares some of the same characteristics, might be Petrobrased. Again, I made the assumption that the trailing 12-month numbers reflected updated iron ore prices and revalued the company, this time removing the excess returns that I assumed in perpetuity in my earlier valuation, to arrive at a value per share of $10.71.

(click to enlarge)

Spreadsheet: http://www.stern.nyu.edu/~adamodar/pc/blog/ValeApril2015.xls

I concluded, with a nod towards the possibility that my conclusions were driven by my desire for confirmation bias (confirming my earlier judgment on Vale being under valued), that while I might not have been inclined to buy Vale in April 2015, I would continue to hold the stock.

Vale: The September 2015 Version

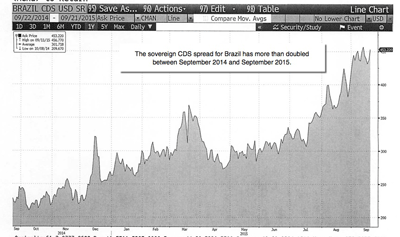

The months since my last valuation (in April 2015) have not been good for Vale, on any of the macro dimensions. The price of iron ore has continued to decline, albeit at a slower rate, over the last few months. That commodity price decline has been partially driven by the turmoil in China, a country whose massive infrastructure investments have been responsible for elevating iron ore prices over the last decade. The political risk in Brazil not only shows no signs of abating, but is feeding into concerns about economic growth and the capacity of the country to repay its debt. The run-up that we saw in Brazilian sovereign CDS prices in April 2015 has continued, with the sovereign CDS spread rising above 4.50% this week.

(click to enlarge)

Source: Bloomberg

The ratings agencies, as always late to the party, have woken up (finally) to reassess the sovereign ratings for Brazil and have downgraded the country, Moody’s from Baa2 to Baa3 and S&P from BBB to BB+, on both a foreign and local currency basis. While both ratings changes represent only a notch in the ratings scale, the significance is that Brazil has been downgraded from investment grade status by both agencies.

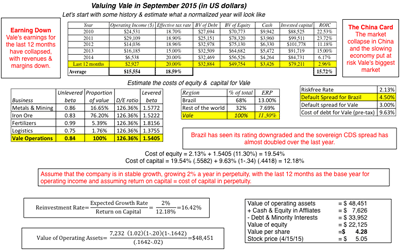

Finally, Vale has updated its earnings yet again, and there seems to be no bottom in sight, with operating income dropping to $2.9 billion, a drop of more than 50% from the prior estimates. While it is true that some of the write offs that have lowered earnings are reflections of iron ore prices in the past, it is undeniable that the earnings effect of the iron ore price effect has been much larger than I estimated to be in November 2014 or April 2015. Updating my numbers, and using the sovereign CDS spread as my measure of the country default spread (since the ratings are not only in flux but don’t seem to reflect the assessment of the country today), the value per share that I get is $4.29.

(click to enlarge)

Spreadsheet: http://www.stern.nyu.edu/~adamodar/pc/blog/ValeSept2015.xls

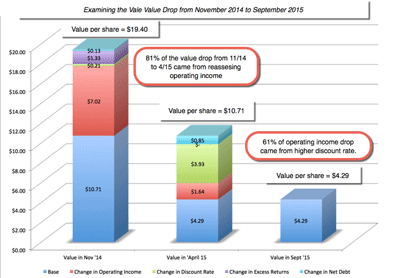

I was taken aback at the changes in value over the three valuations, separated by less than a year, and attempted to look at the drivers of these changes in the chart below:

(click to enlarge)

The biggest reason for the shift in value from November 2014 to April 2015 was the reassessment of earnings (accounting for 81% of my value drop), but looking at the difference between my April 2015 and September 2015 valuations, the primary culprit is the uptick in country risk, accounting for almost 61% of my loss in value.

Vale: Time to Move on?

If I stay true to my investment philosophy of investing in an asset, only if its price is less than its value, the line of no return has been passed with Vale. I am selling the stock, but I do have to tell you that it was not a decision that I made easily or without fighting through my biases. In particular, I was sorely tempted by two games:

- The “if only” game: My first instinct is to play the blame game and look for excuses for my losses. If only the Brazilian government had behaved more rationally, if only China had not collapsed, if only Vale’s earnings had been more resilient to iron ore prices, my thesis would have been right. Not only is this game completely pointless, but it eliminates any lessons that I might be extract from this fiasco.

- The “what if” game: As I worked through my valuation, I had to constantly fight the urge to pick numbers that would let me stay with my original thesis and continue to hold the stock. For instance, if I continue to use the rating to assess default spreads for Brazil, as I did in my first two valuations, the value that I get for the company is $6.65. I could have then covered up this choice with the argument that CDS markets are notorious for over reacting and that using a normalized value (either a rating-based approach or an average CDS spread over time) gives me a better estimate.

After wrestling with my own biases for an extended period, I concluded that the assumptions that I would need to make to justify continuing to hold Vale would have to be assumptions about the macro environment: that iron ore prices would stop falling and/or that the market has over reacted to Brazil’s risk woes and will correct itself. If there is anything that I have learned already from my experiences with commodity companies and country risk, it is that my macro forecasting skills are woeful and making a bet on them magically improving is wishful thinking. In fact, if I truly want to make a bet on these macro movements, there are far simpler, more direct and more lucrative ways for me to exploit these views that buying Vale; I could buy iron ore future or sell the Brazil sovereign CDS. I like Vale’s management but I think that they have been dealt a bad hand at this stage, and I am not sure that they can do much about the crosswinds that are pummeling them. If you have more faith in your macro forecasting skills than I do, it is entirely possible that Vale could be the play you want to make, if you believe that iron ore prices will recover and that the Brazil’s risk will revert back to historic norms. In fact, given my abject failure to get these right over the last few months, you may want to view me as a contrary indicator and buy Vale now.

Investing Lessons

It is said that you can learn more from your losses than from your wins, but the people who like to dish out this advice have either never lost or don’t usually follow their own advice. Learning from my mistakes is hard to do, but let looking back at my Vale valuations, here is what I see:

- The dangers of implicit normalization: While I was careful to avoid explicit normalization, where I assumed that earnings would return to the average level over the last five or ten years or that iron ore prices would rebound, I implicitly built in an expectation of normalization by taking the last twelve-month earnings as indicative of iron ore prices during that period. At least with Vale, there seems to be a lag between the drop in iron ore prices and the earnings effect, perhaps reflecting pre-contracted prices or accounting lethargy. By the same token, using the default spread based on the sovereign rating provided a false sense of stability, especially when the market’s reaction to events on the ground in Brazil has been much more negative.

- The Stickiness of Political Risk: Political problems need political solutions, and politics does not lend itself easily to either rational solutions or speed in resolution. In fact, the Vale lesson for me should be that when political risk is a big component, it is likely to be persistent and can easily multiply, if politicians are left to their own devices.

- The Debt Effect: All of the problems besetting Vale are magnified by its debt load, bloated because of its ambitious growth in the last decade and its large dividend payout (Vale has to pay dividends to its non-voting preferred shareholders). While the threat of default is not looming, Vale’s buffer for debt payments has dropped significantly in the last year, with its interest coverage ratio dropping from 10.39 in 2013 to 4.18 in 2015.

There are two lessons that I had already learned (and that I followed) that helped me get through this experienced, relatively unscathed.

- Spread your bets: The consequences of the Vale misstep for my portfolio were limited because I followed my rule of never investing more than 5% of my money in any new stock, no matter how alluring and attractive it looks, a rule that I adopted because of the uncertainty that I feel in my valuation judgments and that the market price moving towards my value. In fact, it is the basis for my post on how much diversification is the right amount.

- Never take investment risks that are life-style altering (if you fail): Much as I would like to make that life-altering investment, the one whose payoff will release me from ever having to think about investing again, I know it is that search that will lead me to take “bad” risks. Notwithstanding the punishment meted out to me by my Vale investment, I am happy to say that it has not altered my life choices and that I have passed the sleep test with flying colors. (I have not lost any sleep over Vale’s travails).

Closing Thoughts

If I had known in November 2014 what I know now, I would obviously have not bought Vale, but since I don’t have that type of hindsight , that is an empty statement. I don’t like losing money any more than any one else, but I have no regrets about my Vale losses. I made the best judgments that I could, with the data that I had available in my earlier valuations. If you disagreed with me at the time of my initial valuation of Vale, you have earned the right to say “I told you so”, and if you went along with my assessment, we will have to commiserate with each other.

This is not the first time that I have lost money on an investment, and it will not be the last, and I will continue to go where it is darkest, value companies where uncertainty abounds and hope that my next excursion into that space delivers better results than this one.

Leave a Reply