BioCryst Pharmaceuticals, Inc. (BCRX) reported fourth quarter EPS of ($0.16) before the bell Wednesday, compared to the consensus estimate of ($0.20). Revenues declined 49.1 percent from $10.6 million yoy to $5.4 million. Analysts expected revenues of $3.7 million. The stock is now up 1.68% to $10.30 on nearly 51K shares.

For the year, the drugmaker reported that its loss widened to $45.2 million, or $0.68 per share, compared to a net loss of $30.1 million, or $0.55 per share for 2013. Revenue was reported as $13.6 million.

On valuation measures, BioCryst Pharmaceuticals Inc. shares, which currently have an average 3-month trading volume of 833,013 shares, trade at a P/E to growth ratio of 0.80. The median Wall Street price target on the name is $18.00 with a high target of $23.00. Currently ticker boasts 10 ‘Buy’ endorsements, compared to 1 ’Hold’ and no ‘Sell’.

Profitability-wise, BCRX has a t-12 profit and operating margin of (207.95%) and (170.59%), respectively. The $740.19M market cap company reported $127.13M in cash vs. $30.00M in debt in its most recent quarter.

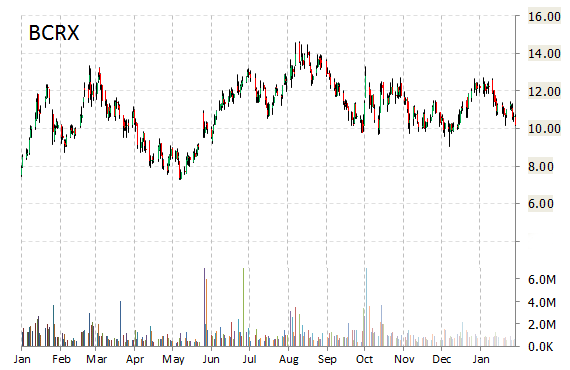

BCRX currently prints a one year return of about 4.11%, and a year-to-date loss of 16.69%.

The chart below shows where the equity has traded over the last 52 weeks.

BioCryst Pharmaceuticals Inc. is a biotechnology company that designs and develops small molecule pharmaceuticals that block key enzymes involved in the pathogenesis of diseases. The company was founded in 1986 and is headquartered in Durham, North Carolina.

Leave a Reply