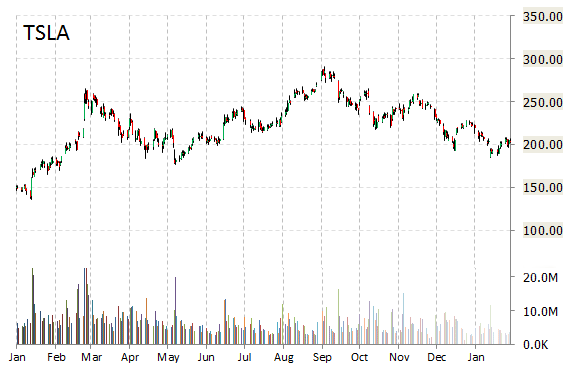

Shares of Tesla Motors, Inc. (TSLA) are down nearly 2% in premarket trade Wednesday, following a Reuters report that said Elon Musk is threatening to fire some overseas executives because of weak sales in China.

Tesla sold about 120 cars in China last month, one of the sources told the publication, well below the company’s aggressive targets. Musk has previously said he expected China sales could rival those in the US as early as 2015.

In other Tesla news this morning, the electric car maker announced that it changed the time of its Q&A webcast on 4Q earnings to 4:30 p.m. PST/7:30 p.m. EST Wednesday. Tesla says it will report Q4 earnings at 2 p.m. PST/5 p.m. EST Wednesday.

TSLA has lost 2.75% year-to-date. Shares ran up nearly 350% in FY’13 and 48% last year. Since its 2010 IPO priced at $17 a share, TSLA has risen about 1,006 percent to about $213.50 as of Wednesday’s open.

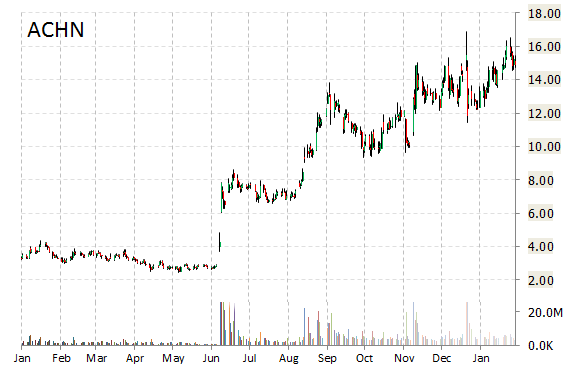

Achillion Pharmaceuticals, Inc. (ACHN) – The drug maker announced today that it has commenced an underwritten public offering of 10 million shares of its common stock.

Achillion said all of the shares in the second offering will be sold by the company and that Leerink Partners and Deutsche Bank are acting as joint book-running managers for the offering.

Achillion Pharmaceuticals, Inc., currently valued at $1.15B, has a median Wall Street price target of $22.00 with a high target of $25.00. In the past 52 weeks, shares of New Haven, Connecticut-based biopharmaceutical firm have traded between a low of $2.45 and a high of $16.87 with the 50-day MA and 200-day MA located at $13.65 and $11.84 levels, respectively. Additionally, shares of ACHN trade at a P/E ratio of -0.99 and have a Relative Strength Index (RSI) and MACD indicator of 36.75 and -2.49, respectively.

ACHN currently prints a one year return of about 246.68%, and a year-to-date loss of around 6.50%.

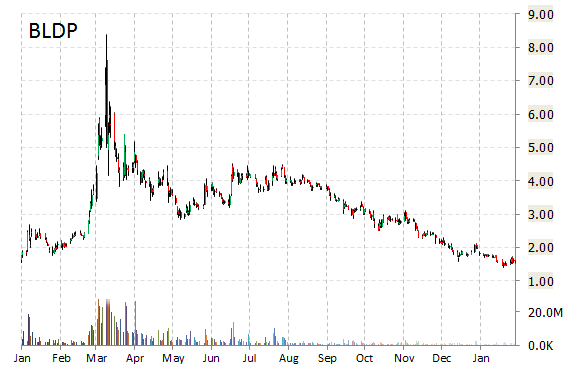

Ballard Power Systems Inc. (BLDP) is a big mover this pre-market session, as its shares are up nearly 46%. The move comes on a big volume too with the issue currently trading more than 7.6 million shares, well above the average of 929K shares for a full session over the past month. The surge came after the company announced the signing of a Technology Solutions agreement with Volkswagen Group for $80 million for the transfer of certain automotive-related fuel cell intellectual property and a two-year extension of an engineering services contract.

Prof. Dr. Ulrich Hackenberg, Member of the Board of Management for Technical Development at AUDI AG and Coordinator of the Technical Development of all brands in the Volkswagen Group said, “Audi, VW and the Volkswagen Group are very pleased with the acquisition of a world-class automotive fuel cell patent portfolio. We believe that this portfolio, together with the combined fuel cell skills and expertise of our group and Ballard, will underpin our ability to play a leading role in fuel cell automotive development and commercialization.”

BLDP shares recently gained 78c to $2.48. In the past 52 weeks, shares of Burnaby, Canada-based developer of proton exchange membrane fuel cells have traded between a low of $1.41 and a high of $8.38. Shares are down 24.55% year-over-year, and 14.65% year-to-date.

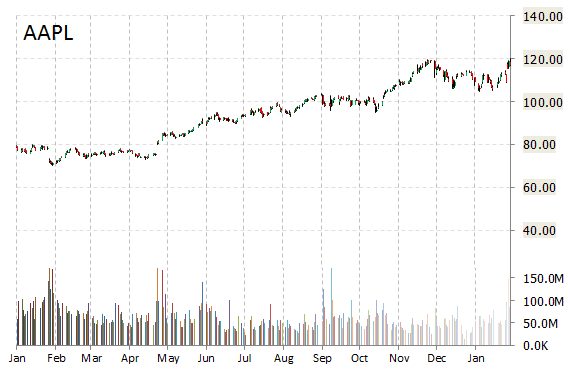

Apple Inc. (AAPL) – The iPhone maker becomes the first U.S. company to close with a market capitalization above $700 billion. CEO Cook cites iPhone maker’s ability to sell pricey products in China, WSJ reports.

Apple Inc., currently valued at $710.74B, has a median Wall Street price target of $133.00 with a high target of $165.00. On valuation-measures, ticker has a trailing-12 and forward P/E of 16.52 and 13.35, respectively. P/E to growth ratio is 1.12, while t-12 profit margin is 22.25%. EPS registers at $7.39.

On trading-measure, AAPL has a beta of 1.06 and a short float of 1.01%. In the past 52 weeks, shares of the tech giant have traded between a low of $73.05 and a high of $122.15 with its 50-day MA and 200-day MA located at $112.90 and $106.46 levels, respectively.

AAPL currently prints a one year return of about 65%, and a year-to-date return of around 11%.

Leave a Reply