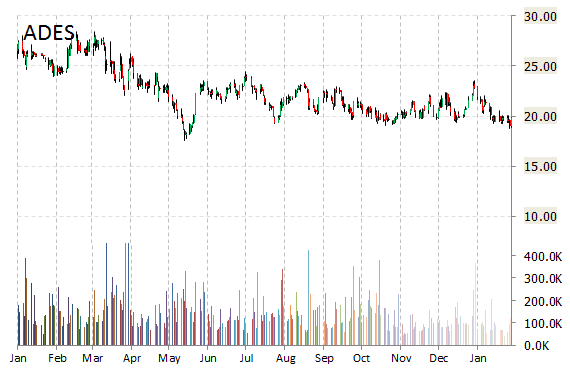

Advanced Emissions Solutions, Inc. (ADES) lost $8.94 to $10.87 in mid-day trading today after the co. disclosed in its Current Report on Form 8-K that KPMG LLP (“KPMG”) resigned as the Company’s independent accounting firm. Except as detailed in the Form 8-K, there are no disagreements with KPMG on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure. Additional information regarding KPMG’s resignation can be found in the Form 8-K. The Company is in the process of engaging a new independent accounting firm.

In addition, the Company has determined that it is unlikely to regain compliance with its SEC filing requirements for continued listing of its common stock on the NASDAQ Stock Market by the previously reported March 27, 2015 deadline set by the NASDAQ Listing Qualifications Panel. As a result, the Company expects its shares of common stock will be delisted from the NASDAQ Stock Market. Following a suspension of trading in the Company’s common stock on NASDAQ, the Company expects that its shares would trade on the OTC Markets – OTC Pink Tier while the Company works to finalize the restatements. The Company’s trading symbol would remain ADES.

Following the news, ADES was downgraded to ‘Market Perform’ from ‘Outperform’ at Cowen.

ADES currently prints a one year loss of about 20.76% and a year-to-date loss of around 13.08%.

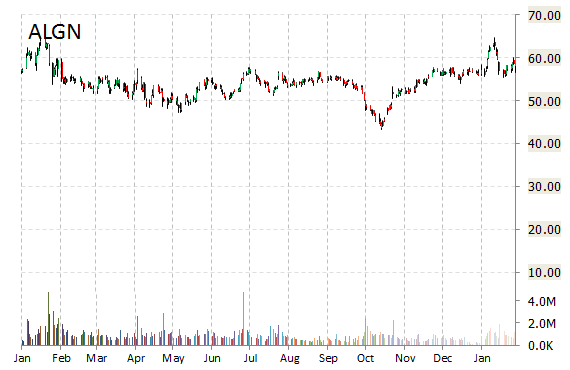

Analysts at JMP Securities are out with a report this morning downgrading shares of Align Technology Inc. (ALGN) with a ‘Market Perform’ from ‘Outperform’ rating after the company provided weaker-than-expected Q1 guidance. The name was also downgraded at Roth Capital. Price target was cut to $62 from $66.

ALGN shares are currently priced at 29.75x this year’s forecasted earnings, which makes them relatively expensive compared to the industry’s 23.56x earnings multiple. Ticker has a forward P/E of 21.65 and t-12 price-to-sales ratio of 6.37. EPS for the same period is $1.81. In the past 52 weeks, shares of the San Jose, California-based firm have traded between a low of $43.27 and a high of $64.75 and are now at $53.85. Shares are up 1.61% year-over-year and 4.94% year-to-date.

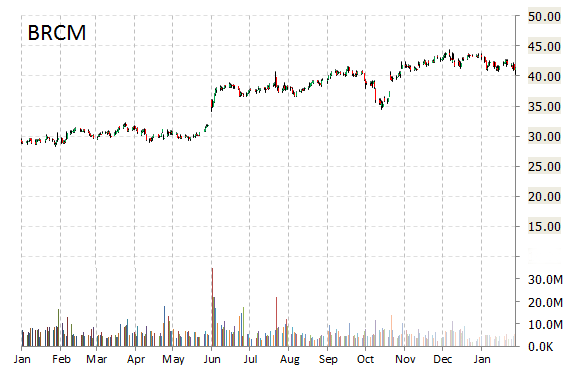

Broadcom Corp. (BRCM) was downgraded to ‘Market Perform’ from ‘Outperform’ at JMP Securities following earnings. On valuation-measures, shares of Broadcom have a trailing-12 and forward P/E of 58.87 and 12.38, respectively. P/E to growth ratio is 1.16, while t-12 profit margin is 5.15%. EPS registers at $0.73. The company has a market cap of $25.37B and a median Wall Street price target of $49.00 with a high target of $55.00.

BRCM currently prints a one year return of about 46%, and a year-to-date loss of 4.66%.

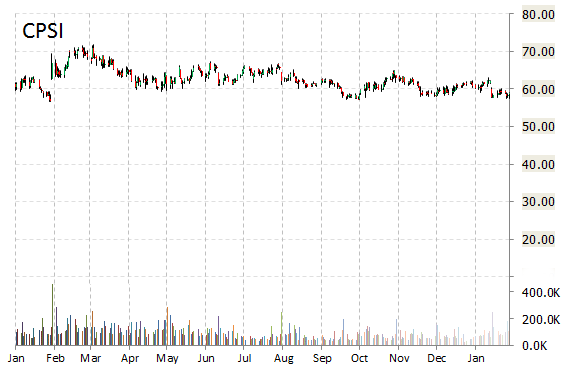

Shares of Computer Programs & Systems Inc. (CPSI) lost $9.78 to $49.16 in mid-day trading today after the company missed expectations and provided lower-than-expected guidance. The name was downgraded to ‘Sell’ from ‘Hold’ at Deutsche Bank. Price target was cut to $49 from $64. CPSI was also downgraded at FBR Capital. Price target lowered to $50 from $66. In the past 52 weeks, shares of the healthcare information technology company have traded between a low of $47.40 and a high of $71.89 with the 50-day MA and 200-day MA located at $60.19 and $61.15 levels, respectively. Additionally, shares of CPSI trade at a P/E ratio of 1.82 and have a Relative Strength Index (RSI) and MACD indicator of 19.58 and -3.11, respectively.

CPSI currently prints a one year return of about 7% and a year-to-date loss of around 3%.

Leave a Reply