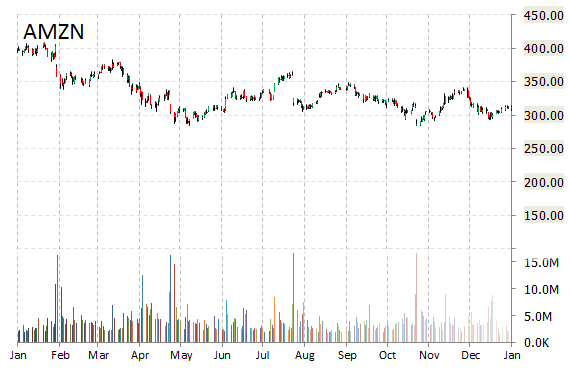

Amazon.com Inc. (AMZN) announced Monday that sellers on the website sold a record-setting more than 2 billion items worldwide in 2014.

“It’s been a record-setting year for selling on Amazon. We’re seeing strong growth from sellers listing their items across our global marketplaces. In fact, there are now more than a billion offers for customers to browse from sellers who are listing items for sale outside their home country,” said Peter Faricy, VP for Amazon Marketplace. “The growth of mobile and the introduction of the Amazon Seller App have also been a big win for sellers this year. Sellers are constantly telling us they value the flexibility of managing their businesses on-the-go from their tablets and mobile devices.”

According to the company’s press release, there are currently more than 2 million sellers on Amazon worldwide that account for over 40% of the total units sold on Amazon.

Shares of Amazon are down by 0.62% to $306.62 in early trade on Monday

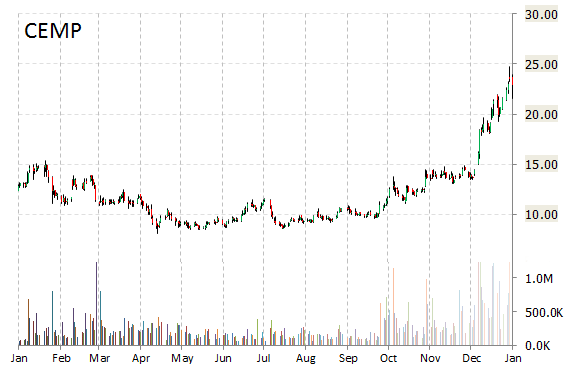

Shares of Cempra, Inc. (CEMP) are seeing notable strength after the antibiotic developer said its treatment for patients with a common type of pneumonia performed well in a late-stage clinical test. Solithromycin capsules proved to be not inferior to a competing treatment, moxifloxacin, when given to patients with community-acquired bacterial pneumonia, according to early results from the study, the company said. The point estimates of early clinical response were 78.2% for solithromycin and 77.9% for moxifloxacin.

Shares of Cempra rose $3.85, or 16.85%, to $26.70 before markets opened. That advance comes as the stock prints a one year return of about 79%.

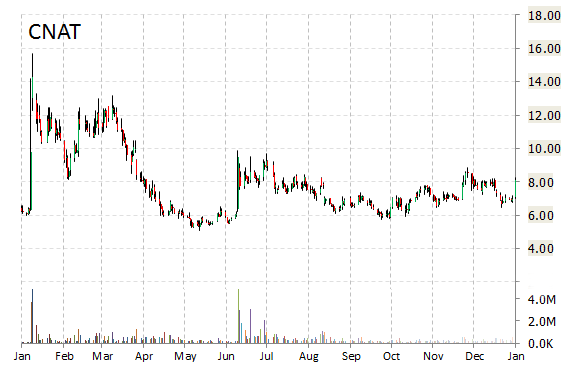

Shares of Conatus Pharmaceuticals (CNAT) are higher by 41% to $11.39 in early trading on Monday, as the stock continues to see gains following the company’s announcement that it will report top-line results from three clinical trials in subjects with varying degrees of organ impairment after the market close on Thursday, January 8, 2015.

On valuation measures, Conatus Pharmaceuticals Inc., currently valued at $173.11 million, has a median Wall Street price target of $16.00 with a high target of $19.00. Approximately 4.5 million shares have already changed hands, compared to the stock’s average daily volume of 237K.

In the past 52 weeks, shares of San Diego, Calif.-based biotech company have traded between a low of $5.06 and a high of $15.67 with the 50-day MA and 200-day MA located at $7.52 and $7.29 levels, respectively. Additionally, shares of CNAT trade at a P/E ratio of -4.80 and have a Relative Strength Index (RSI) and MACD indicator of 61.05 and -0.03, respectively.

CNAT currently prints a one year return of about 29%.

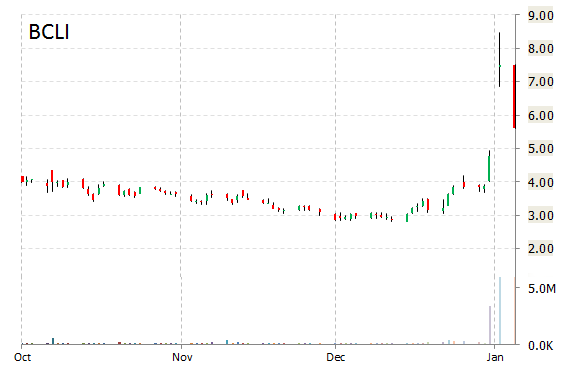

Shares of Brainstorm Cell Therapeutics Inc. (BCLI) are down almost 22% to $5.82 in early trade Monday, despite the company’s announcement of positive final results from its phase 2a clinical trial of NurOwn in amyotrophic lateral sclerosis patients. Brainstorm said its study achieved its primary endpoint in demonstrating that NurOwn is safe and well-tolerated.

“We are gratified to have the final data from this study and are very encouraged by the results,” commented BrainStorm’s CEO Tony Fiorino, MD, PhD. “This study not only extends our earlier phase 1/2 findings regarding the safety of NurOwn™, but also provide a consistent and highly promising picture of NurOwn’s efficacy.”

BCLI currently prints a one year return of about 116%.

Leave a Reply