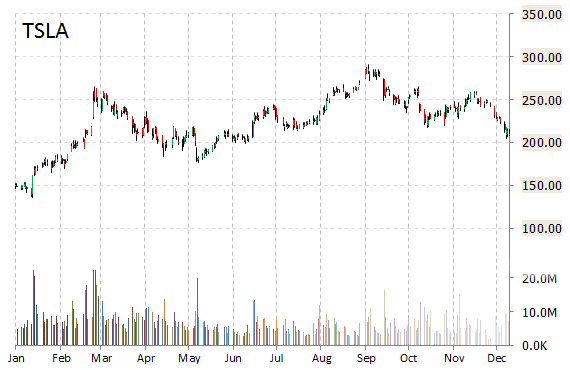

Tesla Motors (TSLA) stock is down 4% in pre-market trade after it was reported that the carmaker’s top manager in China, Veronica Wu, has resigned after less than nine months in the post, without giving a reason for her departure.

Tesla, in a statement, said Tom Zhu, who now heads Tesla’s charging network development in China, would take over the role.

Tesla Motors shares are currently priced at 72.28x next year’s forecasted earnings. Ticker has a PEG and t-12 P/S ratio of 4.24 and 9.21, respectively. Price/Book for the most recent quarter is 27.46 while EPS is ($1.64). Currently there are 11 analysts that rate TSLA a ‘Buy’, 5 rate it a ‘Hold’. No analyst rates it a ‘Sell’. TSLA has a median Wall Street price target of $300.00 with a high target of $400.00.

In the past 52 weeks, shares of Palo Alto, California-based carmaker have traded between a low of $136.67 and a high of $291.42 and are now at $204.98. Shares are up 49.57% year-over-year and 38.86% year-to-date.

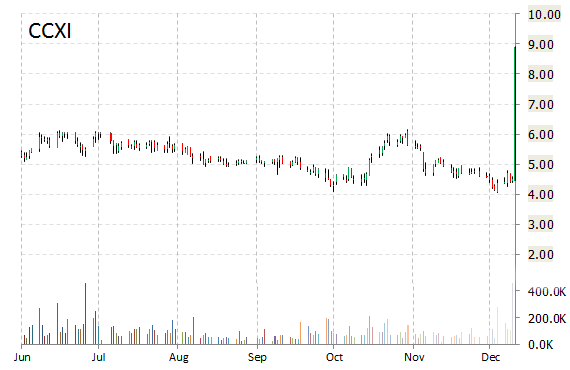

ChemoCentryx, Inc. (CCXI) shares spiked 110% in pre-market trading Friday after the company announced positive top-line 52-week data from its Phase II clinical trial in diabetic nephropathy with CCX140.

ChemoCentryx said CCX140 did not affect systemic blood pressure, suggesting that the beneficial effect of CCX140 is mediated locally in the kidney micro-environment, possibly through a beneficial reduction in renal inflammation. The co. also said CCX140 appeared to be well tolerated with a low overall dropout rate over the 52-week treatment period (10 percent). No safety issues were observed that would prevent further clinical development of CCX140 in diabetic nephropathy.

CCXI shares recently gained $4.62 to $9.10. In the past 52 weeks, shares of Mountain View, California-based biopharmaceutical firm have traded between a low of $4.06 and a high of $8.25. Shares are down 13.49% year-over-year and 22.45% year-to-date.

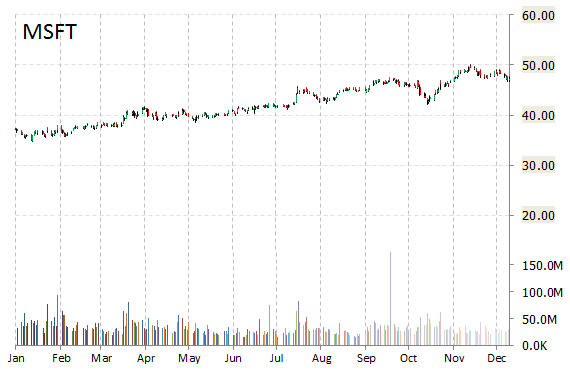

FBR Capital on Friday raised its price target on Microsoft Corporation (MSFT) to $57 from $53. FBR’s 12-month base case estimate indicates a potential upside of about 22% from the company’s current pps.

MSFT shares recently lost $0.37 to $46.80. The name was also initiated with an ‘Overweight’ rating at Piper Jaffray with a $54 price target

In other Microsoft news this morning, the software giant’s Xbox One posted overall record unit sales in November, with 1.2 million units sold in the U.S., outselling Sony Corp (SNE) Playstation.

On valuation-measures, shares of Microsoft have a trailing-12 and forward P/E of 18.49 and 15.02, respectively. P/E to growth ratio is 2.70, while t-12 profit margin is 23.35%. EPS registers at $2.55. The company has a market cap of $388.82B and a median Wall Street price target of $51.00 with a high target of $58.00.

On trading-measure, MSFT has a beta of 0.69 and a short float of 0.88%. In the past 12 months, shares of Redmond, Washington-based tech giant have traded between a low of $34.63 and a high of $50.05 with the 50-day MA and 200-day MA located at $47.85 and $44.83 levels, respectively.

MSFT currently prints a year-to-date return of around 29.55%, compared with an 14.65% gain in the S&P 500.

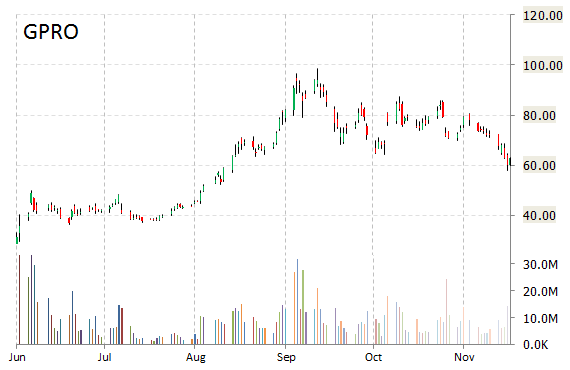

Shares of GoPro (GPRO) are up 4.08% to $62.45 in pre-market trading after JP Morgan (JPM) upgraded the company to ‘Overweight’ from ‘Neutral’, on a valuation basis, with a price target of $70. JPM’s new PT represents expected upside of 12% from the stock’s current pps.

Leave a Reply