In the recent round of 13F filings, Appaloosa Management LP, headed by David Tepper, reported its equity portfolio for the third quarter 2014.

- The filing shows:

- Increased stake in Whirlpool (WHR) from 1,011,750 shares to 2,000,000 shares

- Increased stake in Delta Air Lines (DAL) from 6,411,483 shares to 7,480,799 shares

- Decreased position in American Airlines Group Inc. (AAL) from 11,654,522 shares to 7,286,892 shares

- Decreased position in The Walt Disney Company (DIS) from 1,376,500 shares to 158,600 shares

- Liquidated stake in Mueller Water Products, Inc. (MWA), Comcast Corporation (CMCSA), and American International Group, Inc. (AIG).

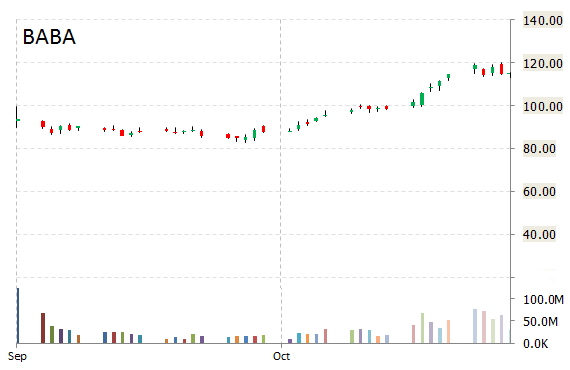

The filing also shows the hedge fund acquired new stakes in Alibaba Group Holding (BABA) totaling 725,000 shares, in Lorillard, Inc. (LO) totaling 1,421,000 shares, and NXP Semiconductors NV (NXPI) totaling 2,530,584 shares.

On Friday, shares of China’s e-commerce giant began trading at $115.06 to finish the session 33 cents higher from the prior days close of $114.84. On an intraday basis it got as low as $113.35 and as high as $115.39.

Alibaba made its market debut in late September after a record-breaking $25B IPO. Since pricing at $68 per share in the IPO, the stock has surged nearly 23%. NXPI closed Friday at $73.73, a gain of $1.15, or 1.58 percent, while Lorillard shares lost $0.51, or 0.82 percent, to close at $61.59.

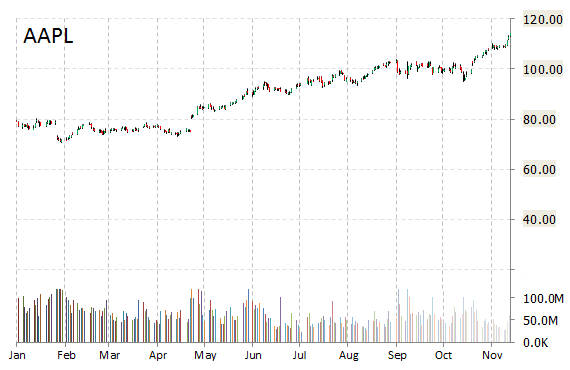

The filing shows reduced position in Apple Inc. (AAPL) from 1,686,146 shares in Q2 to 1,160,705 shares in Q3.

On Friday, the iPhone maker shares began trading at $113.16 to finish the session 1.21% higher from the prior days close of $112.82. On an intraday basis it got as low as $113.05 and as high as $114.19. Apple shares are currently priced at 17.70x this year’s forecasted earnings, which makes them relatively inexpensive compared to the industry’s 25.62x earnings multiple. Cupertino-based Apple, which is currently valued at $669.65B, has a median Wall Street price target of $116.00 with a high target of $143.00. The name is up 54.51% year-over-year as of the close of trading on Sunday.

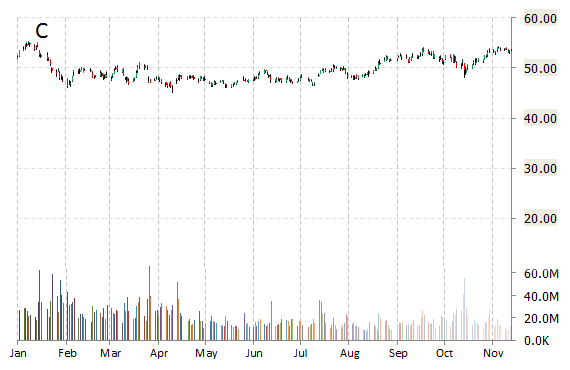

The filing shows decreased position in Citigroup (C) from 8,617,139 shares to 8,319,639 shares. Citi shares are currently priced at 18.34x this year’s forecasted earnings, compared to the industry’s 12.72x earnings multiple. The firm’s current year and next year EPS growth estimates stand at -23.50% and 59.50% compared to the industry growth rates of 22.40% and 15.70%, respectively. Citi has a t-12 price/sales ratio of 2.31. EPS for the same period registers at $2.91.

Citigroup’s shares have advanced 7.32% in the last 4 weeks and 7.84% in the past three months. Over the past 5 trading sessions the stock has lost 0.69%. Shares are up 2.52% this year and 6.40% year-over-year, as of the close of trading on Friday.

Citi is currently valued at $161.71B. The New York-based megabank has a median Wall Street price target of $59.50 with a high target of $66.00.

Just a reminder, hedges only have to disclose their long positions in these filings.

Leave a Reply