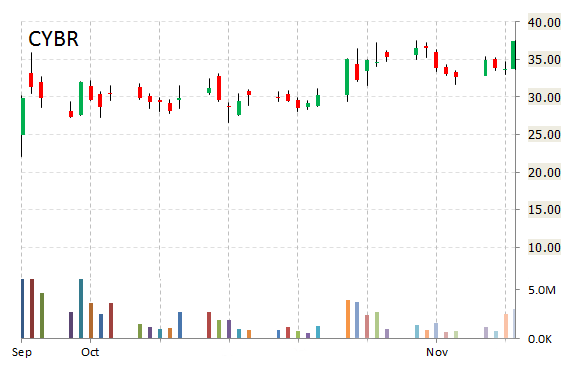

Cyber-Ark Software Ltd. (CYBR) shares are printing a large uptick in pre-market trading Thursday, gaining nearly 16% from the previous close. The gains are as a result of the company’s third-quarter earnings report that smashed analysts’ expectations. Cyber-Ark reported Q3 EPS of $0.20 per share, excluding non-recurring items, $0.19 better than estimates of $0.01. Revs came in strong, jumping 66% year-over-year to $28M versus the $20.9M consensus. As of September 30, 2014, CyberArk, a company that protects organizations from cyber attacks that have made their way inside the network perimeter, had $169M in cash and cash equivalents and short-term deposits inclusive of $90.3M raised in the co.’s IPO which closed on Sept. 29, 2014.

Udi Mokady, CyberArk CEO, said in a statement, “We are very pleased with our strong performance in the third quarter, the first quarter we have completed as a public company. Our solid execution, combined with our industry-leading solutions and our profitable, scalable go-to-market model continue to drive our success across the diverse set of customers in our large and under-penetrated available market.”

CYBR shares recently gained $5.05 to $38.75. The stock has gained roughly 12.60% year-to-date, trading between a low of $22.12 and a high of $37.50.

Cyber-Ark Software Ltd., which closed Wednesday at $33.70, has a total market cap of $996.85M.

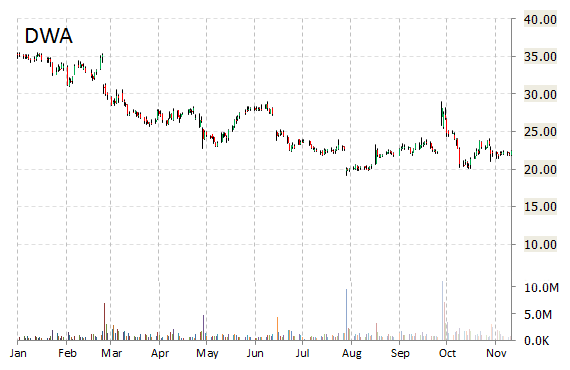

DreamWorks Animation SKG Inc. (DWA) shares are trading higher by 20% pre-market on news that Hasbro, Inc (HAS) is in advanced talks to buy DreamWorks Animation for a mix of cash and stock. According to reports, DreamWorks CEO Jeffrey Katzenberg is said to be looking for $35 per share, but the deal price is yet to be determined. That would be a 56.5% premium over DWA’s closing pps on Wednesday.

On valuation measures, DreamWorks Animation shares have a PEG and forward P/E ratio of -24.30 and 24.58, respectively. Price/Sales for the same period is 2.87 while EPS is ($0.35). Currently there are 10 analysts that rate DWA a ‘Hold’, while 2 rate it a ‘Sell’. No analyst rates it a ‘Buy’. DWA has a median Wall Street price target of $22.00 with a high target of $27.00.

In the past 52 weeks, shares of Glendale, California-based company have traded between a low of $19.20 and a high of $36.01 and are now at $26.60. Shares are down 29.10% year-over-year, and 36.99% year-to-date.

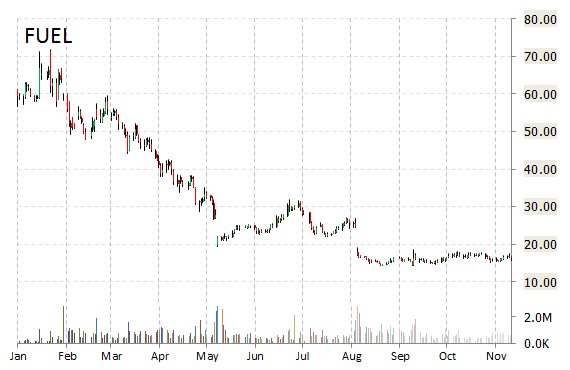

Rocket Fuel Inc (FUEL) is seeing notable move pre-market following better than expected 3Q results, and a 4Q outlook that was higher than the Wall Street consensus. The artificial-intelligence digital ad solutions provider posted an adjusted quarterly loss of $0.18 per share, smaller than $0.30 loss predicted by the Street. The company also forecast Q4 revs of $140 million to $165 million vs Q4 revs of $140 million. Q3’14 revenue came in at $102.1 million, an increase of 63% compared to $62.5 million for the third quarter of 2013.

“Rocket Fuel delivered strong results for our customers which drove solid financial results for our company, highlighted by another great quarter for mobile…” said Chairman and CEO George John.

Despite the company’s results, the name had its price target lowered this morning to $22 from $31, and to $35 from $40 at Oppenheimer and Piper Jaffray, respectively.

FUEL shares recently gained $2.73 to $18.96. The stock is down more than 67.19% year-over-year and has lost roughly 73.61% year-to-date. In the past 52 weeks, shares of Redwood City, California-based firm have traded between a low of $14.29 and a high of $71.89.

Rocket Fuel Inc., which closed Wednesday at $16.23, has a total market cap of $581.91M.

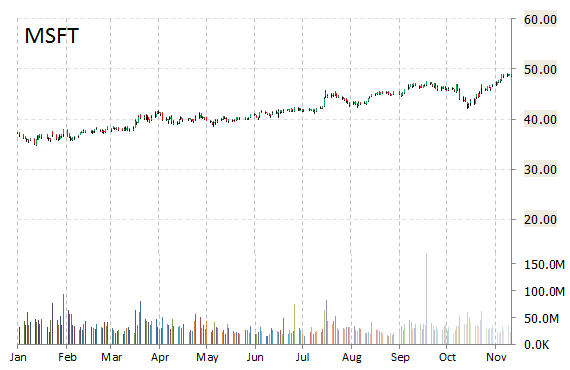

Microsoft (MSFT) is ticking slightly higher following headlines that the software giant will acquire Israeli cybersecurity start-up Aorato for about $200 million.

Founded in 2011 Aorato develops and sells software that monitors access to central communication components in enterprise IT systems.

Microsoft Corporation shares are currently priced at 19.12x this year’s forecasted earnings, compared to the industry’s 30.45x earnings multiple. Ticker has a PEG and forward P/E ratio of 2.78 and 15.49, respectively. Price/sales for the same period is 4.40 while EPS is $2.55. Currently there are 14 analysts that rate MSFT a ‘Buy’, while 16 rate it a ‘Hold’. 1 analyst rates it a ‘Sell’. MSFT has a median Wall Street price target of $50.00 with a high target of $56.00.

In the last 12 months, shares of Redmond, Wa.-based company have traded between a low of $34.63 and a high of $49.15 and are now at $48.82. Shares are up 34.31% year-over-year, and 33.13% year-to-date.

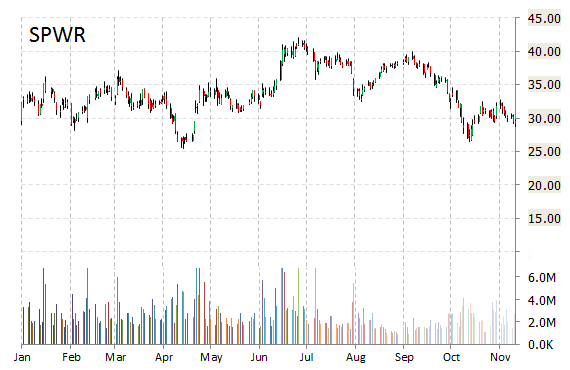

SunPower Corporation (SPWR) are trading down 8% in Thursday pre-market trading following the company’s light guidance. SunPower today guided FY15 revs and EPS below consensus ahead of ‘Analyst Day’ today.

SPWR shares are currently priced at 33.51x this year’s forecasted earnings, which makes them relatively expensive compared to the industry’s 12.30x earnings multiple. The company’s current year and next year EPS growth estimates stand at -22.00% and 29.00% compared to the industry growth rates of 23.50% and 30.20%, respectively. SPWR has a t-12 price/sales ratio of 1.53. EPS for the same period registers at $0.87.

SPWR’s shares have advanced 6.00% in the last 4 weeks and declined 17.47% in the past three months. Over the past 5 trading sessions the stock has lost 4.99%. Shares of SunPower Corporation are down 2.21% this year, and 6.72% year-over-year

The San Jose, California-based company, which is currently valued at $3.83B, has a median Wall Street price target of $39.00 with a high target of $48.00.

Leave a Reply