Shares of Lakeland Industries Inc. (LAKE) are higher by approximately 41% this morning after the company released an update stating that it has been experiencing significant interest globally for its ChemMAX and MicroMAX protective suit lines which are used in controlling the Ebola outbreak. The company also said that it had received orders for nearly a million of them.

LAKE shares recently gained $4.92 to $16.50. In the past 52 weeks, shares of Ronkonkoma, New York-based international protective clothing manufacturer have traded between a low of $4.75 and a high of $29.55. Shares are up 106.79% year-over-year, and 120.15% year-to-date.

Alpha Pro Tech (APT) shares are trading higher by 23% pre-market. Just like Lakeland Industries, the company is a manufacturer of safety garments for the industrial protective clothing market worldwide and is currently being picked up as an Ebola play.

APT shares recently gained $0.65 to $4.20. In the past 52 weeks, shares of Markham, Canada-based company have traded between a low of $1.51 and a high of $10.73. Alpha Pro Tech is a small, sub $70M market cap stock. The name is up 135.10% year-over-year 65.12% year-to-date.

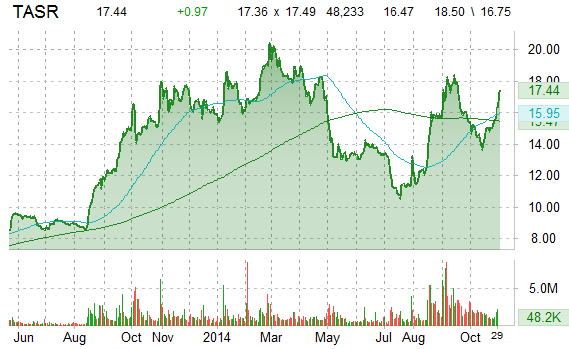

Shares of Taser International Inc. (TASR) are up 6% in pre-market trading Thursday, after the company reported fiscal Q3 revenue and EPS that topped analysts’ expectations. On a per-share basis, the Scottsdale, Arizona-based company said it had profit of $0.14 per share, $0.04 better than the Street’s estimate of $0.10. Revenues rose $9.2M, or 26% on a year-over-year basis to $44.3M, topping Street forecasts. Analysts expected $39.2 million, according to Zacks.

Taser said the increase was primarily driven by total law enforcement weapon handle sales which increased $6.9 million in Q3 2014 compared to Q3 2013. International sales were $6.7 million in the quarter an increase of $3.0 million compared to the same period last year.

On valuation measures, Taswer International, currently valued at $865.22M, has a median Wall Street price target of $18.00 with a high target of $19.50. In the past 52 weeks, shares of the stun gun maker have traded between a low of $10.46 and a high of $20.83 with the 50-day MA and 200-day MA located at $15.68 and $14.38 levels, respectively. Additionally, shares of TASR trade at a P/E ratio of 1.52 and have a Relative Strength Index (RSI) and MACD indicator of 60.78 and +1.09, respectively.

TASR currently prints a one year return of about 5.17% and a year-to-date return of around 3.72%.

Oculus Innovative Sciences, Inc. (OCLS) is a big mover this pre-market session with its shares spiking nearly 17%. The move follows an announcement from company confirming the issuance of a new CE Mark in Europe for Microcyn(R)-based Pediacyn(TM) Hydrogel. Pediacyn Hydrogel is indicated for the care of lesions associated with atopic dermatitis by assisting with moistening while forming a protective barrier against physical, chemical and microbial invasion of the atopic dermatitis lesions.

Bruce Thornton, Oculus senior VP for international operations said in a statement: “We have seen the successful adoption in the United States of our various Microcyn-based atopic dermatitis products with over 100,000 prescriptions written. The clinical evidence confirming Microcyn’s efficacy in the treatment of atopic dermatitis is highly compelling. Following our European introduction, we look forward to offering our partners in the Middle East, Asia and India this exciting new offering…”

Oculus Innovative Sciences is up $0.53 to $2.30 in pre-market trading today. On valuation-measures, OCLS has a trailing-12 of 2.42 and a profit margin of 39.28%. EPS registers at $0.73. The company has a market cap of $15.00M and a median Wall Street price target of $7.50 with a high target of $7.50.

On trading-measure, OCLS has a beta of 2.45 and a short float of 6.74%. In the past 52 weeks, shares of Petaluma, California-based firm have traded between a low of $1.60 and a high of $7.21 with the 50-day MA and 200-day MA located at $2.08 and $2.72 levels, respectively.

OCLS currently prints a one year loss of about 31.40%, and a year-to-date loss of around 49.14%.

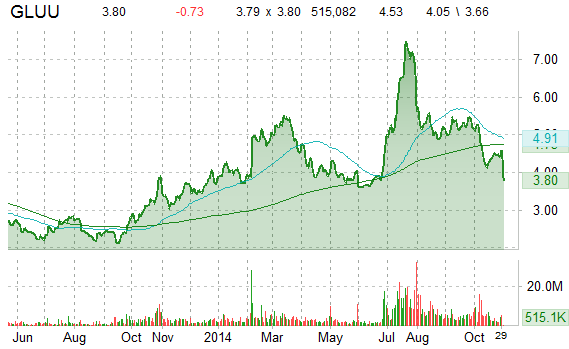

Glu Mobile, Inc. (GLUU) shares tumbled nearly 16% in pre-market trading Thursday, after the mobile game maker posted Q4 revs of $64.8 million, falling short of Street forecasts of $84.2 million, and guided Q4 below consensus. The company however, beat on EPS, reporting Q3 earnings of 17 cents a share vs 11 cents a share analysts surveyed by Thomson Reuters expected for the quarter.

On valuation measures, Glu Mobile’s current year and next year EPS growth estimates stand at 350.00% and 20.00% compared to the industry growth rates of 25.90% and 25.60%, respectively. Ticker has a t-12 price/sales ratio of 3.12. EPS for the same period registers at ($0.19).

GLUU’s shares have declined 12.38% in the last 4 weeks and 19.25% in the past three months. Over the past 5 trading sessions the stock has gained 2.03%.

The San Francisco, California-based company, which is currently valued at $436.18M, has a median Wall Street price target of $8.00 with a high target of $10.00. GLUU is up 15.86% year-over-year, and 16.75% year to date.

Leave a Reply