Shares of Lions Gate Entertainment Corp. (LGF) are up 5.26% to $33.00 in mid-day trading Friday after The NY Post reported that Alibaba (BABA)’s billionaire Jack Ma has his sites set on Mark Rachesky’s 37.4%, LGF stake. As Lionsgate’s chairman and single biggest shareholder, Rachesky’s stake is worth $1.6 billion based on the stock’s current price-per-share.

According to the Post’s report, Rachesky began accumulating Lionsgate shares in 2005 through his $6B Manhattan investment firm ‘MHR Fund Management LLC’. Five year later he acquired an additional 16.2 million of the studio’s shares via a convertible debenture that was adopted to avert Carl Icahn’s potential hostile takeover of the studio at the time.

The conversion took place at $6.20 per share, which was followed by Rachesky purchasing Icahn’s stake in Lionsgate at $7 a share.

Selling off his current 51.3M LGF shares will allow Rachesky to rake in a whopping $1.3 billion in quantitative terms – with a cost basis under $350 million.

The Post also notes that asian bankers reportedly told Hollywood investors that Rachesky’s exit from Lionsgate will be revealed next month or possibly sooner. His exit comes as Alibaba Group is looking for ways to spend some of its $25B in proceeds from its record-setting IPO.

Lions Gate shares are currently priced at 26.97x this year’s forecasted earnings compared to the industry’s 14.10x earnings multiple. Ticker has a PEG and forward P/E ratio of 0.70 and 18.30, respectively. Price/Sales for the same period is 1.71 while EPS is $1.22. Currently there are 13 analysts that rate LGF a ‘Buy’, while 2 rate it a ‘Hold’. No analysts rate it a ‘Sell’. LGF has a median Wall Street price target of $38.50 with a high target of $45.00.

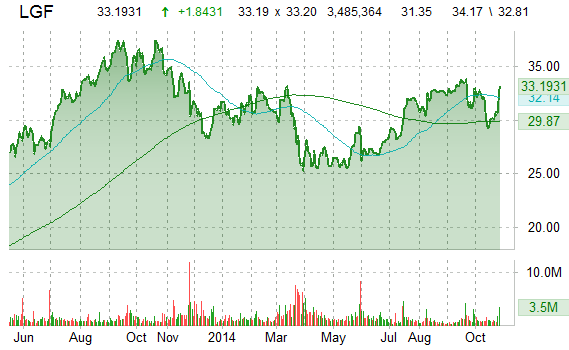

In the past 52 weeks, shares of Santa Monica, California-based entertainment provider have traded between a low of $24.54 and a high of $37.33. Shares are down 13.09% year-over-year and 0.38% year-to-date.

Regulus Therapeutics Inc. (RGLS) is a big mover this session with its shares surging nearly 13% on the day. The move comes on solid volume too with the issue trading 2.9M shares compared to the average volume of 596,408.

RGLS had a massive spike in pre-market trading couple of sessions ago as early test data of a hepatitis C drug appeared promising. The stock rocketed almost 200% at one point from Tuesday’s close at the $6 level to print the tape as high as $18.33 on Wednesday pre-market. Last session saw RGLS shares surge another 103% on the day.

RGLS has a median Wall Street price target of $18.00 with a high target of $19.00.

In the past 52 weeks, shares of San Diego, California-based company have traded between a low of $5.40 and a high of $16.73 and are now at $16.56. Shares are up 94.65% year-over-year and 96.75% year-to-date.

Amedica Corporation (AMDA) shares are printing a large uptick today. The stock is trading at a higher than average volume with the issue trading 330K shares, compared to the average volume of 49,771. Ticker began exchanging hands this morning at $1.90 to currently print the tape up $0.80, or 53%, from the prior days close of $1.87. On an intraday basis it has gotten as low as $1.90 and as high as $2.90.

In the past 52 weeks, shares of Salt Lake City, Utah-based company have traded between a low of $0.99 and a high of $9.37 and are now at $2.85. Shares are down 65.31% year-to-date.

The chart below shows where the equity has traded over the last 52 weeks, with the 50-day and 200-day MAs included.

Leave a Reply