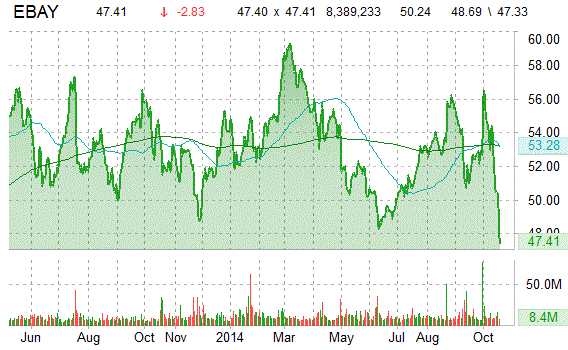

Shares of eBay Inc. (EBAY) were downgraded to an ‘Underperform’ rating from ‘Buy’ by CLSA on Thursday. The firm also cut its 12-month base case estimate to $52 from $66. Separately, the name was also downgraded to ‘Sector Perform’ from ‘Outperform’ at RBC Capital and had its price target lowered to $60 from $63 at Cantor.

eBay shares currently have a PEG and forward P/E ratio of 1.34 and 14.19, respectively. Price/Sales for the same period is 3.66 while EPS is ($0.09). Currently there are 16 analysts that rate EBAY a ‘Buy’, while 23 rate it a ‘Hold’. No analysts rate it a ‘Sell’. EBAY has a median Wall Street price target of $62.00 with a high target of $68.00.

In the past 52 weeks, shares of San Jose, California-based company have traded between a low of $47.33 and a high of $59.70 and are now at $47.78. Shares are down 6.91% year-over-year and 8.44% year-to-date.

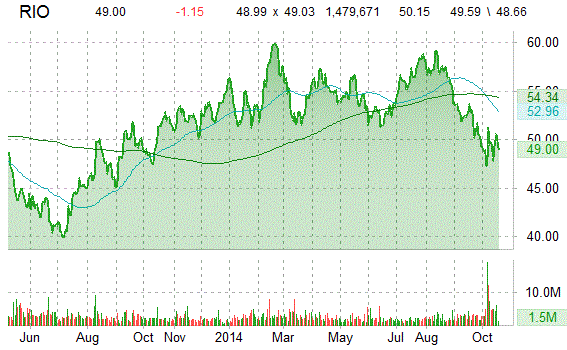

Analysts at Cowen downgraded Rio Tinto plc (RIO) to ‘Market Perform’ and lowered their price target to $54 from $64.

In the past 52 weeks, shares of London-based multinational metals and mining corporation have traded between a low of $46.83 and a high of $60.61 and are now at $49.44. Shares are down 0.36% year-over-year and 9.36% year-to-date.

Rio Tinto shares are currently priced at 14.47x this year’s forecasted earnings compared to the industry’s 2.60x earnings multiple. Ticker has 19 analysts that rate RIO a ‘Buy’, and 3 that rate it a ‘Hold’. 3 analysts rate it a ‘Sell’. RIO has a median Wall Street price target of $62.36 with a high target of $73.86.

The company has a market cap of $90.96B.

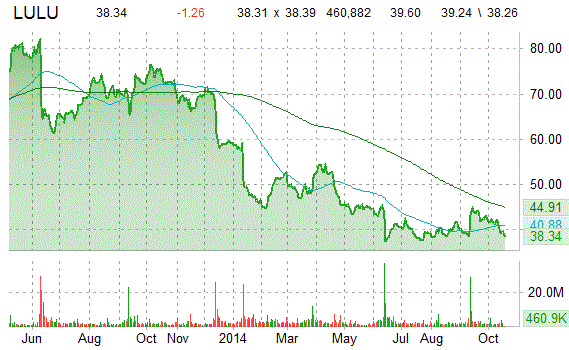

Macquarie reported on Thursday that they have lowered their rating for Lululemon Athletica Inc. (LULU). The firm has downgraded LULU from a ‘Neutral’ to an ‘Underperform’ rating and lowered its price target to $34 from $40. The firm said the company’s expansion into Asia and Europe will drive a meaningful increase in spending.

Lululemon lost $1.30 to $38.30 in morning trading today. Approximately 460,982 shares have already changed hands, compared to the stock’s average daily volume of 2,852,280 shares.

On valuation-measures, shares of Lululemon Athletica Inc. have a trailing-12 and forward P/E of 23.14 and 19.01, respectively. P/E to growth ratio is 1.46, while t-12 profit margin is 14.53%. EPS registers at $1.66. The company has a market cap of $5.51B and a median Wall Street price target of $45.50 with a high target of $55.00.

On trading-measure, LULU has a beta of 1.44 and a short float of 21.15%. In the past 52 weeks, shares of the Vancouver, Canada-based athletic apparel company have traded between a low of $36.26 and a high of $74.07 with the 50-day MA and 200-day MA located at $41.41 and $42.83 levels, respectively.

LULU currently prints a one year loss of about 46.96% and a year-to-date loss of around 32.92%.

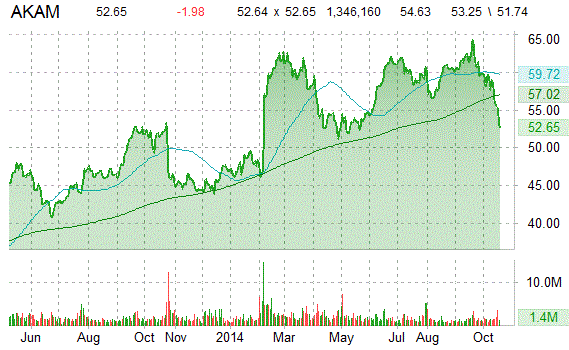

Shares of Akamai Technologies, Inc. (AKAM) are down 3.50% to $38.92 in early trade after Wells Fargo (WFC) downgraded its rating to ‘Market Perform’ from ‘Outperform’, citing a slowdown in the company’s video and audio streaming traffic during the first two weeks of October.

The firm lowered its price target range for shares to $57-$61 from $70-$75.

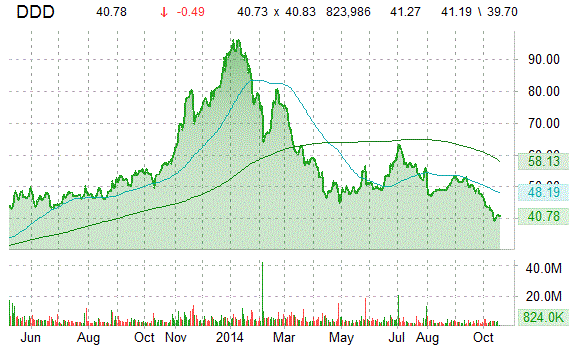

Shares of 3D Systems Corporation (DDD) were downgraded to an ‘Equal Weight’ from ‘Overweight’ rating by Stephens on Thursday.

3D Systems Corporation, currently valued at $4.49B, has a median Wall Street price target of $58.00 with a high target of $84.00. Approximately 801,396 shares have already changed hands, compared to the stock’s average daily volume of 3,068,730.

In the past 52 weeks, shares of the 3D printing centric design-to-manufacturing solutions provider have traded between a low of $38.70 and a high of $97.28 with the 50-day MA and 200-day MA located at $47.92 and $51.03 levels, respectively. Additionally, shares of DDD trade at a P/E ratio of 2.65 and have a Relative Strength Index (RSI) and MACD indicator of 31.44 and -1.63, respectively.

DDD currently prints a one year loss of about 23.43% and a year-to-date loss of around 55.59%.

Leave a Reply