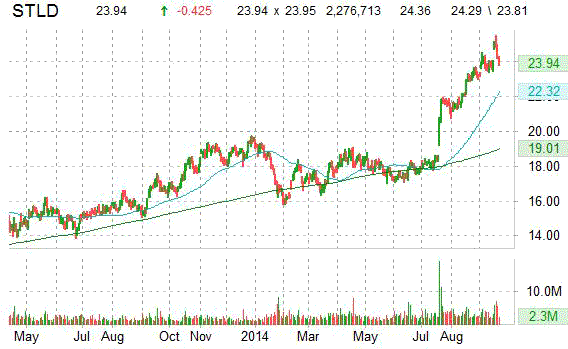

Recent short interest data for the 8/29/2014 settlement date shows an increase in short interest for shares of Steel Dynamics Inc. (STLD). As of August 29, the short interest for the diversified carbon-steel producer totaled 5,516,938 shares, as compared to 5,301,258 shares since August 15, an increase of 4.07%. Average daily volume [AVM] for the same period fell by 310,000 to 3,037,577 shares from 3,313,737 shares. It is worth mentioning that ticker’s short interest has declined by more than 1.4M shares, or 20.97%, from the 5/30/2014 settlement date.

Based on the latest AVM, the days-to-cover ratio — a metric that includes both the total shares short and the average daily volume of shares traded — is currently 1.81 days. Days-to-cover for STLD increased to 1.81 for the August 29 settlement date, as compared to 1.59 days at the August 15 report.

Steel Dynamics Inc. has a beta of 2.05 and a short float of 2.40%. In the past 52 weeks, shares of Fort Wayne, Indiana-based company have traded between a low of $15.80 and a high of $25.16 and are now at $23.94. Shares are up 48.09% year-over-year and 27.18% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

Recent short interest data for the 8/29/2014 settlement date shows an increase in short interest for shares of Time Warner Inc. (TWX). As of August 29, the short interest for the media and entertainment company totaled 11,506,535 shares, as compared to 10,935,700 shares since August 15, an increase of 5.22%. Average daily volume [AVM] for the same period fell by 7.34M to 3,554,466 shares from 10,903,243 shares. It is worth mentioning that ticker’s short interest has declined by more than 2.53M shares, or 18.06%, from the 7/15/2014 settlement date.

Based on the latest AVM, the days-to-cover ratio — a metric that includes both the total shares short and the average daily volume of shares traded — is currently 3.23 days. Days-to-cover for TWX increased to 3.23 for the August 29 settlement date, as compared to 1.00 day at the August 15 report.

Time Warner has a beta of 1.25 and a short float of 1.35%. In the past 52 weeks, shares of the New York-based company have traded between a low of $58.22 and a high of $88.13 and are now at $75.99. Shares are up 22.87% year-over-year and 10.26% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

Recent short interest data for the 8/29/2014 settlement date shows a decrease in short interest for shares of Newmont Mining Corporation (NEM). As of August 29, the short interest for the producer of gold, copper, and silver deposits totaled 14,382,519 shares, as compared to 14,725,764 shares since August 15, a decline of -2.33%. Average daily volume [AVM] for the same period fell by 1.72M to 4,259,483 shares from 5,985,534 shares. It is worth mentioning that ticker’s short interest has declined by more than 2.72M shares, or 15.90%, from the 2/14/2014 settlement date.

Based on the latest AVM, the days-to-cover ratio — a metric that includes both the total shares short and the average daily volume of shares traded — is currently 3.37 days. Days-to-cover for NEM increased to 3.37 for the August 29 settlement date, as compared to 2.46 days at the August 15 report.

Newmont Mining Corporation has a beta of -0.01 and a short float of 2.89%. In the past 52 weeks, shares of Greenwood Village, Colorado-based company have traded between a low of $20.79 and a high of $31.12 and are now at $23.83. Shares are down 12.52% year-over-year ; up 7.12% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

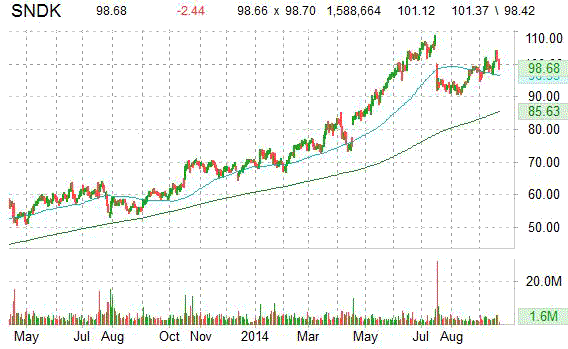

Recent short interest data for the 8/29/2014 settlement date shows an increase in short interest for shares of SanDisk Corp. (SNDK). As of August 29, the short interest for the data storage developer totaled 16,536,429 shares, as compared to 16,265,604 shares since August 15, an increase of 1.66%. Average daily volume [AVM] for the same period fell by 358,000 to 2,432,937 shares from 2,790,343 shares. It is worth mentioning that ticker’s short interest has declined by more than 5.77M shares, or 25.87%, from the 1/15/2014 settlement date.

Based on the latest AVM, the days-to-cover ratio — a metric that includes both the total shares short and the average daily volume of shares traded — is currently 6.79 days. Days-to-cover for SNDK increased to 6.79 for the August 29 settlement date, as compared to 5.82 days at the August 15 report.

SanDisk Corp. has a beta of 1.45 and a short float of 7.41%. In the past 52 weeks, shares of Milpitas, California-based company have traded between a low of $58.57 and a high of $108.77 and are now at $98.68. Shares are up 64.65% year-over-year and 42.08% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

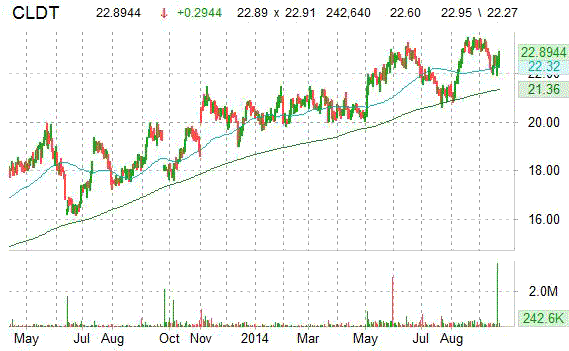

Recent short interest data for the 8/29/2014 settlement date shows an increase in short interest for shares of Chatham Lodging Trust (CLDT). As of August 29, the short interest for the equity real estate investment trust totaled 2,247,109 shares, as compared to 2,047,994 shares since August 15, an increase of 9.72%. Average daily volume [AVM] for the same period rose by 47,265 to 249,556 shares from 202,291 shares. It is worth mentioning that ticker’s short interest has jumped by more than 1.93M shares, or 615%, from the 1/15/2014 settlement date.

Based on the latest AVM, the days-to-cover ratio — a metric that includes both the total shares short and the average daily volume of shares traded — is currently 9.00 days. Days-to-cover for CLDT decreased to 9.00 for the August 29 settlement date, as compared to 10.12 days at the August 15 report.

Chatham Lodging Trust has a beta of 1.26 and a short float of 9.28%. In the past 52 weeks, shares of Palm Beach, Florida-based firm have traded between a low of $17.60 and a high of $23.50 and are now at $22.89. Shares are up 16.62% year-over-year and 10.81% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

Leave a Reply