BioCryst Pharmaceuticals, Inc. (BCRX) was initiated with a ‘Overweight’ and it was given a $20.00 price target at JP Morgan (JPM) in a research report issued to clients on Friday. The prior close was $13.03, but the stock is sliding in premarket hours, trading down 1% at $12.90. That leaves close to 51% upside from JP Morgan’s new target price.

Other equities research analysts have also recently issued reports about BioCryst Pharmaceuticals. Analysts at Wells Fargo (WFC) upgraded their rating on shares of BioCryst from ‘Market Perform’ to ‘Outperform’ in a research note on Friday, June 23. Separately, analysts at Brinson Patrick initiated BCRX with a ‘Market Outperform’, placing a target price of $15.00/share in a research note on April 14. Finally, analysts at HC Wainwright initiated BCRX with a ‘Buy’ and $21.00 price target in a research note issued to clients on Monday, March 10.

BioCryst Pharma shares, which currently have an average 3-month trading volume of 1.3 million shares, trade at a P/E to growth ratio of -2.75. Price/Sales for the last 4 quarters registers at 43.28 while EPS is at (-$0.62). The median Wall Street price target on the BCRX is $16.50 with a high target of $24.00.

Profitability-wise, BioCryst Pharmaceuticals’ trailing-12 profit margin currently stands at (-213.74%) while operating ones are at (-180.45%). The $766 Million market cap company reported $31.39 Million in cash vs. $30 Million in debt in its most recent quarter.

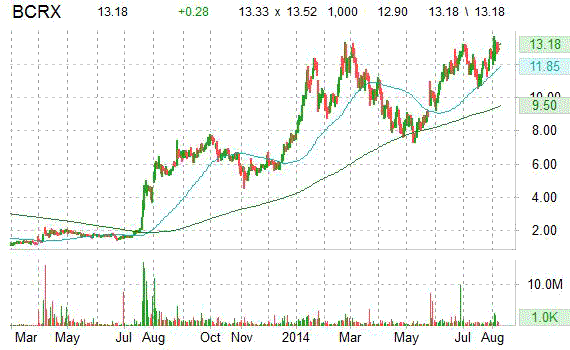

Over the last 52 weeks, BCRX has been trading between $4.55 and $13.65. More recently in the last 4 weeks, the stock has been trading between $12.10 and $12.90. Shares are up 119.76% y/y, and 69.74% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

BioCryst Pharmaceuticals, Inc., is a biotech company, which designs and develops small molecule pharmaceuticals that block key enzymes involved in the pathogenesis of diseases. The firm was founded in 1986 and is headquartered in Durham, North Carolina.

Update: BCRX has reversed course and is now up almost 4% at $13.40.

Leave a Reply