Analysts at Susquehanna upgraded shares of Red Hat, Inc. (RHT) to ‘Positive’ from ‘Neutral’ and lifted their price target to $70 from $57 in a research report issued to clients and investors on Friday. Susquehanna’s new PT points to a potential upside of 22.80% from the stock’s current price-per-share.

Other equities research analysts have also recently issued reports about the name. Analysts at Citigroup (C) maintained their ‘Neutral’ rating on the shares of the software solutions company in a research note issued on June 19. The firm placed a price target of $54.00. Analysts at Raymond James and JP Morgan (JPM) also maintained an ‘Outperform’ and ‘Underweight’ rating on RHT in a note to clients on Friday, Mar 28. Both firms placed price targets of $63.00 and $46.00, respectively. Finally, analysts at Cowen & Company upgraded shares of Red Hat to an ‘Outperform’ rating from a ‘Market Perform’ rating in a research note to clients on Feb. 19.

Red Hat, Inc currently trades at forward P/E of 62.49. The median Wall Street price target on the company’s stock is $65.00 with a high target of $74.00.

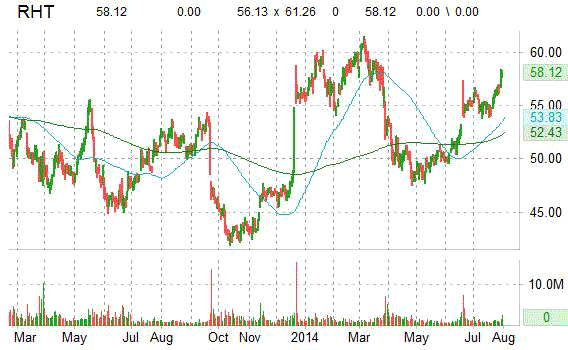

Profitability-wise the company’s trailing-12 profit margin currently stands at 11% while operating ones are 14.47%. The $11 billion market cap company reported $803.19 million in cash vs. $0 in debt in its most recent quarter. RHT has a 52 week low of $41.89 and a 52 week high of $61.45. The stock’s 50-day moving average is $55.02 and its 200-day moving average is $54.32.

The chart below shows where the equity has traded over the last 52 weeks, with the 50-day and 200-day MAs included.

In today’s session, the equity is changing hands at $58.12 a share. RHT is up 14.34% year-over-year, and 3.71% year-to-date.

Red Hat, Inc. provides open source software solutions to enterprise customers worldwide. The company was founded in 1993 and is headquartered in Raleigh, North Carolina.

Leave a Reply