Galectin Therapeutics (GALT) is one of today’s biggest pre-market movers, down a mind-boggling 60% to $5.75. Late Tuesday, Galectin shares started to nosedive after the drug development company reported poor results in Phase 1 trial of its experimental GR-MD-02 (GR02) drug for treatment of a fatty liver disease.

Following the announcement, equities research analysts at MLV & Co issued a research note to investors where they lowered their price target on shares of Galectin Therapeutics to $15.00 from $27.00. The firm however, noted it believes the stock’s 60% plunge and investor reaction are overdone, and thus see current price-per-share as a buying opportunity. MLV currently has a ‘Buy’ rating on the stock. The firm’s new PT suggests a potential upside of nearly 3.50% from the stock’s previous close.

A couple of investment firms have recently commented on Galectin Therapeutics. Analysts at McNicoll Lewis maintained a ‘Buy’ rating on Galectin shares in a report released on April 2, 2014. The firm set a $27.00 price target on the stock. Analysts at Aegis Capital also maintained a ‘Buy’ rating on GALT but with a price target of $13.00 in a research note issued to clients on Monday, October 7, 2013.

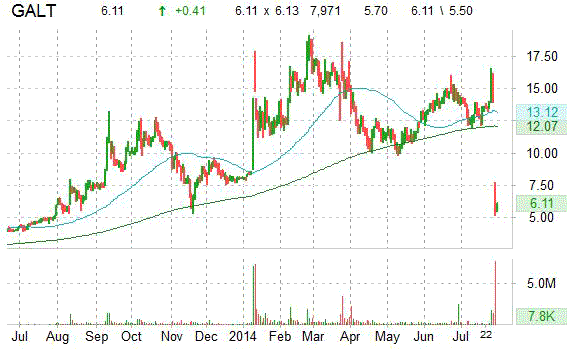

Despite Tuesday’s plunge shares of Galectin are up more than 15% on a year-over-year basis. Year-to-date however, the stock is down almost 30%. GALT’s low 52 week point is $4.80 per share, with $19.11 as the 52 week high point.

The chart below shows where the equity has traded over the last 52 weeks, with the 50-day and 200-day moving averages included.

Technically speaking: ticker seems poised to retest its lows and probably make lower lows.

GALT was up 33 cents to $6.03 at 8:38AM ET.

Leave a Reply