Central to any discussion about monetary policy is the degree to which the economy is underperforming relative to its potential, or in more ordinary language, how much slack exists. OK, so how much slack is there, and how long will it take to be absorbed? Well, if you ask the Congressional Budget Office (and a lot of people do), they would have told you last February (their latest estimate) that the economy was underperforming just a shade more than 4 percent relative to its potential last summer, and that slack was likely to increase a little by this summer (to around 4.7 percent). Go to the International Monetary Fund (IMF), and they tell a very similar story in their April World Economic Outlook. The IMF estimates that the amount of slack in the U.S. economy was about 4.2 percent last year, and they expected it would rise a little to about 4.4 percent this year.

As devotees of our Business Inflation Expectations survey know (and you know who you are), the Atlanta Fed has a quarterly, subjective measure of economic slack in the economy as seen by business leaders. This month, businesses told us something pretty interesting—the amount of slack they think they have narrowed pretty sharply between March and June.

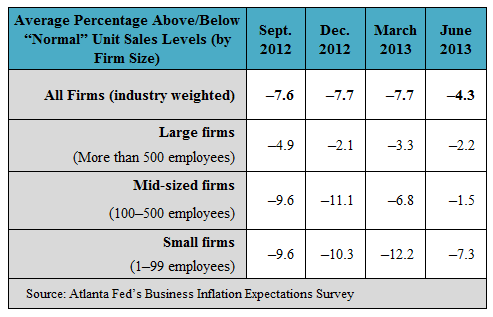

Last March, the panel told us that their unit sales were 7.7 percent below “normal”—similar to their assessments in December and September. This month, however, the group cut their estimate of slack to 4.3 percent below normal, on average (see the table).

What we find most encouraging about this assessment (well, besides the speed at which the slack was being taken up) is that the improvement was most prominent among small and medium-sized firms. These are firms that, according to our survey and other reports (like this one from the National Federation of Independent Business), have been lagging behind in the recovery. Indeed, in June, mid-sized firms indicated that unit sales were only 1.5 percent below normal, a shade better than the big firms in our panel (see the table).

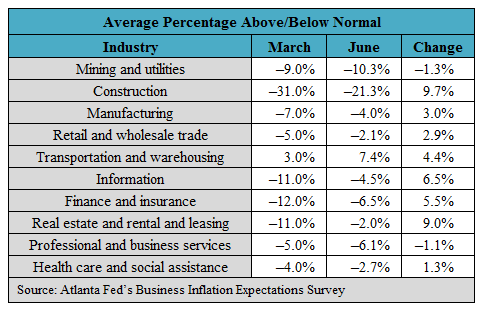

A look at the industry composition of our survey reveals that the pickup of slack was relatively broadly based too. Only the firms in the mining and utilities, and the professional and business services areas reported more slack relative to March (and the amounts were pretty small at that). Elsewhere, the amount of slack appears to have narrowed quite a bit.

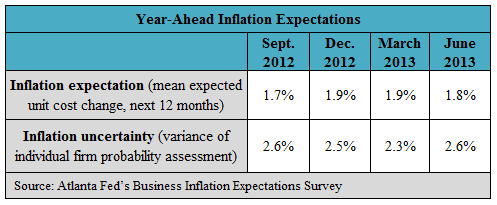

OK, so slack is shrinking, and according to these estimates, it shrank quite a bit between March and June. Does that mean we should be anticipating growing price pressure? Well, we can turn to our panelists again for an answer, and they say no. Projecting over the year ahead, our panelists report little change in either their inflationary sentiment or their inflation uncertainty (see the table).

Last Wednesday, at the conclusion of its June meeting, the Federal Open Market Committee said that the recovery is proceeding and the labor market is improving, but inflation expectations remain stable. Our June poll of business leaders appears to have also endorsed this view of the economy.

Leave a Reply