Barnes & Noble, Inc. (NYSE:BKS): The bookseller reported a dismal quarter, losing significantly more money than expected on both the top and bottom lines. The EPS number missed by a whopping $1.12. BKS is down 20% midday following the troubling report.

EPS Results

Actual $-2.11 vs. Expected $-0.99

Year Earlier EPS: $-0.98

Net Loss of $118.6 million

Revenue Results

Actual $1.28 billion vs. Expected $1.33B

Decreased 7.44% from year-earlier

Revenue decreased 42.58% from $2.22 billion in the previous quarter

Guidance

EPS Q1 2014: Actual -$0.67 vs. Expected -$0.69

Earnings per share in the current fiscal year: Actual -$1.56 vs. -$2.01

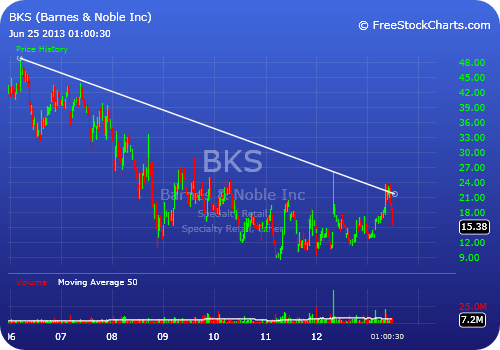

Taking a Look at the Chart

Pattern: Long-term downtrend, short-term downtrend

Barnes & Nobles (BKS) made an all-time high of $48.41 in March 2006, but by January of 2013 had lost nearly 75% of its value. However, since mid-January, the stock had nearly doubled in price back to the $24 area, and leading up to this morning’s earnings report investors had reason to be optimistic that the worst was over. Instead, today’s earnings numbers were an absolute disaster.

The company, which was already expected to lose a considerable amount of money, came in very light expectations and opened sharply lower this morning. The selling pressure has continued during the session, as BKS is down nearly 20%. Heading into the report it looked as though BKS may be trying to break higher out of a long-term downtrend, but today’s sharp sell-off keeps the downtrend well intact. The company looks like it could be destined for bankruptcy, and the stock looks like it could have a one-way ticket to the single digits.

Potential Sympathy Trades – Stocks in the Same Sector

Amazon, (NASDAQ:AMZN)

Books-A-Million Inc., (NASDAQ:BAMM)

Apple Inc. (NASDAQ:AAPL)

Microsoft Corporation (NASDAQ:MSFT)

Leave a Reply