It’s currently very trendy in Italy to blame Angela Merkel, Mario Monti, and austerity measures for the current recession. This column argues that while the severity of the downturn is clearly a cyclical phenomenon, the inability of the country to grow out of it is the legacy of more than a decade of a lack of reforms in credit, product and labour markets. This lack of reform has suffocated innovation and productivity growth, resulting in wage dynamics that are completely decoupled from labour productivity and demand conditions.

Italy is currently facing its worst recession in recent history, having lost about 8.5% of GDP between 2007 and 2013. The current situation is, to a large extent, the result of the Eurozone crisis and of the tough fiscal-austerity measures introduced across Europe, and particularly in Italy. Since 2007, the Italian primary balance improved by 3.3 points of potential GDP according to the OECD, almost exclusively through tax increases.

However, in a new CEPR Policy Insight, “The roots of the Italian Stagnation” (2013), I argue that the inability of the Italian economy to pull itself out this recession mainly lies in the legacy of the past ‘lost decade’ of missed reforms in product, labour and credit markets: a large competitiveness gap due to ailing productivity growth and to a dynamics of earnings totally decoupled from productivity and market pressure. The crisis brought to light and made more dramatic the problems Italy has ignored for too long.

Competitiveness …

Competitiveness measures the price of foreign goods relative to that of domestic goods. Different measures of competitiveness (or its reciprocal, the real effective exchange rates, see Chinn 2006 for more) rely on consumer prices or on unit labour costs, and use weights derived from trade shares to compute a ‘foreign goods’ basket. The unit labour costs measure is particularly interesting because it is not affected by firms’ pricing policies which may vary over time and markets.

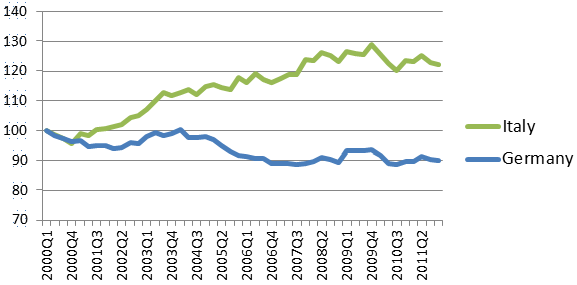

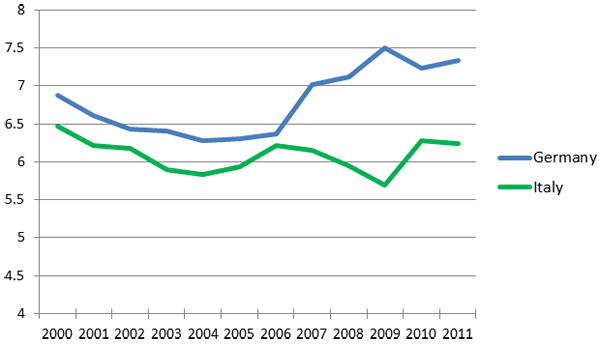

The unit labour costs-based indexes for Italy (green line) and Germany (blue) are shown in Figure 1. Between the first quarter of 2001 and the last of 2011, unit labour cost in Italy rose by 23 percentage points more than in its trading partners (a real appreciation), while unit labour costs in Germany declined by 9.7 percentage points (a real depreciation). What explains the huge rise in the Italian relative unit labour costs?

Figure 1. Unit labour cost-based real effective exchange rates

Source: Darvas (2012).

… And beyond

I decompose ‘competitiveness’, into its main determinants (see Appendix 1 of Manasse 2013 for a formal definition). A country becomes more competitive if the domestic relative (to foreign) average wage per hour falls, if the domestic relative average labour productivity rises, if the relative social security tax rate paid by domestic employers falls, if the domestic relative sales tax rate rises, and if the (trade weighted) nominal exchange rate depreciates. In this context, a country can improve its competitiveness by a ‘fiscal devaluation’, that is, by raising the VAT tax rate, which exempts domestic exports but hits imported goods, and by cutting social security contributions (which benefits domestic but not foreign producers). Given the focus on Europe, I do not discuss the issues relating to changes in the nominal exchange rates with trading partners, nor the composition of trade and value added, that affect the definition of real effective exchange rates based on unit labour costs.

Hourly labour compensation

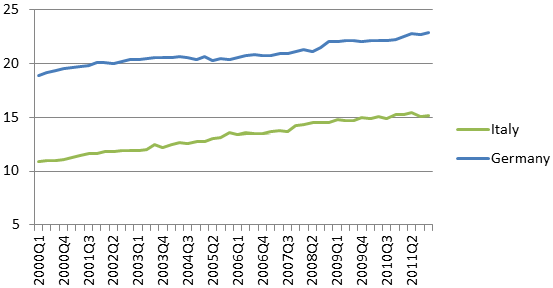

Figure 2 shows the evolution of the average cost of one hour of work in Italy and Germany in the last decade. In 2000, the price of one hour of work in Germany was almost double that in Italy (about 19 euro compared to 10.9). In following decade nominal wages per hour converged, although not completely: they rose by 39.5% in Italy against 21.1% in Germany.

Figure 2. Hourly labour compensation

Source: Darvas (2012).

Hourly labour productivity

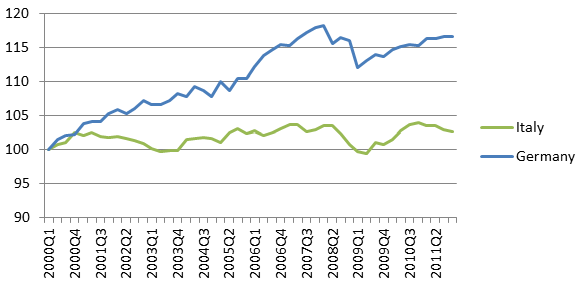

Labour productivity, however, did not follow wages. Figure 3 shows that labor productivity completely stagnated in Italy (+2.7% in the entire period) while it rose considerably Germany (+16.7%). As a result, net of taxes, unit labour costs in Italy rose about 32.5% more rapidly than in Germany.

Figure 3. Hourly labour productivity

Source: Darvas (2012).

Social-security contributions and consumption taxes

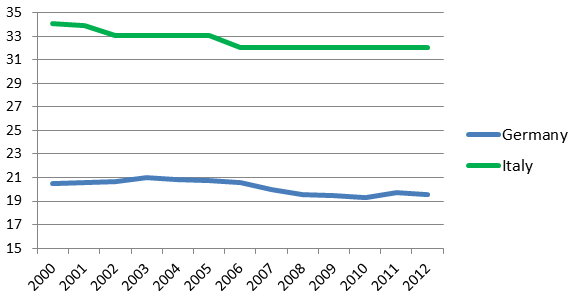

Figure 4 plots the average tax rate on social-security contributions paid by employers. The difference between the levels Germany and Italy contribution rates is striking, although it is quite stable (the Italian rate fell by two points and the German by one point between 2000 and 2012).

Figure 4. Average rate of employer’s social-security contributions (%)

Source: OECD

Consumption taxes show a different dynamics. Figure 5 plots the ratio of VAT revenue to GDP in Italy and Germany. Provided the ratio of consumption expenditures (the tax base) to GDP does not change across countries in a different way, we can infer the relative change in tax rates from the differences in the ratio of tax revenue to GDP (this is because the average tax rate is equal to the VAT revenue over GDP times by GDP over consumption). Starting in 2006, Germany raised its reliance on VAT considerably, thus engineering a ‘fiscal devaluation’ of around one percentage point, while from 2006 to 2009, Italy did the opposite. Over the entire period, however, the changes in tax rates were rather small.

Figure 5. VAT revenue over GDP

Source: OECD

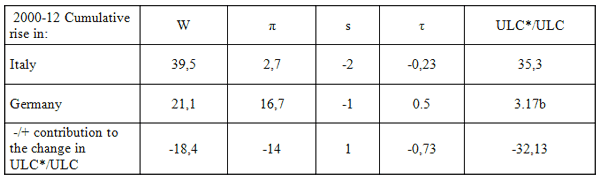

Explaining Italy’s loss of competitiveness

Table 1 summarises the contribution of these different factors to Italy’s loss of competitiveness. Unit labour costs in 2000-12 rose in Italy by 35.3 percentage points and only by 3.17 points in Germany, resulting in a competitive loss of more than 32%. The largest share of this competitiveness loss is accounted for by the difference in the dynamics of the hourly wage rate, which rose in Italy by 18.4 percentage points more rapidly than in Germany. Since labour was much cheaper in Italy at the beginning of the period, we had partial wage convergence. The problem was that labour productivity did not follow: to the contrary, it grew much slower (by 14 points) in Italy than in Germany. Overall, changes in the structure of taxation had a negligible impact on competitiveness. Finally, if we compare the developments in relative unit labour costs in Italy and Germany, with the dynamics of the real effective exchange rates described in Section 1, we can see that that other factors that affect competitiveness, such as changes of the composition of trade and of the nominal exchange rates (with respect to non-EU trade) did not play a significant role in explaining the Italian competitive gap.

Table 1. A Decomposition of unit labour costs

What ‘should have happened’ in Italy as a consequence of productivity-enhancing reforms by its trading partners (largely Germany)? Based on the Dornbusch, Fisher, Samuelson ‘Ricardian’ model (1977), as some industries migrate abroad, the excess labour supply should have reduced the domestic wage rate relative to the foreign wage rate. The fact that the opposite actually occurred exacerbated the effects of the competitiveness gap.

Conclusions

It’s currently very trendy in Italy to blame Angela Merkel, Mario Monti, the euro and austerity measures for the current recession, the worst and most prolonged of the post-War period. While the severity of the downturn is clearly a cyclical phenomenon owing much to the fiscal contraction, its persistence, that is, the inability of the country to grow out of it, is the legacy of more than a decade of a lack of reforms in credit, product and labour markets, which suffocated innovation and productivity growth, and resulted in wage dynamics that were completely decoupled from labour productivity and demand conditions. In a ‘rapidly changing world’, where trade and non-trade barriers were falling and commercial partners were rapidly innovating, the Italian reform inertia has built up a competitive gap that the crisis has brought to the fore with dramatic and, in all likelihood, long-lasting consequences.

Editor’s note: This article is based on the author’s presentation at a conference on “Italy’s challenges in the midst of the euro-crisis”, a joint workshop of Bruegel and Dipartimento del Tesoro – Ministero dell’Economia e delle Finanze, Rome, 8 May 2013.

References

•Chinn, Menzie D (2006), “A Primer on Real Effective Exchange Rates: Determinants, Overvaluation, Trade Flows and Competitive Devaluation”, Open Economies Review 17, 115–143, http://www.springerlink.com/content/n4745m7668314m72/.

•Darvas, Zsolt (2012), “Real effective exchange rates for 178 countries: A new database”, Working Paper 2012/06, Bruegel, 15 March.

•Keen, Michael, Ruud de Mooij (2012), “Fiscal devaluation as a cure for Eurozone ills – Could it work?”, VoxEU.org, 6 April.

•IMF (2011), “Fiscal Devaluation: What is it and does it work?”, Appendix 1, Fiscal Devaluation Monitor, September.

•Dornbusch, R, S Fischer, PA Samuelson (1977), “Comparative advantage, trade, and payments in a Ricardian model with a continuum of goods”, The American Economic Review 67(5), December, 823-839.

•Phillips, A W (1958), “The Relation Between Unemployment and the Rate of Change of Money Wage Rates in the United Kingdom, 1861–1957” Economica, 25, 283–299.

•Manasse, Paolo (2013), working paper, based on presentation at a conference on “Italy’s challenges in the midst of the euro-crisis“, a joint workshop of Bruegel and Dipartimento del Tesoro – Ministero dell’Economia e delle Finanze, Rome, 8 May.

![]()

Leave a Reply