Karl Smith recently made the following offhand comment:

To give meat to the idea – its conventional wisdom to deny the existence of race. Scott Sumner has denied the existence of inflation. I assert the existence of both.

I agree about race, but have two problems with inflation. First, the term has never been clearly defined by economists. Is it the increase in nominal consumption that an American would need to maintain a constant flow of utility? If so, then we shouldn’t be using price indices to measure it. If happiness surveys show no rise in the reported happiness of Americans (on average) over the past 65 years, then inflation roughly equals median wage growth.

But I’m a philosophical pragmatist, happy to live with fuzzy concepts that are useful. The problem is that inflation isn’t even useful, as whenever people talk about inflation they are actually talking about something else.

- Does inflation impose a tax on capital? No, rising nominal returns on capital impose a tax on capital. And those are caused by faster NGDP growth (and rising levels).

- Are eurozone officials correct when they say inflation hurts consumers? No, supply shocks hurt consumers, and if the ECB prevents the supply shock from leading to inflation, consumers will be hurt EVEN MORE THAN IF PRICES DO RISE. The harm to consumers has NOTHING TO DO with prices rising.

- Does inflation lead workers to demand higher wages? No, rising NGDP leads workers to demand higher wages.

If you are talking about inflation, you are talking about the wrong variable.

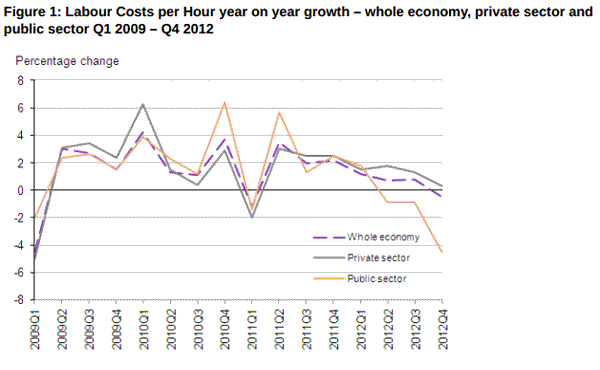

Britmouse sent me some data showing that nominal wage growth in the UK has fallen below zero by the end of 2012:

At the same time that wage growth has been slowing to zero, the BoE has been worried about high inflation–you know, the stuff that’s supposed to trigger high wage growth. Lars Christensen sent me the following:

U.K. inflation expectations risk becoming dislodged because consumer-price growth has been elevated for such a long time, Bank of England economists said.

“The prolonged period of above-target inflation could cause inflation expectations to become less well anchored,” the researchers wrote in an article in the central bank’s Quarterly Bulletin, published in London today. “That could trigger changes in the nominal exchange rate, and affect consumption and investment decisions, as well as wages and prices, and could cause inflation to persist above the target for longer.”

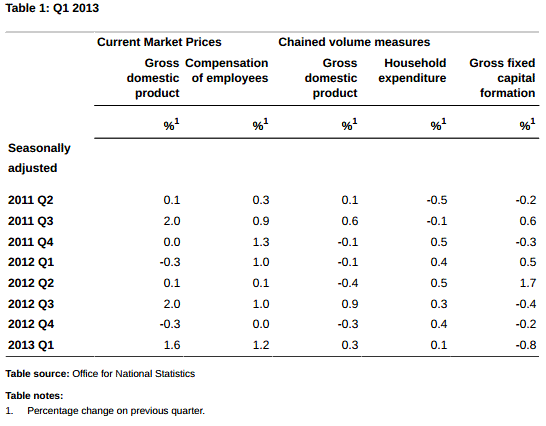

No, high inflation does not feed into high wage growth, as wages follow NGDP. British NGDP has been very weak; rising a total of 3.6% in the 7 quarters leading up to 2012:4, or 2% per annum:

Slow British NGDP growth has led to slow nominal wage growth. Indeed in one respect Britain is doing fairly well—employment has risen to record levels in recent months, unlike the US. What explains the difference? It appears that British wages are more flexible than US wages, which are still rising at about 2% per year.

Most people focus on British inflation and real GDP numbers. If these numbers are to be believed (and I have my doubts), all they tell us is that British productivity has fallen for some mysterious reason. British workers today are simply not as productive as British workers of 2007. The data tell us nothing about demand-side conditions in the economy. Inflation is a nearly worthless concept, and should be discarded from business cycle analysis. NGDP, hours worked, and wage inflation are the key concepts to focus on. The musical chairs model.

And Osborne is right:

Inflation has exceeded the BOE’s 2 percent target every month since December 2009, and Chancellor of the Exchequer George Osborne revamped its mandate in March to give it more flexibility to set policy.

I suspect that in private Osborne would agree with the analysis in this post, but holds back from NGDP targeting because of the innate conservatism of central banks and the financial establishment. Perhaps he also fears being bashed by Labour, and the Tory voters that are high savers. Maggie Thatcher got in hot water for saying there is no such thing as society. If I was advising Osborne I would recommend he NOT say; “Sumner’s right, there is no such thing as inflation.”

Leave a Reply