Lets take a look at Apple (NASDAQ:AAPL) after last night’s disappointing earnings report. Over the last two months I’ve been doing specific Apple strategic videos to try to keep investors out of harm’s way and provide traders a tactical plan to approach it. Some people still think Apple is a good investment, some think the analysts put their expectations too high. All in all, the price action is king and it is telling us a clear story on the stock.

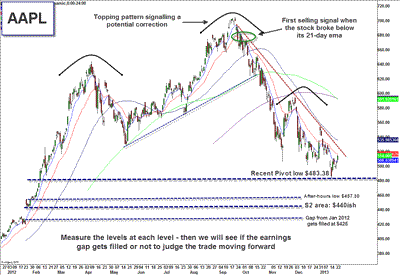

We have the head-and-shoulders short-term pattern from August to October signaling potential downside. Then Apple broke and closed below its 21-day moving average in October 1. The stock was riding its 21-day during the Summer, and when it broke that moving average, it was a day to take notice and be flexible. We did not know where it was heading to but we had a few signals to stay out of the harm’s way. The stock stayed below the 21-day during its entire down move after breaking below all other key moving averages.

In November, we had a nice rally that was tradable back to the downward trend line starting from September’s highs, but overall this downtrend kept controlling the stock.

(click to enlarge)

Yesterday before earnings, we were measuring the stock to see if its report could be good enough to bring the stock back above this trendline. And it didn’t. So now the question is, what type of action will it be after the earnings?

The best part of earnings for traders is that we get nice gaps to base trades off and get clues to future direction. I come in flat in Apple today as I played its earnings with an option strategy with risk as premium paid. Apple is opening down 50 points, and we have $457.30 as the new pre-market pivot low. Lets see if it will test this low, then we have a bigger area at $440ish from the January 2012 gap. I’m going to watch the stock closely, let it put a pivot low in, and perhaps put on a feeler vs the new pivot low. It’s prudent to see if it could build and try to fill a portion of this post earnings gap. If it can’t, I will get out of the way.

There are two other gaps in Apple that also tell us a story which I want to show as an example. The first one is the gap up after earnings way back in January 2012. The stock consolidated above this gap and gave you a clues about its direction. It then rode its 8-day moving average all the way up. You don’t have to be long stock into earnings to make a profitable trade, you can judge composure after the report.

The second gap came in July when AAPL fell short of earnings expectations. The first post-earnings trading day, it rested, the second day it continued to holder highe, and then on the third day it tried to enter the bearish gap and actually filled it in three days, demonstrating good resilience and a potential buying opportunity.

That would be how I will look at Apple’s gap today. If we open down and still don’t fill the gap whatsoever in the next couple days, it will create a massive hole which will show you a lack of demand, and that could mean a lot lower prices. Although I wouldn’t press shorts here, I’d rather wait and see, and trade it a level vs. a level. Let’s see if Apple can shake off its earnings and show any signs of life, then we will measure the gap for clues on its potential future direction.

Disclosure: Scott Redler is long AAPL, WFC, LNKD, GE, MGM, WMT, DBC, CAT. Short SPY.

Leave a Reply