Credit Suisse is downgrading Lululemon Athletica (NASDAQ:LULU) to Neutral from Outperform this morning while lowering their target price to $80 (prev. $86).

– With slowing comp momentum likely and further merchandise margin pressure a distinct risk, they believe the shares are range bound.

Signs of Slowing Momentum in Mature Markets Gives Pause. LULU’s mature store (59% of stores) comp momentum has slowed in Canada over the past several quarters. Credit Suisse believes 3Q12’s low-single-digit comp highlights LULU’s challenges in driving incremental sales in these highly productive mature stores (Canada stores doing ~$3,000/sq ft vs. U.S’s ~$2,000.) With this recent deceleration, their prior thesis for sustained doubledigit comps is at risk, as it was predicated on mature stores comping high single digits.

Elevated Discounting In Stores and On Line, Re-Pricing High Ticket Items

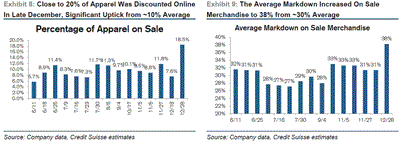

CSFB’s analysis of over 2,500 lululemon SKUs offered on the company’s eCommerce site highlights a significant increase in discounted apparel at the end of December. As of December 28, close to 20% of apparel was on sale, compared to 8% in mid- December and average of 10% since the beginning of June. Additionally, the average markdown on sale apparel increased to 38% at the end of December, up from an average of 30% since June. This coincides with what the firm sees in stores, with additional racks of sale merchandise brought onto floors. According to CSFB, this indicates that new and winter product lines have stretched outside of the company’s comfort zone, resulting in re-pricing actions, broader discounting, and higher markdown levels than they have historically seen.

(click to enlarge)

With Additional Focus on Activewear, Increased Long-Term Risk to LULU’s Competitive Positioning and Pricing Power. Credit Suisse believes LULU brand and product positioning has fended off competition due to 1) casual luxury positioning; 2) cross-sports appeal; and 3) brand authenticity. However, CSFB sees long-term risks to its competitive positioning and pricing power as activewear gains shelf space across retail channels (particularly premium department stores) and competitive vendors adjust offerings to compete with lululemon at lower price points.

Adjusting Estimates and Lowering Target Price. Reflecting their more conservative model for mature store sales, firm’s 2013 comps, sales, and EPS estimates are 9.7%, $1.73B, and $2.29 from 12.5%, $1.76B, and $2.40. CSFB’s new target price of $80 (from $86 previously) is an equal-weighted average of: 1) comparable multiples ($80); 2) a DCF analysis ($84); and 3) long-term growth scenario ($75).

Notablecalls: Higher than usual discounts is the biggest takeaway from this CSFB call in the short term. It could imply at least two things:

– Consumers unwilling to pay the 25-50% premium for LULU stuff as the hype is starting to subside.

– GPS’ Athleta brand with its significantly lower price points starting to take its toll on LULU.

People have been wondering about the discounts over the past week or so and the CSFB comments seem to confirm their worries. Selling 90%+ of their product at full price is still very good but what if it’s just the beginning of a trend?

With the stock trading around 30x EPS, this is probably not what investors want to see.

I’m guessing there will be ample selling pressure in the n-t. Thinking $72/share or lower today and possibly below $70 in couple of weeks.

Leave a Reply